Many quantum computing stocks have seen massive gains in the past year, including IonQ (IONQ 1.63%). Its shares surged by more than 450% in the last 12 months through the week ending Aug. 8.

IonQ has lofty goals: It aspires to become the Nvidia of quantum computing. Just as Nvidia provides components critical to today's most advanced computer systems, IonQ seeks to fill the same role by providing the quantum devices of the future.

If it can achieve its objectives, the stock could soar. But is now a good time to scoop up shares?

Image source: Getty Images.

IonQ's technological success

Many approaches exist to building quantum computers, and their differences largely rest in what they use to create their qubits -- the parts of the system where data is stored and manipulated. IonQ's tech uses trapped ions -- individual positively charged atoms -- which it manipulates with lasers. Without getting any deeper into the technical weeds, it's enough to say that these computers process data in a much different way than conventional ones, and that allows them to rapidly deliver answers to certain categories of complex problems that would take years, or even centuries, for conventional computers to solve.

For instance, in July, IonQ partnered with the U.S. Department of Energy to compute the optimal schedule for power generators to cost-effectively satisfy increasing electricity demands. This task is complicated because it must factor in an array of sources such as hydroelectric, wind, and solar.

IonQ's revenues have about doubled annually since its IPO in 2021. For this year, management has forecast between $82 million and $100 million in revenue, compared to $43.1 million in 2024.

So far, it's on track to hit this target. In the second quarter, IonQ's sales were $20.7 million, up from $11.4 million in the prior-year period. It expects Q3 revenue of at least $25 million -- about double the $12.4 million it booked in Q3 2024.

NYSE: IONQ

Key Data Points

IonQ's financial situation

Although IonQ's top line is growing fast, it's not a profitable business. Its Q2 operating expenses were $181.3 million, resulting in an operating loss of $160.6 million.

This was a significant increase from its $48.9 million loss from operations a year prior. Its skyrocketing costs are the result of several acquisitions, including a business that operates in the quantum cryptography arena, and another that's putting quantum-based tech into orbital satellites.

The massive gap between its Q2 sales of $20.7 million and an operating loss of $160.6 million is cause for concern. IonQ needs to begin getting costs under control or its business will eventually run into financial difficulties. This is particularly relevant in the current macroeconomic climate of persistent inflation as President Donald Trump's tariff policies contribute to rising prices.

In the short term, IonQ will be able to maintain operations. As of the end of Q2, its balance sheet boasted total assets of $1.3 billion versus total liabilities of $168.2 million. This included cash, cash equivalents, and short-term investments of $546.9 million. On top of that, the company completed an equity offering in July that raised over $1 billion, further securing its financial stability.

To buy or not to buy IonQ

It could be years before IonQ's tech is adopted widely. All quantum computers operating today are still subject to issues that hinder their broader usage. Among the problems, due to the extreme sensitivity of atomic particles to environmental changes, quantum computers are far more prone to computational errors than conventional tech. There are ways to mitigate and reduce those errors -- but developing the tech to overcome these challenges is one of the central problems IonQ and its peers face.

It could be a long race to that goal. Earlier this year, Nvidia CEO Jensen Huang stated that practical quantum systems were still 15 to 20 years away. And Nvidia is one of the businesses building quantum computers.

Although Huang later walked back that prediction, industry forecasts estimate that quantum computing technology won't hit key levels of maturity until sometime between 2030 and 2040.

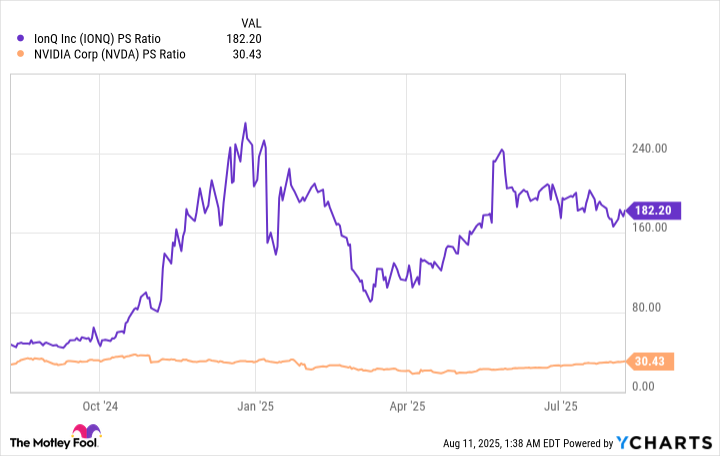

For investors weighing whether to scoop up shares of IonQ now, another consideration must be its valuation. Because it's operating in the red, there are no earnings to measure it by. But one can assess it using the price-to-sales (P/S) ratio, which measures how much investors are paying for each dollar of revenue it has generated over the trailing 12 months.

Data by YCharts.

Relatively speaking, by that metric, IonQ stock is expensive. Its P/S ratio is far higher than it was a year ago, and as a point of comparison, it's sky-high compared to Nvidia, a rival in the quantum computing space and a company IonQ aspires to emulate.

That elevated share price valuation means now is not a good time to buy IonQ. Further, since it's likely to be years before quantum computers gain wider adoption, there's no telling how IonQ's tech will fare over time, especially against competitors with far deeper pockets.

As a result, IonQ stock is a highly risky investment that should only be considered by those who have a high risk tolerance. Watch IonQ's performance over the coming quarters. If it maintains its rapid revenue growth and can reduce its costs and losses, perhaps then, the stock will be worth revisiting.