Artificial intelligence (AI) investing is still a prevailing theme in the market, and there are several stocks that look like excellent buys in August. If you're looking to increase your AI exposure, then taking a look at these four is a great idea.

At the top of my list for best AI stocks to buy in August are Nvidia (NVDA 2.84%), Taiwan Semiconductor (TSM +3.23%), Alphabet (GOOG +1.88%) (GOOGL +1.68%), and ASML (ASML +1.18%). These four have a great combination of growth and value.

Image source: Getty Images.

1. Nvidia

Nvidia has been the top stock of AI investing for a reason: Its graphics processing units (GPUs) have become the nearly universal computing equipment for training and running AI workloads. The demand for Nvidia GPUs is still quite strong, and it could get another growth catalyst in the near future.

Back in April, the U.S. government revoked Nvidia's license to export to China the H20 chips that it had specifically designed to meet export restrictions. This was a huge blow to Nvidia's business, with Nvidia losing out on $8 billion in projected revenue from the $45 billion it had expected to generate.

NASDAQ: NVDA

Key Data Points

Fortunately, Nvidia has reapplied for its export license and says it has assurances from the government that it will be approved. While this won't affect Q2 results (which Nvidia will report in late August), a restart of H20 sales to China should boost growth for the remainder of the year. This will give Nvidia's stock a strong boost, making it a smart stock to buy in August.

2. Taiwan Semiconductor

Taiwan Semiconductor is the world's largest chip foundry, and makes chips for companies like Nvidia that lack the capabilities to do it themselves. TSMC is winning business from other foundries, making it the clear leader in this space.

It has already reported Q2 results, which delivered impressive 44% year-over-year revenue growth in U.S. dollars. However, that's just the beginning.

NYSE: TSM

Key Data Points

Management expects that for the five-year period starting in 2025, it will deliver nearly a 20% compound annual growth rate (CAGR) for revenue. With TSMC's stock trading at 25 times forward earnings, it's not that expensive right now.

3. Alphabet

Alphabet recently reported impressive earnings, with revenue rising 14% year over year and diluted earnings per share (EPS) rising 22%. Normally, that would cause a big tech company to be assigned a forward earnings multiple in the high 20s to the low 30s, but Alphabet doesn't receive the same respect as other big tech companies.

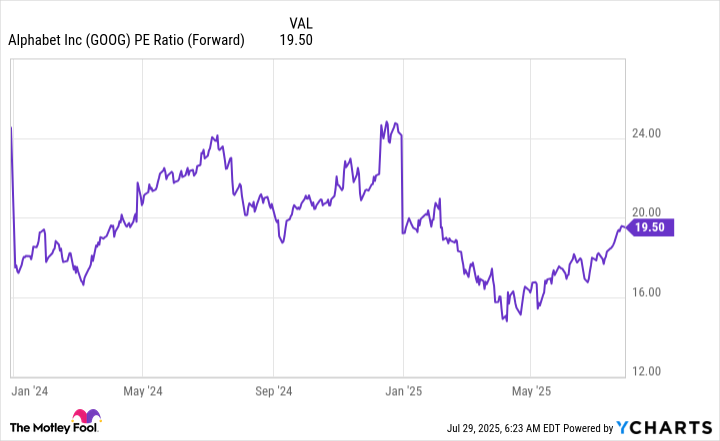

It trades for less than 20 times forward earnings, making it cheaper than the S&P 500 (^GSPC +0.54%), which trades at 24 times forward earnings.

GOOG PE Ratio (Forward) data by YCharts

This cheap price tag is assigned to Alphabet's stock because investors are worried about Google Search losing market share to generative AI products. However, that hasn't surfaced. Google has integrated AI search overviews, which bridge the gap between a full generative AI experience and traditional search. Management stated that over 2 billion people have used this and that it has the same monetization as a traditional search.

There have been no signs of weakness with Google Search, as revenue rose 12% year over year in the recent quarter. This indicates that Alphabet is cheap for no solid reason, which makes it a great buy for August.

4. ASML

ASML is probably the least known company on this list, but it may be the most important. ASML has a technological monopoly on extreme ultraviolet (EUV) lithography, which chip fabricators (like Taiwan Semiconductor) use to lay the microscopic electrical traces on chips. Without ASML's machines, none of the AI tech we enjoy today would be possible.

NASDAQ: ASML

Key Data Points

As chip demand rises, so will demand for ASML machines. While management was a bit bearish on its 2026 outlook thanks to tariff concerns, the long-term trend is still positive for ASML, as it's clear that chip demand is increasing.

ASML is still slated to deliver strong growth over the next few years, and its fairly cheap 26 times earnings estimates price tag looks like a steal considering its dominant market position.