Palantir (PLTR 3.49%) is one of the hottest stocks in the market. It has delivered explosive returns for shareholders this year and is rapidly growing from a business standpoint, too.

There's nothing to dislike about Palantir's business from an investing standpoint (you may have qualms about what its software is used for in government, but that's beside the point), but there is a lot to dislike about the stock.

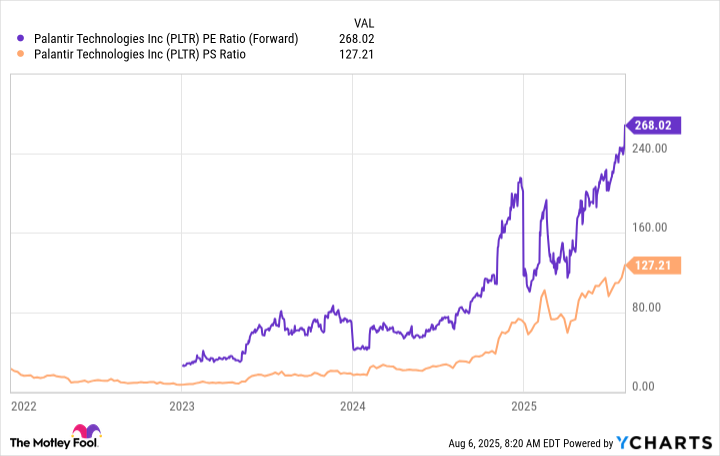

Alongside Palantir's rapid rise has been a massive expansion in valuation, and it has become the most expensive stock on the market. I think that this is unsustainable and could lead to some lackluster stock performance over the next few years.

Although Palantir has a market cap of over $425 billion, I think ASML (ASML +2.27%) and AMD (AMD 0.24%) could surpass it over the next three years, despite each being worth around $275 billion.

Image source: Getty Images.

The case against Palantir

As mentioned above, Palantir's business is phenomenal. Its software is becoming the building blocks for deploying AI in business and government, and it has the growth to show for it. In the second quarter, Palantir's revenue rose 48% year over year to more than $1 billion. That blew away expectations and showcases the unstoppable demand Palantir is experiencing.

The problem is that the growth rate is already baked into the stock.

One of the premier AI stocks over the past few years has been Nvidia. Nvidia posted growth rates of more than 200% during its run, yet never traded for more than 46 times sales or 51 times forward earnings. Palantir has far exceeded those levels despite much slower growth.

PLTR PE Ratio (Forward) data by YCharts

Let's break down what growth it would take for Palantir to trade at a reasonable level. If Palantir can sustain a 50% revenue growth rate over the next three years, it would increase its revenue from today's $3.44 billion total to $11.6 billion. If we give Palantir a 30% profit margin (its profit margin was 22% over the past 12 months), that would indicate Palantir would generate $3.5 billion in profits.

At today's $425 billion market cap, that would still price Palantir's stock at 122 times three-year forward earnings. This showcases how expensive Palantir's stock is, and indicates it could be ripe for a pullback.

As a result, I think it's possible that ASML and AMD could be larger than Palantir in three years by doing nothing different.

ASML and AMD don't have to do anything special to be worth more than Palantir

Both ASML and AMD are reasonably priced for their current business, and each is expected to put up respectable growth figures over the next few years, although still far slower than Palantir.

Using Nvidia's max valuation of about 50 times forward earnings as the high point for Palantir's earnings in three years ($3.5 billion), that would indicate the stock should be worth around $175 billion. As mentioned before, Palantir trades at around a $425 billion market cap right now, so this would indicate a substantial drop.

Both ASML and AMD are valued at around $275 billion, so Palantir's potential drop would cause these two to be worth more.

Palantir is an incredibly overvalued stock, but it has a strong and devoted following, and it may continue to defy traditional valuation metrics, similar to Tesla. Investors are more than capable of holding onto Palantir stock at elevated prices, so the correction to its price may never come, despite all factors indicating that it should.

I still think AMD and ASML will (and should) be valued higher than Palantir's stock, but investors will have to wait and find out if that turns out to be true.