The nascent field of quantum computing looks like a promising investment frontier. The industry expects to grow rapidly from $4 billion in 2024 to $72 billion by 2035.

The market growth makes sense given the potential of quantum computers. These machines use atomic particles to perform calculations at speeds beyond the abilities of any classical computer.

One business in the space to consider investing in is Quantum Computing Inc. (QUBT 8.94%), which also refers to itself as QCi. The company's stock is up more than 2,000% over the past 12 months.

Given QCi stock's astounding performance, should you consider scooping up shares now? To get to an answer, let's dive into the company to understand its investment potential.

Image source: Getty Images.

The state of Quantum Computing Inc. today

Computing companies are taking several approaches to constructing quantum computers. While many methods involve carefully controlling atomic particles in a closed environment, QCi does the opposite, using an open system in what's called entropy quantum computing. The technique holds the promise of overcoming the scalability challenges inherent in quantum devices.

QCi experienced a momentous year, and not just due to its share price performance. The company's CEO, William McGann, retired in April.

Yuping Huang took over as interim CEO until a replacement is found. Huang was the CEO of a quantum computer business QCi acquired in 2022.

In addition, QCi opened a quantum chip fabrication facility in May. By operating a foundry, the company seeks to increase its capacity for delivering quantum computing solutions to customers while working to miniaturize quantum hardware to fit on a standard computer's PCIe card.

NASDAQ: QUBT

Key Data Points

Quantum Computing Inc.'s financial performance

Since the CEO transition, QCi has released its first-quarter earnings results. Revenue jumped 44% year over year to $39,000. This continued the year-over-year sales growth seen in 2024 when revenue reached $373,000 (compared to 2023's $358,000).

The modest income QCi is collecting comes primarily from research grants. However, that may be changing. In April of this year, the company sold equipment to an automotive manufacturer. At the time, McGann called the sale an "example of the increasing demand we're seeing for our devices and offerings in diverse markets."

Then in July, a major unidentified U.S. bank made a purchase valued at $332,000. These deals may portend a breakout 2025 for QCi's revenue growth.

Despite the encouraging signs in its sales, QCi's revenue is eclipsed by its massive costs. The company's Q1 operating expenses rose 31% year over year to $8.3 million.

As a result, QCi implemented a private equity offering that produced $200 million. With that, the company has accumulated $350 million in cash and equivalents with no debt as of June 24. This war chest enables QCi to continue operations in the short term, but it will need to ramp up its sales efforts if its business is to survive over the long run.

To buy or not to buy

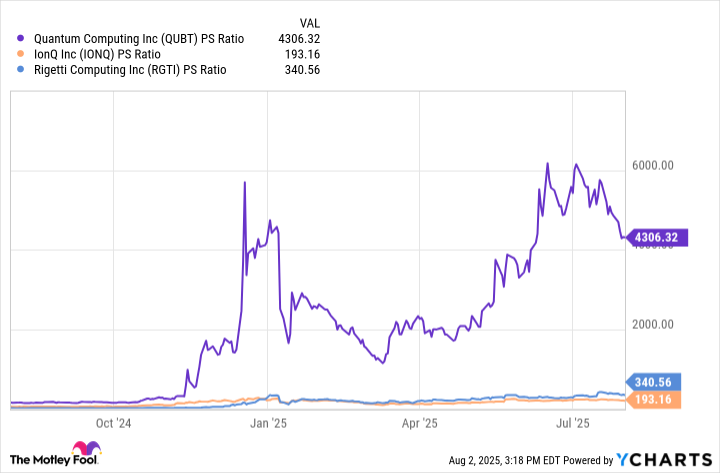

Another factor to consider in weighing whether to invest in QCi is its share price valuation. Since the company isn't profitable, we can assess its value using the stock's price-to-sales (P/S) ratio, which measures how much investors are willing to pay for every dollar of revenue generated over the trailing 12 months.

Data by YCharts.

QCi's P/S multiple is exceptionally high, indicating its stock is expensive. To give you a sense of how astronomical the figure is, the chart includes a comparison against IonQ and Rigetti Computing, two of QCi's competitors in the quantum computer space.

Although QCi's sales seem to be picking up steam, and its cash position will keep the lights on for a while, its sky-high stock valuation is reason enough to avoid an investment. On top of that, the company's slim sales to date and rising costs suggest QCi may not survive over the long run unless this trend reverses.

Given the excessive risks involved with this company, the best approach is to put its stock on your watch list and see if its sales momentum accelerates in the coming quarters. If so, that may be the time to revisit the stock. But for now, Quantum Computing Inc. does not look like a good long-term investment.