The stock market has had a roller-coaster of a year, both entering correction territory and setting new all-time highs within a matter of months.

It is not surprising, then, that investor sentiment is mixed right now. While around 35% of investors feel optimistic about the next six months, according to the most recent weekly survey from the American Association of Individual Investors, around 43% are pessimistic about the future.

Many stocks and funds are still reaching new heights, but is it safe to invest right now? Here's what you need to know.

Image source: Getty Images.

An unstoppable growth ETF reaching record highs

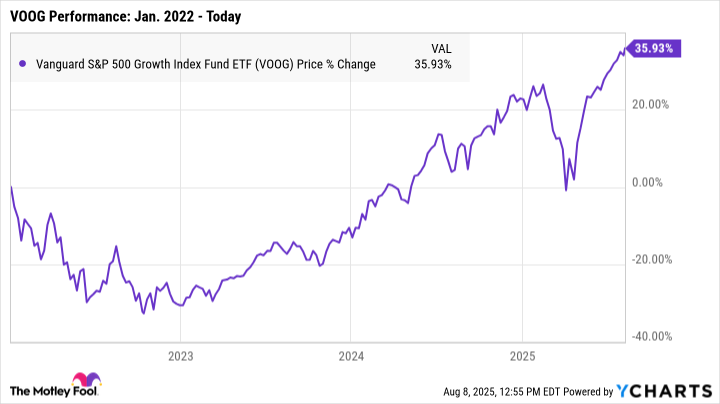

Despite mixed feelings among investors, many funds are still surging -- including the Vanguard S&P 500 Growth ETF (VOOG 0.28%). This exchange-traded fund (ETF) reached a new all-time high on Aug. 8, climbing by more than 38% since its low point in early April of this year.

Although the market still faces a threat of a downturn or recession -- especially as new tariff policies begin taking effect -- this ETF is more likely than many other investments to withstand volatility while still helping you build wealth.

The Vanguard S&P 500 Growth ETF includes only stocks that are listed in the S&P 500 (^GSPC +0.21%). Making it into the S&P 500 is a high bar, and these stocks are among the largest and strongest in the U.S. While the index itself contains stocks from 500 companies, this ETF includes only 212 stocks with the most potential for growth.

That combination can make this ETF a particularly strong investment. Many stocks within the S&P 500 are industry-leading juggernauts, making them more likely to survive periods of volatility. At the same time, though, because this fund includes only those with the most growth potential, you're also more likely to see above-average returns over time.

NYSEMKT: VOOG

Key Data Points

In fact, over the last 10 years, the Vanguard S&P 500 Growth ETF has earned an average rate of return of 15.79% per year. The Vanguard S&P 500 ETF, by comparison, has earned an average return of 13.62% per year in that time.

Is it really safe to buy now?

Nobody knows when the next downturn will begin, how long it will last, or how severe it might be. But the good news is that, with the right strategy, there's never necessarily a wrong time to invest.

When stocks take a turn for the worse, your portfolio will likely lose value. But you don't technically lose any money unless you sell your investments for less than you paid for them. If you invest now, the market immediately plummets, and then you sell, you'll likely lock in significant losses.

However, if you simply hold your investment until stock prices eventually recover, your portfolio should regain any value it lost -- without you losing a dime.

For example, say you invested in the Vanguard S&P 500 Growth ETF in January 2022. The S&P 500 was about to descend into a bear market that would last nearly a year, and your ETF would have plunged by nearly 33% by October. But if you simply held on to your investment, you'd have earned total returns of nearly 36% by today.

In another scenario, say you'd waited until mid-2024 to buy. This ETF had fully recovered from the 2022 bear market by then, setting new record highs. While it may have felt safer to invest at that point -- and stocks still had many more months of growth ahead -- you'd have earned total returns of only around 23% by today.

Time is your best friend as an investor. If you can't hold your investments for at least five to seven years (or, ideally, a couple of decades), it can be a risky time to buy. In that case, you may be better off contributing to an emergency fund rather than investing your spare cash.

But if you're able to stay in the market for the foreseeable future, the Vanguard S&P 500 Growth ETF is more likely than many others not only to recover but also to go on to experience long-term growth. Time in the market is far more valuable than timing the market, no matter what the future may hold.