There are plenty of growth stocks in the market, but the key is finding one that's smart to buy. The market has gotten a bit overheated in some areas, and some growth stocks are just too expensive to justify buying right now.

However, I've pinpointed one growth stock that also provides investors significant value, and it's well positioned to crush the market moving forward. The stock? Alphabet (GOOG 1.19%) (GOOGL 1.16%).

Image source: Getty Images.

Generative AI is challenging Google Search

When it comes to big tech growth stocks, Alphabet usually isn't on top of the list, although it's typically included (think of FAANG or the "Magnificent Seven"). The reason why it doesn't top the list is that it has more challenges to its growth story than the others do.

The primary growth challenge is Alphabet's largest segment by revenue: Google Search. Many investors are worried that Google Search could lose out to generative artificial intelligence (AI) products, resulting in significant lost revenue for Alphabet. While there have been some defectors from Google Search to generative AI, investors need to be careful about using anecdotal evidence to estimate what will happen with the broader population.

NASDAQ: GOOGL

Key Data Points

The reality is that the vast majority of Google users don't need a full-on generative AI experience. Instead, they have a simple question and want a simple answer, not a long, drawn-out explanation that some generative AI products give. Additionally, Google has taken steps to bridge the gap between a traditional search and a generative AI experience by integrating AI search overviews.

This has become an incredibly popular product, and management has stated that the monetization of AI search overviews is similar to a typical Google Search, so investors don't need to worry about lost revenue with this feature. With over 2 billion users in 40 different languages, this evolution of Google Search is a key part of the Alphabet investment thesis.

Even with some of the challenges Google is said to be facing, it's still delivering strong growth.

Alphabet's stock is cheap for its growth rate

In Q2, Google Search's revenue rose 12% year over year. That's an acceleration from Q1's 10% growth, so at least from a short-term financial-related standpoint, the bear case against Google Search appears to be incorrect. This could shift over the next five years, but considering Google's strong market position, I doubt this will happen.

Alphabet also has other promising growth divisions, like its Waymo self-driving cars and Google Cloud. Google Cloud, in particular, is probably the most promising, as it's benefiting from the AI arms race. In Q2, Google Cloud's revenue rose 32% year over year, another acceleration from Q1's 28% growth. With its rapid growth rate and massive tailwinds, Google Cloud could become a much larger part of the Alphabet investment thesis over the next few years, making it a key area to watch.

Overall, Alphabet posted a stellar Q2 with revenue rising 14% year over year and diluted earnings per share (EPS) rising 22%. Both of those far outperform the historical returns of the market (around 10%), clearly placing Alphabet in the growth stock category.

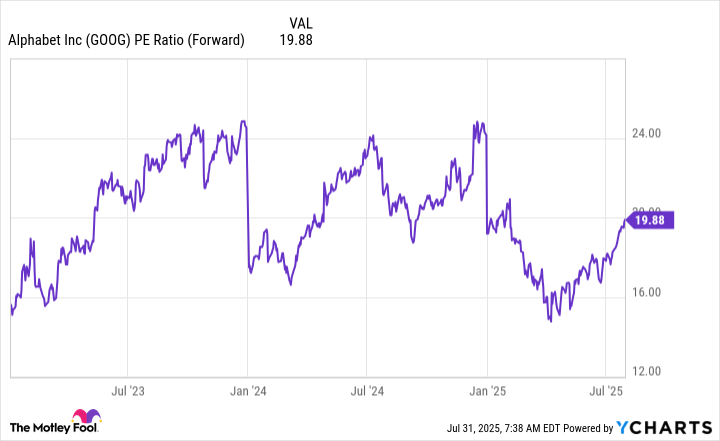

However, there's one catch. Alphabet could also be considered a value stock. With the stock trading for under 20 times forward earnings, that's cheaper than the broader market, as measured by the S&P 500, which trades at 24 times forward earnings.

GOOG PE Ratio (Forward) data by YCharts

With Alphabet being both cheaper than the market and growing faster than it, it makes for one of the smartest stocks to buy now. I think Alphabet has some of the best chances to outperform the market over the next five years, and buying the stock today gives investors a great shot at outperformance.