Amazon (AMZN +0.10%) stock sold off nearly 10% in the two days after reporting second-quarter 2025 results. It has since recovered some of those losses but remains up just slightly year-to-date -- underperforming the S&P 500 and Nasdaq Composite.

Here's why Amazon is out of favor, along with the biggest mistake investors make when buying the growth stock.

Image source: Getty Images.

Amazon's underwhelming guidance

Amazon reported excellent quarterly results, including growing operating income far faster than revenue. However, its third-quarter guidance and anticipated growth slowdown in Amazon Web Services (AWS) may be reasons for the stock's pullback. The AWS results are particularly jarring, considering Microsoft (MSFT +0.28%) Azure and Alphabet's (GOOGL 0.12%) (GOOG 0.07%) Google Cloud are growing more quickly than AWS.

What's more, Amazon's free cash flow plummeted to $18.2 billion for the trailing 12 months ended June 30, 2025, compared to $53 billion for the trailing 12 months ended June 30, 2024. The company is deploying excess cash back into the business to invest in big ideas, such as building out AWS data centers, launching generative AI tools, expanding Amazon Prime delivery capabilities, and more. And yet, Amazon's third-quarter guidance calls for just 10% to 13% revenue growth and between an 11% decline in operating income and an 18% increase.

NASDAQ: AMZN

Key Data Points

Amazon's aggressive capital allocation strategy

The biggest mistake investors make when buying Amazon stock is not realizing that the company's modus operandi is plowing profits back into innovative ideas rather than booking short-term profits. Amazon takes a lot of risks, most of which have paid off and led to phenomenal long-term gains for patient investors. But this strategy also produces inconsistent earnings per share and cash flow. Amazon has fallen at least 25% from its all-time high three times in the last decade -- showcasing the stock's volatility.

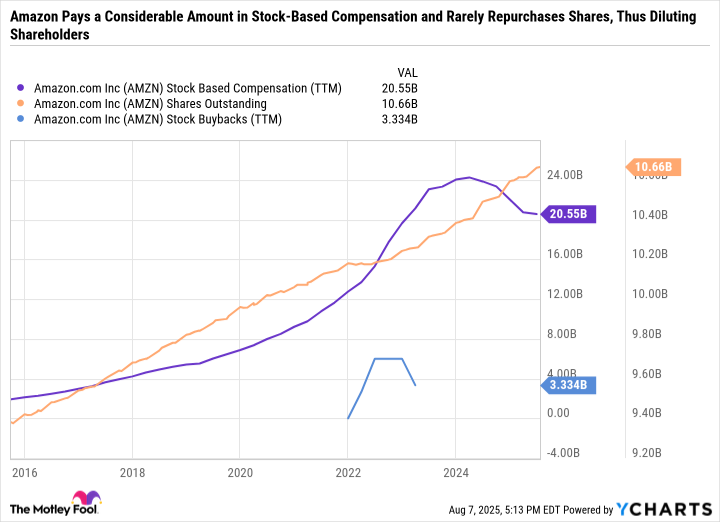

Amazon's stock-based compensation regularly exceeds its buybacks. Amazon hasn't repurchased stock in years, and it doesn't pay a dividend. Meanwhile, its stock-based compensation is over $20 billion for the trailing 12 months, and its outstanding share count continues to climb as Amazon dilutes existing shareholders.

AMZN Stock Based Compensation (TTM) data by YCharts. TTM = trailing 12 months.

This is a far different approach from other big tech giants like Apple (AAPL +0.59%), Microsoft, Alphabet, and Meta Platforms (META +0.39%). Like Amazon, these tech giants shell out billions in stock-based compensation each year to attract top talent, but they more than offset this expense with buybacks, which avoid dilution. In fact, having buybacks outpace stock-based compensation accelerates earnings growth by lowering the number of outstanding shares.

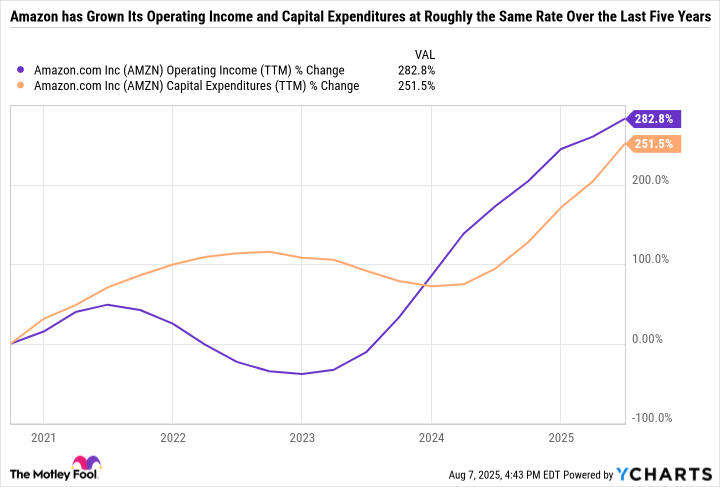

Meanwhile, Amazon is ramping up spending in the pursuit of long-term growth. As you can see in the following chart, the company has grown its operating income at an impeccable pace over the last five years, but it has also magnified its capital expenditures.

AMZN Operating Income (TTM) data by YCharts. TTM = trailing 12 months.

AWS remains the undisputed leader in the global cloud market, but its dominant market share is partly due to its entrenched position in the industry. In this vein, Amazon is making the right decision to reinvest profits in AWS to expand capacity and build out its AI capacity to bolster its competitive advantages. But investors will want to see these investments pay off.

The good news is that Amazon's valuation has gotten much more attractive as its earnings have grown and the stock price has stagnated. Amazon commands a 33.9 forward price-to-earnings (P/E) ratio -- which is nearly identical to Microsoft's 33.6 forward P/E ratio.

The best way to approach Amazon stock

Investors who buy and hold Amazon stock must do so for the right reasons. Amazon's capital spending is surging, and if Wall Street doesn't see these investments pay off, the stock could keep tumbling.

Amazon tends to get a shorter leash than other mega-cap names, so buying the stock requires a high risk tolerance. But this shorter leash is by design, as Amazon could easily pull back on spending and boost its cash flow or return capital to shareholders through buybacks and dividends.

Investors looking for a company with a more balanced capital allocation may want to consider Microsoft or Alphabet as preferred cloud plays over Amazon. However, Amazon is a decent valuation for folks looking to invest in the cloud and who believe in the strength of Amazon's core e-commerce and advertising business.