About three years ago, a little-known start-up called OpenAI sparked a generational shift across the technology ecosystem after it released ChatGPT.

At its core, ChatGPT is a large language model (LLM) that allows users to input queries and test features including image generation, writing software code from scratch, or scraping the internet to answer basic questions on just about any topic.

In early August, OpenAI CEO Sam Altman took center stage to showcase the latest version of ChatGPT called GPT-5. While GPT-5 is great for OpenAI's early backers, I see its creation as a massive -- albeit overlooked -- win for Nvidia (NVDA 0.36%) investors.

Let's explore why GPT-5 is a big deal as the artificial intelligence (AI) narrative continues to unfold, and assess why Nvidia stock is positioned to benefit from the rise of more sophisticated LLMs.

NASDAQ: NVDA

Key Data Points

GPT-5 is more than just a new chatbot; it's rewriting the playbook for enterprise AI

GPT-5 does not represent a routine upgrade compared to prior models released by OpenAI. Rather, large corporate enterprises are demanding more advanced functionality across a host of use cases and applications from LLMs.

New models such as GPT-5 doesn't simply mean "smarter" chatbots. Rather, GPT-5 and the competition that it spurs will open the door to a host of new applications in agentic AI, healthcare, and even adjacent models that lead to breakthroughs in robotics, autonomous vehicles, and wearable tech.

Considering OpenAI reportedly already has millions of paying customers and is on track to generate $20 billion in annual recurring revenue this year, I suspect the release of GPT-5 will serve as a bellwether for even more accelerated AI adoption.

Image source: Getty Images.

How is GPT-5 bullish for Nvidia?

In a recent article by my fellow Fool Danny Vena, he made an astute point that AI adoption is moving downstream -- an idea that I don't think most investors fully grasp yet.

Each new generation of an AI software model such as GPT innately leads to more demand for training and inferencing hardware. These developments require significant computational power in the form of GPU clusters, which plays right into Nvidia's rolodex of industry-leading AI accelerators, networking equipment, and CUDA software stack.

Taking this one step further, the release of GPT-5 now raises the stakes for rival LLM platforms like Anthropic, Claude, Gemini, and Perplexity -- ultimately creating an intensified arms race for complex GPU architectures, such as Nvidia Blackwell.

Is Nvidia stock a buy right now?

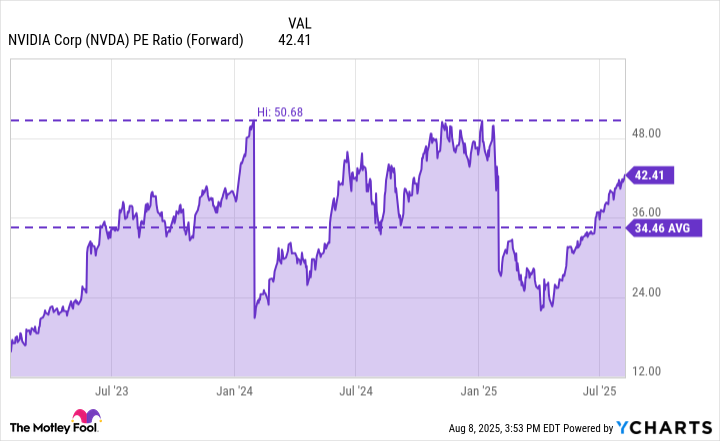

The chart below illustrates trends in Nvidia's forward price to earnings (P/E) multiple over the last three years. Although Nvidia's forward P/E ratio is both higher than the three-year average and clearly experiencing an expansion phase at the moment, the valuation multiple does remain at a steep discount to prior levels seen during the AI revolution.

NVDA PE Ratio (Forward) data by YCharts

I think Nvidia's premium forward earnings multiple suggests that investors are generally bullish on the company's prospects.

However, the discount to historical levels could suggest that investors may not fully appreciate how rising AI infrastructure investment will translate into meaningful and accretive gains across Nvidia's ecosystem.

More advanced applications will continue to drive demand for Nvidia's full stack as the company plays a critical dual role in powering the creation and ongoing development of AI models across hardware and software. For this reason, I think Nvidia is positioned for further valuation expansion and see the stock as a no-brainer opportunity for long-term investors to buy and hold for years to come.