It's fair to say the latest earnings report from Advance Auto Parts (AAP 0.23%) was not well received by the market -- the stock was initially sold off by a mid-teens percentage. However, I think there was more good than bad in the actual numbers. That's not to say anyone should get overly excited, because this is still an underperforming company. Still, there are some positives here, and there are some things for the stock's bulls to build on.

The investment case for Advance Auto Parts

The case for buying the stock is well known, and if not, it should be, because the company has been around for over a decade. Simply put, the auto parts retailer's operational metrics are so woefully short of its peers, principally AutoZone and O'Reilly Automotive, that all it will take is some restructuring to get the company somewhere close to its peers' margins, cash flow, and earnings, and a substantial amount of value will be generated for investors.

NYSE: AAP

Key Data Points

That was the gist of the case when activist investor Starboard Value got involved a decade ago (only to exit in 2021), having failed mainly in helping engineer any kind of significant closing of the gap with AutoZone and O'Reilly.

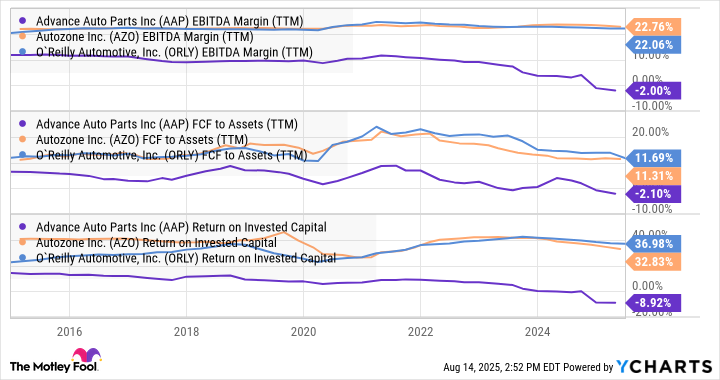

In case you are wondering what I'm referring to, here are a few charts to demonstrate. They show earnings before interest, taxation, depreciation, and amortization (EBITDA) margins, free cash flow (FCF) generated from assets, and finally return on invested capital (ROIC).

None of these metrics has improved over the last decade.

AAP EBITDA Margin (TTM) data by YCharts

The problem with Advance Auto Parts

The main areas of improvement that Starboard articulated a decade ago still apply today. Auto parts retailing is a business that ensures the right stock is in the right store at the right time. In other words, it's a game of optimizing inventory, building supplier relationships, and above all, logistics management. Time is of the essence in the industry, as customers, whether in the do-it-yourself or especially in the do-it-for-me market, usually demand a part as soon as possible to help repair a vehicle and get it back roadworthy.

It's also a game Advance Auto Parts hasn't played well over the years, as evidenced by its inability to generate good cash flow from its assets in the chart above. Simply put, the company has lagged its peers in converting inventory into cash. It outflows cash by paying its suppliers quicker than it generates cash from the parts it sells to retail customers.

What happened in the recent results

The recent results were in line with what management had pre-announced on July 24, except for one crucial detail.

Management lowered its guidance for full-year adjusted diluted EPS from continuing operations from $1.50-$2.50 to a new range of $1.20-$2.20 "to account for higher net interest expense related to its recent senior notes offering," according to the earnings release. The company recently took on $1.95 billion in debt to redeem existing debt maturing in 2026 and provide it with cash to support its ongoing restructuring.

Image source: Getty Images.

The good news from the results

On a more positive note, management's restructuring resulted in a return to profitability in the quarter. Furthermore, its full-year guidance for an outflow of $85 million to $25 million implies FCF generation of $116 million to $176 million in the second half, given there was a $201 million outflow in the first six months. These are positive steps, but as management noted on the earnings call, "we recognize that we are still in the early phases of our three-year turnaround plan."

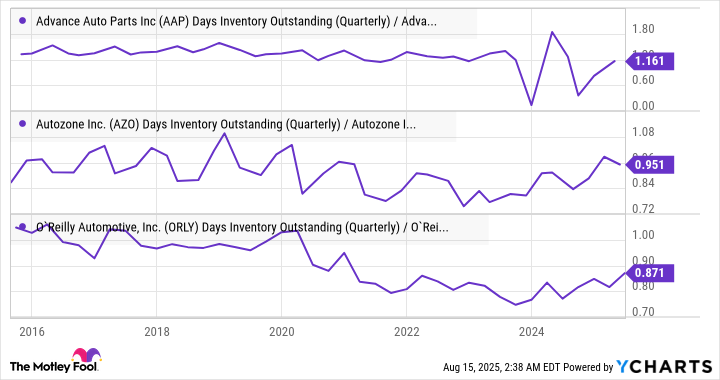

Moreover, turning back to the fundamental issue of selling inventory down quicker than paying suppliers, Advance Auto Parts continues to lag its peers. These charts show how many days it takes the company to sell its inventory compared to the days it takes to pay suppliers -- a low number is better.

Fundamental Chart data by YCharts

Investors should monitor this metric closely, as Advance Auto Parts will not be able to demonstrate improvement in its efforts to improve operational performance until it lowers this metric.