Netflix (NFLX +0.37%) has been one of the top-performing stocks in the market over the last few years, but that blistering growth seemed to catch up with it in July, as a strong second-quarter earnings report wasn't enough to push the stock higher.

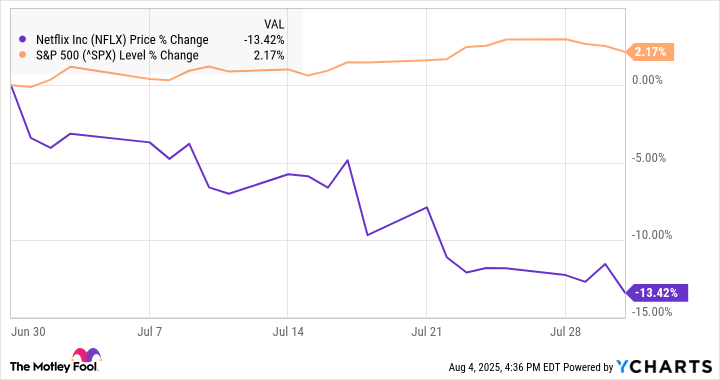

Instead, investors bailed on the stock as valuation concerns seemed to override another round of solid growth. According to data from S&P Global Market Intelligence, the streaming stock finished the month down 13%.

As you can see from the chart, the stock headed lower over much of July, even as the S&P 500 (^GSPC 0.43%) finished with a 2.2% gain.

Netflix takes a step back

Netflix's pullback last month showcases what happens when a stock is priced to perfection. The stock was already falling heading into the second-quarter report, even though there was no major news out on the company.

When it came time for its update, Netflix delivered strong numbers. Revenue rose 16% to $11.08 billion, narrowly topping expectations at $11.04 billion.

Netflix no longer reports quarterly subscriber growth, but its growth was broad-based across all four of its regions, with currency-neutral revenue growth of 15% or better in each territory. On the bottom line, its operating margin jumped from 27.2% in the quarter a year ago to 34.1%, and it reported earnings per share of $7.19, up from $4.88 in the quarter a year ago and better than the consensus at $7.06.

The company also raised its guidance for the year, upping its revenue forecast from $43.5 billion-$44.5 billion to $44.8 billion-$45.8 billion and its operating margin from 29% to 29.5%. However, that was not enough to push the stock higher, as pressure from valuation and high expectations leading into the report seemed to have overcome the "beat and raise" results.

Image source: Getty Images.

Is Netflix a buy after the pullback?

Netflix is now trading at a price-to-earnings ratio of 50, which is expensive, even for a growth stock.

However, its recent push into advertising is paying off, and its local content strategy is driving growth around the world. Its subscription model should also drive profit margins higher as its subscriber base continues to grow.

In the near future, valuation pressure could push the stock lower, but over the longer term, its leadership in streaming and broader growth tailwinds should make the stock a winner.