UPS (UPS 0.38%) stock failed to deliver for investors in July. The stock declined by 14.6% according to data provided by S&P Global Market Intelligence. There's little doubt about the reason for the monthly move, as most of it came after the release of a disappointing set of second-quarter earnings reports.

UPS disappoints the market

The package delivery company missed earnings estimates, declined to update on its full-year guidance again (management did this on the first-quarter earnings call in April), cited volume declines in its most profitable international trade lane (China to the U.S.), and served notice that one of its key end markets, small and medium-sized businesses (SMBs), are being inordinately impacted by the tariff conflict.

NYSE: UPS

Key Data Points

As such, the level of uncertainty and range of potential outcomes were so wide as to encourage management not to give guidance. In a nutshell, the uncertainty and ever-changing tariff landscape is making it very hard for SMBs (an area UPS is highly focused on growing into) to plan.

It's understandable if the market didn't take all of this too well. On the other hand, what management is saying is also understandable. UPS relies on trade and requires its customers to have a clear understanding of the playing field, including the tariffs it incurs when importing goods from specific sources.

UPS operational and capital allocation policies

It's a somewhat frustrating scenario because management's strategic direction makes sense. The company is focusing on optimizing profitability in its network by growing selected higher-margin end markets, such as SMBs and healthcare, while eschewing lower-margin deliveries for Amazon. Meanwhile, its investments in technology (smart facilities, automation, etc.) to create the "network of the future" also make sense, and will allow it to consolidate facilities due to increased productivity.

Image source: Getty Images.

What's more questionable is its capital allocation policy of spending $1 billion on buybacks during an uncertain trading environment, and continuing to commit to $5.5 billion in dividends when trailing-12-month free cash flow (FCF) is just $3.7 billion.

To be fair, UPS aims to pay 50% of its earnings per share, not FCF, in dividends, but even on this basis, the $6.56 annual dividend per share is 99% of the Wall Street full-year earnings-per-share consensus estimate of $6.63 per share. Its balance sheet is solid enough to pay it, but quite often, solid balance sheets can be used, notably in downturns, to make acquisitions or accelerate investment in its network.

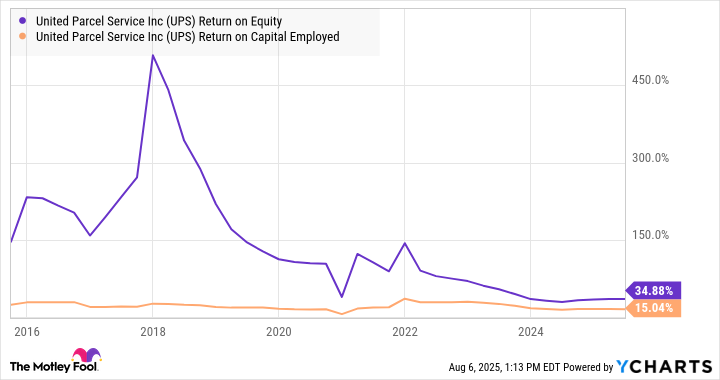

It's a particularly relevant point as UPS does have an excellent track record of generating returns from its investments.

UPS Return on Equity data by YCharts

Either way, the market is not impressed by UPS right now, so whether it's due to the trading environment or management, the stock's decline in July is a reality.