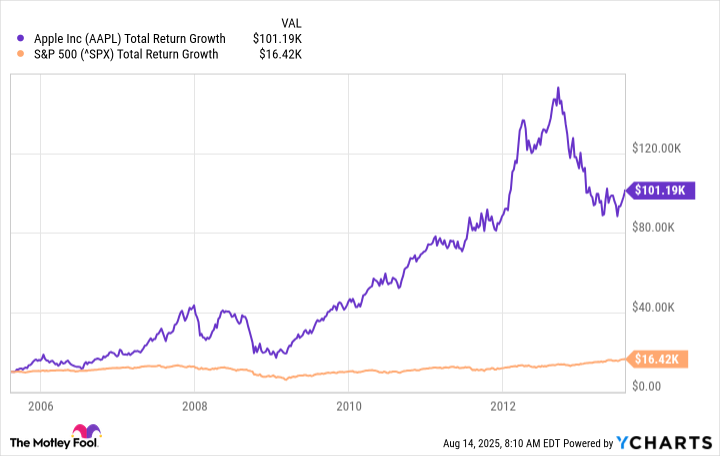

Apple (AAPL +1.68%) stock has been one of the best-ever investments on the market, crushing the market over several decades. Consider how much money you'd have today if you'd invested $10,000 in Apple stock 20 years ago vs. in the S&P 500; the difference gets wider as you go back in time.

AAPL Total Return Level data by YCharts

It has outperformed the market over the past five years, too, but only by a hair's breadth. That's largely due to its performance this year, which has been dismal.

However, there have been many times in the past when Apple stock plunged, and there were times it remained low even for several years before rebounding in a big way. For example, it hit a high in 2007 before the mortgage crisis and didn't reach it again until 2009. Let's see what's happening at Apple and where it might be in five years.

Image source: Getty Images.

Tariffs, iPhones, and AI

There are several factors working together against Apple stock these days, as there usually are when there's a drastic change from the norm. They are mostly concentrated in tariff uncertainty, iPhone sales, and artificial intelligence (AI).

Tariff uncertainty is weighing on it

The market has been worried about how Apple will be impacted by tariffs, considering its reliance on getting its products made in China. It has already diversified its supply chain to include India to a large degree, but tariffs went there, too, and seem to have chased it into a corner where it recently announced that it would invest $600 billion in manufacturing in the U.S.

The tariff issue is stabilizing, and should be a blip five years from now. However, there could be large-scale aftereffects as it changes its supply chain. Having more operations domestically could lead it in many different directions that are unforeseeable today, such as having a more expensive workforce but a lower tariff rate.

iPhones account for a large part of sales

There's also been concern that it has too few products, which means that any change in one of them could impact the business in a big way. iPhones account for nearly half of total sales, and as artificial intelligence changes how people engage with technology, the iPhone business is vulnerable to innovation in new areas from competitors.

Apple still has a tight ecosystem with users who are loyal to its products, so it's not a near-term worry. But in five years, the landscape could look a lot different, with other kinds of devices taking the place of smartphones for many actions. I don't see iPhones becoming obsolete even in five years, but Apple would need to make some major changes to its premier products to keep customers buying new ones.

Slow progress in AI

CEO Tim Cook gave an upbeat outlook about Apple Intelligence on the fiscal third-quarter earnings call (for the period ended June 28), but so far, it hasn't suitably impressed investors, who feel it's falling behind the competition.

However, as Cook noted, "In everything we do, we're driven by transformative innovation, delivering the most exceptional products and services we've ever created, and we're especially excited about what's ahead." I think that sums up Apple's approach to its consumer goods business. It's not, for example, like Amazon, which tries to be everything to everyone. Many users still remember its "Think Different" campaign, which still defines its model, and investors shouldn't expect it to do things the same way as other companies. It wouldn't be Apple if it did.

NASDAQ: AAPL

Key Data Points

Things could get better, but how much?

That said, Apple is now the third-largest company in the world by market cap, and it's questionable whether it can continue beating the market at this size. It still offers value and is likely to keep growing, but there's a cap on how much it can gain. For example, if we surmise it can grow its revenue at a compound annual growth rate of 8% over the next five years, which is a generous estimate considering its recent performance, and assume the price-to-sales ratio remains constant, revenue and the stock price would increase 47%. That's one possibility of many, and a new product or advances in AI could boost revenue growth.

Considering its recent drop, I would expect it to recoup the loss and go on to be bigger and better sooner rather than later. But over the next five years, I wouldn't count on Apple gaining as quickly as it has in the past.