Artificial intelligence (AI) stocks have been hot, and many experienced strong growth in 2025 alone. For example, this year, AI luminaries Nvidia and Broadcom saw shares soar more than 30% and 26%, respectively, through July 28.

But one lackluster AI stock has been C3.ai (AI 1.78%). Its shares are down about 25% this year through July 28. Could the price drop signal an opportunity to scoop up shares at a discount? After all, the global AI market is forecast to expand from $244 billion in 2025 to $1 trillion by 2031, providing a tailwind for C3.ai's business.

The reality is that evaluating whether to purchase its stock requires digging into the company. Let's delve into C3.ai to help assess if it's a sound investment for the long run.

Image source: Getty Images.

A look at C3.ai's business

C3.ai is an enterprise AI applications business servicing the needs of corporate and government organizations. Its customers include the U.S. Department of Defense, Dow Inc., and ExxonMobil.

The company built a network of partnerships to assist in selling its solutions, which includes Microsoft and energy giant Baker Hughes. These alliances resulted in partners closing 73% of the customer agreements signed in C3.ai's 2025 fiscal year, ended April 30.

C3.ai's business model translated into record revenue of $108.7 million, a 26% year-over-year increase, in its fiscal fourth quarter. For the full year, sales grew 25% year over year to $389.1 million.

The company's offerings have proven popular with customers. In May, the U.S. Air Force expanded its contract with C3.ai from $100 million to $450 million to supply predictive analytics that proactively identify aircraft maintenance needs.

In June, Univation Technologies, a Dow subsidiary, adopted C3.ai's predictive maintenance capabilities to deliver to its petrochemical industry customers.

NYSE: AI

Key Data Points

C3.ai's pros and cons

The company's customer wins this year suggest more revenue expansion to come. In fact, C3.ai forecasts fiscal 2026 sales to reach between $447.5 million and $484.5 million, another solid year of growth over fiscal 2025's $389.1 million.

Despite rising sales, C3.ai's business isn't profitable. It ended fiscal 2025 with an operating loss of $324.4 million, deepening from a $318.3 million loss in the prior year. Costs increased from adding employees to support its business growth.

On top of that, a health issue struck CEO Tom Siebel this year, and the company is now searching for a successor. This is unfortunate news, and it contributed to the decline in C3.ai's share price. The stock price drop is understandable, since a leadership change risks disrupting the company's future success.

However, C3.ai is striving to cut costs and strengthen its finances. Management expects to be free-cash-flow (FCF) positive by next year. It ended fiscal 2025 with negative FCF of $44.4 million, which is an improvement over the previous year's $90.4 million in negative FCF.

Its balance sheet shows C3.ai is well capitalized with total assets of $1 billion, $742.7 million of which represent cash, cash equivalents, and short-term investments. Total liabilities were $187.6 million.

Deciding whether to buy C3.ai stock

Although C3.ai isn't profitable, its strategy to prioritize business expansion over immediate profit follows a typical approach adopted by many companies in the technology sector. As long as year-over-year revenue growth remains strong and it continues to improve its financials, such as reaching positive FCF, C3.ai's operating loss isn't a major concern.

The impending departure of its CEO is regrettable, but Siebel intends to continue shepherding the company as executive chairman. This positions C3.ai for a smooth leadership transition.

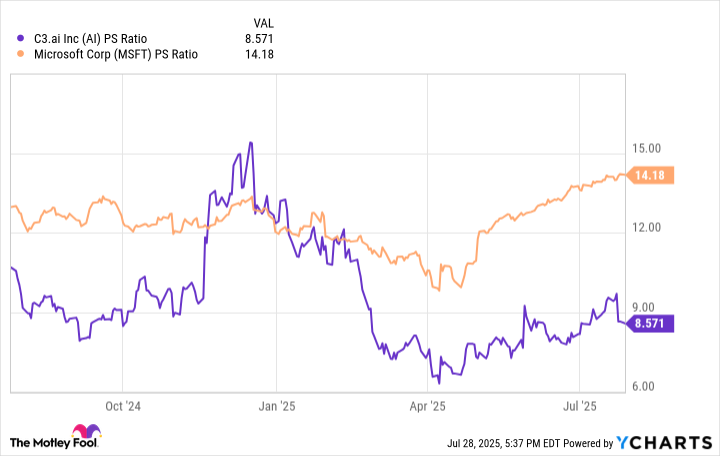

With plenty of positives in its favor, does this mean now is the time to buy C3.ai's shares? To answer that, here's a look at its stock's price-to-sales (P/S) ratio with a comparison to Microsoft's, given Microsoft sells C3.ai's offerings, and is a prominent AI business in its own right.

Data by YCharts.

The chart reveals C3.ai's valuation has significantly improved, as evidenced by the substantial drop in its P/S multiple from its late 2024 peak. This multiple is now considerably lower than Microsoft's, further highlighting C3.ai's attractive valuation.

This, combined with growing sales, a robust balance sheet, and strengthening free cash flow, makes C3.ai stock a compelling investment opportunity.