Last week, Amazon (AMZN +1.60%) reported its second-quarter earnings. Investors were not enthused. The stock dipped 10% and is now trailing the valuation of its big technology peers, with Nvidia and Microsoft having market caps of around twice the size of Amazon today. Wall Street is concerned about slower growth in cloud computing and Amazon falling behind in artificial intelligence (AI).

This pins the stock down on one topic when in reality Amazon has all the ingredients to keep growing its profits over the long term, which is what will drive the share price higher. Here's why Amazon -- with a market cap of $2.3 trillion right now -- can finish 2025 valued at over $3 trillion.

NASDAQ: AMZN

Key Data Points

More profits arriving in e-commerce

The biggest reason for Amazon's profit expansion in its e-commerce division the last few years is advertising. High-margin advertising revenue has grown from $7.4 billion in the second quarter of 2021 to $15.7 billion last quarter, and is still growing 22% year over year. This division has now generated $61 billion in revenue over the last 12 months and has incredibly strong profit margins.

Advertising, along with growth in third-party seller services, subscription revenue, and operating leverage over its fixed cost base, has enabled Amazon's North American retail division to expand its profit margin to 7% over the last 12 months. Through the rest of 2025, there is plenty of room for this expansion to keep occurring, which will have a large impact on profitability given how much revenue the division generates ($400 billion over the last 12 months). Even slight profit margin enhancements mean billions of dollars in extra earnings for Amazon.

The same thing is happening in international markets, where Amazon has a 3.4% operating margin on $150 billion in revenue. These segments are behind North America but have the same business model at the end of the day, meaning there is even more room for margin expansion over the long haul.

Over $500 billion in annual revenue for segments growing revenue in the double digits means Amazon can add tens of billions of dollars in earnings power from North America and international retail in the years to come just by expanding its profit margin slightly each year. Through the rest of 2025, this story will continue to unfold.

Image source: Getty Images.

Sustained cloud computing tailwind

A once shining star of Amazon's business, cloud computing division Amazon Web Services (AWS) was the reason for the stock falling after its latest quarterly result. Revenue grew 17.5% for AWS in the quarter, which was well behind competitors Microsoft and Alphabet.

Even though AWS is growing slower than its peers, it will still benefit greatly from the AI revolution, especially because of its relationship with Anthropic. The fast-growing AI start-up is seeing booming revenue and is planning to spend a boatload of money at AWS, its key partner. This can drive an acceleration of revenue growth for AWS through the rest of 2025. With over $130 billion in annualized sales, AWS is on a path to hitting close to $150 billion in annual recurring revenue by the end of 2025.

Its profit margin is also strong, at 37% over the last 12 months. A strong profit margin and fast revenue growth mean huge earnings gains for AWS, which will lead to consolidated earnings gains for Amazon.

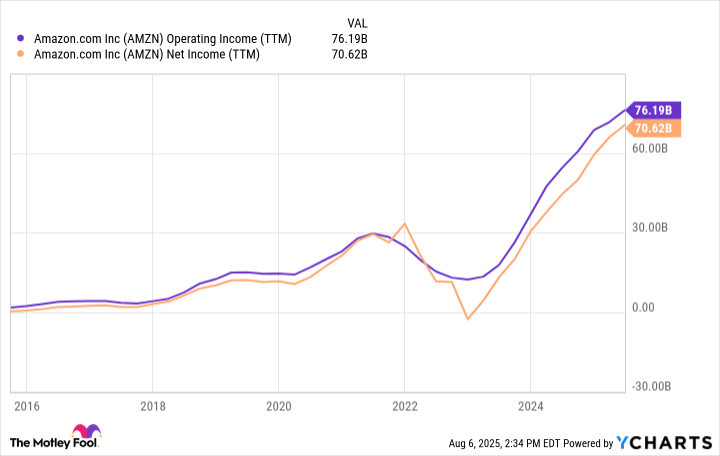

AMZN Operating Income (TTM) data by YCharts

The math to a $3 trillion valuation

Over the last 12 months, Amazon has generated $76 billion in operating income and $70 billion in net income. Through continued margin expansion in retail and fast growth at AWS, both of these figures can keep chugging higher through the end of 2025. In 2026, it is likely that Amazon's annual earnings will be close to or exceed $100 billion.

Today, Amazon trades at a forward price-to-earnings ratio (P/E) of 33. The S&P 500 index trades at a P/E ratio of close to 30. A forward P/E ratio of 30 and $100 billion in 2026 earnings means that Amazon would trade at a market cap of $3 trillion by the end of this year. That is the math behind Amazon's potential in 2025, and why the stock is set to surge in the next few quarters. Buy Amazon stock and hold on tight for the long term.