Back in 1999, a fledgling semiconductor company called Nvidia invented a chipset called the graphics processing unit (GPU) -- a product that, at the time, few people realized they would one day need.

Two decades ago, GPUs were primarily marketed toward gamers and graphic designers. But Nvidia's visionary CEO, Jensen Huang, saw the broad potential of these advanced chips before anyone else.

When the GPU was initially released, AI applications were both niche and barely imagined. But Huang understood that the world's most important problems would be solved by anticipating latent needs -- capabilities that people will demand at some point in the future, even if they can't fully describe them today.

Huang realized that GPUs could be parlayed for more sophisticated problem solving that traditional CPUs at the time could not handle efficiently, ultimately becoming the foundational layer on which artificial intelligence (AI) modeling, research, and data analytics are built.

In a similar fashion, internet and cloud computing juggernaut Alphabet (GOOG 0.24%) (GOOGL 0.27%) has been quietly pushing the envelope in a new pocket of the AI realm that's gaining attention: quantum computing.

Let's dive into Alphabet's innovative approach to developing quantum applications and explore how the company's progress parallels that of Nvidia's pioneering role in AI before it went mainstream.

NASDAQ: GOOGL

Key Data Points

How is Alphabet building quantum computing applications?

Back in December, Alphabet unveiled its latest breakthrough in the quantum computing arms race: a processor called Willow. With 105 qubits and enhanced algorithmic features across error correction, Willow might appear as just another incremental improvement over prior generations of quantum chips released by Alphabet and its peers.

Where Willow caught the attention of AI enthusiasts was through an experiment in Random Circuit Sampling (RCS), in which its quantum processing was measured against classical supercomputers. In this study, Alphabet claims that Willow solved a sophisticated series of computations in under 5 minutes that would take today's most capable supercomputers an estimated 10 septillion years to complete.

Image source: Getty Images.

Why Alphabet is to quantum computing what Nvidia is to AI

While Alphabet's quantum supremacy may not have ample commercial uses today, the idea here is that the company's innovations and technological breakthroughs are similar to that of Nvidia and the invention of the GPU back in the late 1990s. Willow and the GPU both represent underlying proof that Alphabet and Nvidia have been at the forefront of innovations where conventional approaches are not able to compete at scale.

Similar to Nvidia, Alphabet is not building its AI business through a singular lens. Under its umbrella, Alphabet has TensorFlow -- an open-source machine learning platform. In addition, Alphabet's Google Quantum AI team operates an open-source software framework called Cirq, which helps Python developers research and build applications. Lastly, Google DeepMind serves as a research lab spanning various aspects of the AI spectrum, including quantum computing.

To me, the formation of Alphabet's AI ecosystem aligns closely with Nvidia's approach. Outside of its hardware specialty, Nvidia also offers software through its CUDA infrastructure. This decision ultimately created a virtuous cycle in which developers building generative AI applications continually demand additional GPU and software capacity -- leading to a self-reinforcing technological moat for Nvidia.

I think Alphabet is employing a similar strategy, betting that classical computing will eventually become exhausted by increasingly sophisticated AI workloads. When this occurs, Alphabet will have already architected the leap from classical to quantum computing.

Just as Nvidia has done throughout the AI revolution thanks to its GPUs and software platform, Alphabet could one day be positioned as the main ecosystem on which quantum applications are developed.

Is Alphabet stock a buy right now?

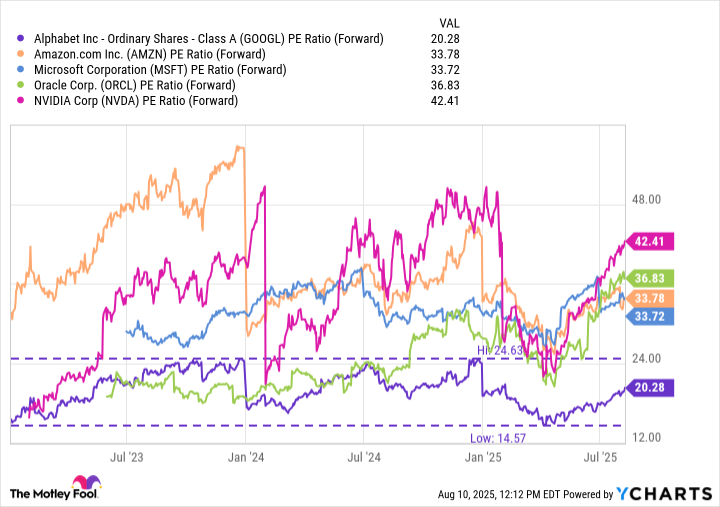

Throughout the AI revolution, many of Alphabet's peers have experienced notable expansion in their valuation multiples.

GOOGL PE Ratio (Forward) data by YCharts

At the moment, however, Alphabet is trading roughly in line with its three-year average forward price to earnings (P/E) ratio. Not only is the valuation discount to its peers striking, but I think it's overstated.

Over the last three years, Alphabet has continued to innovate across several areas of AI, including new capabilities in search, video, e-commerce, cybersecurity, and of course, hardware such as quantum chips. Nevertheless, the upside from these investments do not appear to be fully priced into the company's long-term financial success.

Just as Nvidia has proven to be one of the most lucrative long-term buys of the decade, I see Alphabet positioned to follow a prolonged breakout period featuring notable valuation expansion as its AI-powered products continue to scale and become a more central part of the company's growth narrative. For these reasons, I think that Alphabet stock is dirt cheap and looks like a compelling opportunity at its current price level.