Wall Street is in the throes of earnings season, with the world's top businesses checking in at the halfway point of 2025. It's a crucial time for investors. There have been virtually no signs of artificial intelligence (AI) losing its momentum. While it's still early, some of the leading AI stocks have already reported outstanding results that solidify their prolific roles in AI's coming of age.

These three AI stocks have delivered impressive earnings results and still trade at compelling valuations, making them no-brainer buys right now.

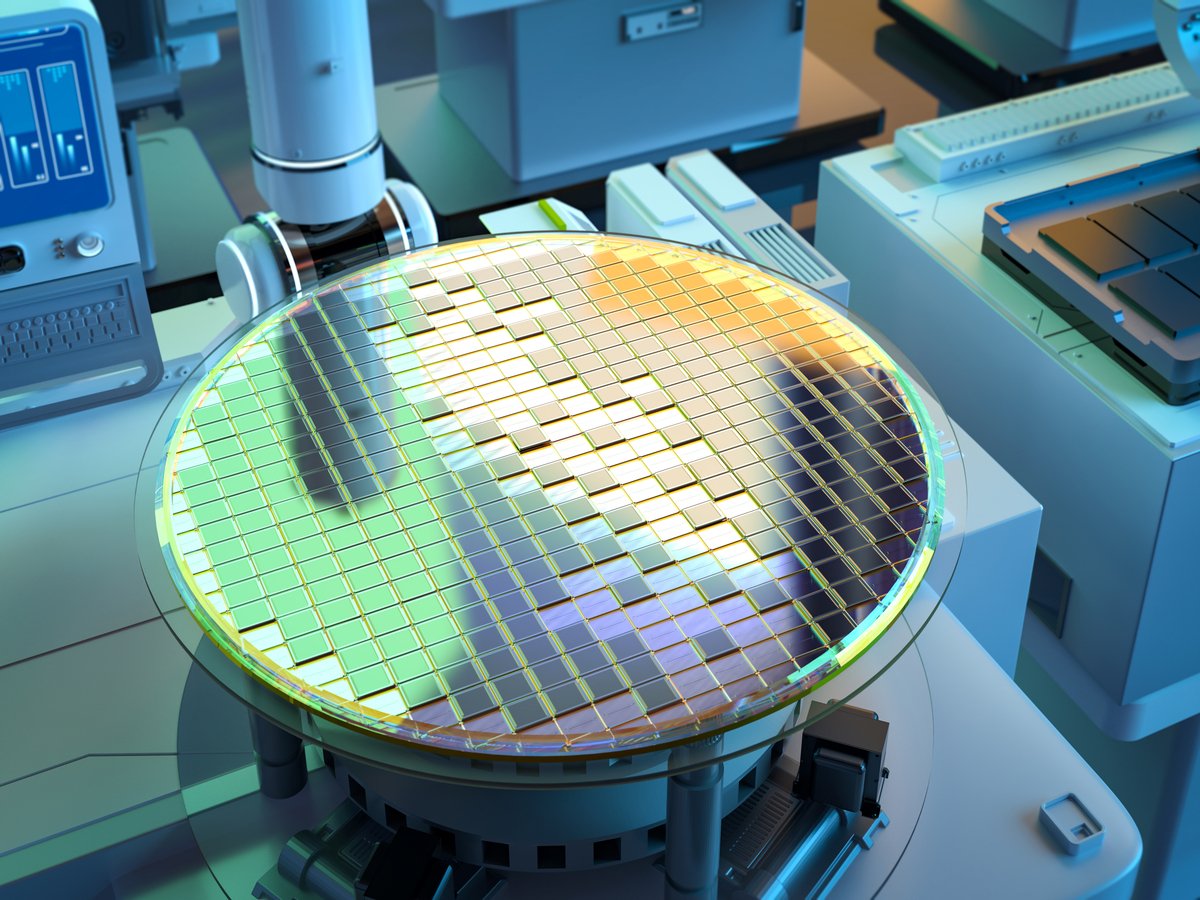

Image source: Getty Images.

1. ASML

Dutch company ASML Holdling (ASML +0.43%) builds complex equipment systems that are crucial to manufacturing the high-end chips used in AI. As one might guess in this ongoing AI boom, the company reported stellar earnings results for the second quarter of 2025, surpassing Wall Street estimates in both sales and earnings. Yet, the stock has veered lower and now sits nearly 40% below its all-time high. So what's going on?

ASML's management issued very cautious guidance for next year, citing uncertainty related to tariffs and geopolitical trade tensions (export controls) that could potentially threaten ASML's ability to grow its business. But here's the thing: ASML is the only company in the world that produces extreme ultraviolet (EUV) lithography machines, which use highly concentrated UV light to etch patterns onto silicon.

NASDAQ: ASML

Key Data Points

If the world needs more and increasingly complex chips, that demand should trickle to ASML over time. That could be why analysts still anticipate ASML growing earnings by an average of over 17% annually for the next three to five years, even if management is erring to the side of caution for right now.

Meanwhile, the stock's price-to-earnings (P/E) ratio of 25 is a five-year low. In other words, ASML, a mission-critical player in AI infrastructure, is the cheapest it's been since the AI boom started.

2. Alphabet

Google's parent company, Alphabet (GOOGL +1.48%)(GOOG +1.40%), continues to slump on concerns that AI models will continue to grow and eventually pressure Google's search engine advertising profits. While ChatGPT continues to swell in popularity, Google is doing just fine. Alphabet's Google ad revenue grew by an impressive 12% year over year in the second quarter. For now, at least, it appears that ChatGPT and Google can coexist profitably.

The stock isn't even down much, just 8% below its all-time high. Yet, it feels like Wall Street just isn't respecting the tech giant enough; shares trade at a P/E ratio of only 20, versus an average of nearly 30 over the past decade.

NASDAQ: GOOGL

Key Data Points

Investors who buy here have much to be excited about, and it spans well beyond the search engine business. Alphabet's Google Cloud is rapidly growing due to AI tailwinds, and the company's Waymo subsidiary is establishing itself as the leader in the autonomous driving space, as its ride-hailing service continues to expand into new markets.

In all, analysts have Alphabet slotted for nearly 15% annualized earnings growth over the next three to five years, making the stock a bargain at just 20 times earnings today. Alphabet could outperform the market on growth alone moving forward, and could be a genuine game changer for your portfolio if sentiment improves and boosts the stock's valuation closer to its long-term norms.

3. Taiwan Semiconductor Manufacturing

Global foundry behemoth Taiwan Semiconductor Manufacturing (TSM +1.25%) -- also known as TSMC --is the world's leading producer of semiconductors, and it continues to cement its status as a leading AI company and juggernaut in the broader tech space. Companies like Nvidia turn to TSMC to manufacture their AI chips, which has helped the company expand its market share to an estimated 35.3% in Q1 2025, up from 29.4% just a year ago.

TSMC's AI momentum helped the company turn in a blowout second quarter. Research by McKinsey & Company estimates that companies will continue to invest in data centers over the coming years, with worldwide estimates projected to exceed $7 trillion over the next five years alone. All those data centers will need vast quantities of chips, which should keep TSM busy for the foreseeable future. Analysts estimate TSMC will grow earnings by an average of over 21% annually for the next three to five years.

NYSE: TSM

Key Data Points

The caveat with this stock is the geopolitical risk associated with TSMC's location in Taiwan, which has a long-standing dispute with China over the land's sovereignty. While an escalation of those tensions could impact TSMC's business, it's becoming hard to ignore the value here. The stock's P/E ratio is just 27, a bargain for the growth that investors anticipate from TSM moving forward. This makes Taiwan Semiconductor a strong buy for anyone comfortable with the geopolitical risks.