Apple's (AAPL +0.62%) decision to increase its U.S. investment by $100 billion -- bringing its total recent commitment to $600 billion in the next four years -- comes at a critical time for the iPhone maker. But it could be a net positive as the company looks for ways to increase its sales and grow on the momentum of its promising fiscal third-quarter earnings report.

Apple and President Donald Trump made the announcement on Wednesday, Aug. 6, which is the same day that the White House announced a series of new tariffs against dozens of countries to take effect on Thursday. Tariffs have been a concern for Apple stock because the company makes most of its celebrated iPhones in China. While it had made plans to move some production to India, Trump has loudly proclaimed that he wants iPhone manufacturing to be in the U.S. instead.

The announcement falls short of actually building smartphones in the U.S., but it does include concrete plans and partnerships to manufacture several components used in iPhones domestically. Through the creation of Apple's American Manufacturing Program, the company is bringing more supply chain and advanced manufacturing resources to the U.S.

NASDAQ: AAPL

Key Data Points

Apple announced that initial partners in the program include Corning, Coherent, GlobalWafers America, Applied Materials, Texas Instruments, Samsung, GlobalFoundries, Amkor Technology, and Broadcom. Previously, Apple had also committed to buying rare earth materials from MP Materials.

Examples of the partnership, according to Apple, is that it will use Corning glass products for its iPhones and Apple Watches, and will work with Coherent to source the VCSEL lasers needed for facial recognition and other services. Apple also says it will use GlobalWafers to produce chips for iPhones and iPads, with the products being fabricated by Texas Instruments and by Taiwan Semiconductor Manufacturing's Arizona plant.

"Apple engineers work closely with suppliers across the United States to create silicon chips that are on the leading edge of innovation," Apple Chief Operating Officer Sabih Khan said. "We're committed to supporting U.S. suppliers involved in every key stage of the chip-making process -- from the earliest stages of research and development, to final fabrication and packaging. We want America to lead in this critical industry, and we're expanding our efforts to grow a silicon manufacturing ecosystem that will benefit innovators across America."

The market reacted positively to the announcement, as Apple stock jumped 5% on Wednesday.

Image source: Getty Images.

A turnaround for Apple stock?

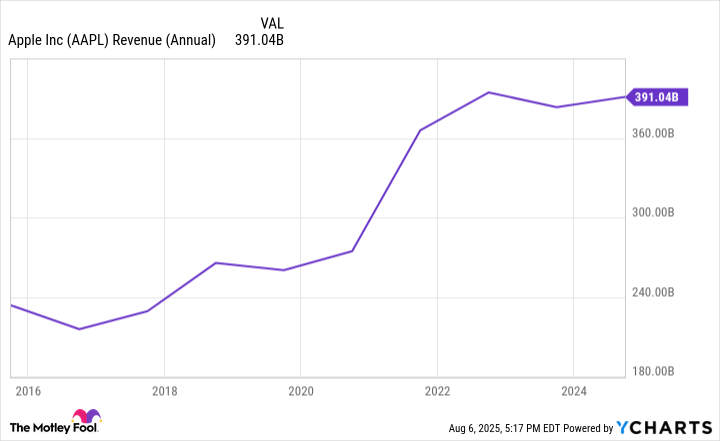

Investors are obviously hoping that this, coupled with Apple's most recent earnings report, will spark a fire under Apple stock and finally get it moving higher. While other tech stocks are booming, Apple has been relatively flat, rising less than 2% in the last 12 months. Its annual revenue, which helped make Apple the biggest publicly traded company in the world for nearly two decades, flattened in the last three years.

AAPL Revenue (Annual) data by YCharts.

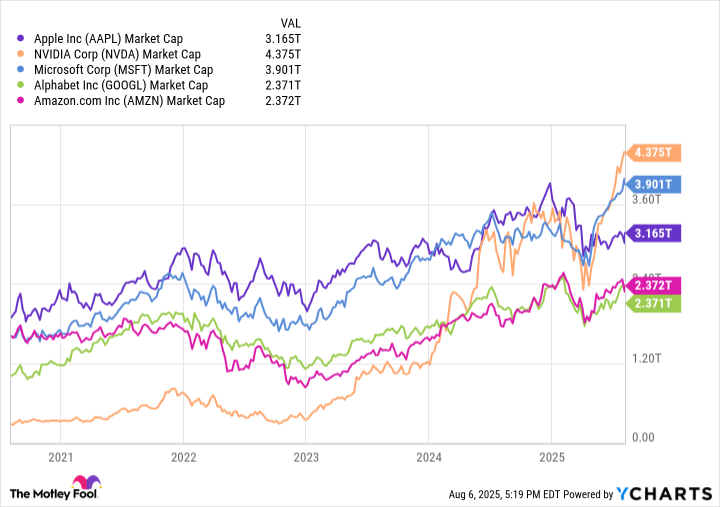

Now both Nvidia and Microsoft top Apple in the rankings of largest companies, with Alphabet and Amazon rapidly closing the gap.

AAPL Market Cap data by YCharts.

However, investors finally got some good news on July 31, when Apple reported its fiscal third-quarter earnings (ended June 28). Revenue jumped 10% to $94 billion, and earnings per share were up 12% to $1.57. Product sales were up 8.2%, which was a vast improvement from the 2.7% increase that Apple saw in the fiscal second quarter.

Regarding Wednesday's announcement, Apple isn't the first tech company to promote U.S. manufacturing to avoid tariff issues. TSMC, which is the world's largest fabricator for high-level semiconductors that power generative artificial intelligence platforms, is investing $165 billion in Arizona to create a research and development center, two advanced packaging facilities, and three fabricators. The work is widely viewed as a hedge to avoid being penalized by future tariffs.

It's unclear so far how Apple's announcement will affect the cost of products. While Apple's Services division continues to grow and has a far higher profit margin, Apple continues to get the lion's share of its revenue from its products, including smartphones, Macbooks, iPads, and wearable devices.

Should you invest in Apple stock?

Apple has been a disappointment of late, but there's real momentum here that the company can use to make a change. The company is also fairly valued, with a recent price-to-earnings ratio of 32, which is reasonable for tech stocks.

Apple's announcement should be enough to keep it out of the White House's disapproval. Whether it's enough to keep Apple customers buying its products and help Apple continue to grow its quarterly revenue is another question.