Many artificial intelligence (AI) stocks have seen strong returns in 2025. One of these has been BigBear.ai (BBAI 2.00%). Its shares are up nearly 40% this year through the week ending Aug. 15.

But currently, BigBear.ai stock is well below the 52-week high of $10.36 reached in February. Does this signal an opportunity to pick up shares?

To answer that question, let's dig into the company to understand where it's at today, and if it's a worthwhile investment in the burgeoning field of AI.

Image source: Getty Images.

From growth to setback for BigBear.ai

BigBear.ai is a provider of artificial intelligence solutions for national security and infrastructure. For example, it supplies the U.S. Navy with shipbuilding software for submarine construction, and several U.S. airports with biometric technology to scan and identify travelers, both powered by AI.

The federal government is the source for a majority of BigBear.ai's income. The company had been enjoying revenue growth, delivering a solid 2024 with sales of $158.2 million, up from $155.2 million in 2023. It kicked off 2025 with a 5% year-over-year rise in revenue to $34.8 million in the first quarter.

But then, the Trump administration announced spending cuts this year, and in Q2, BigBear.ai's revenue plunged 18% year over year to $32.5 million. Consequently, the company revised its 2025 revenue target to a range of $125 million to $140 million. That's a substantial drop from 2024's $158.2 million.

In addition, BigBear.ai is not profitable. It reported an operating loss of $90.3 million, a significant jump up from the prior year's $16.7 million, as a result of a goodwill impairment charge of $70.6 million.

NYSE: BBAI

Key Data Points

How BigBear.ai is addressing its challenges

Against this backdrop, BigBear.ai is working to expand its business. CEO Kevin McAleenan, who took over the role in January, recognized that the company's sales pipeline was poor, since it relied on just a handful of customers.

McAleenan is addressing this shortcoming, stating, "We have taken steps this year to deepen and broaden that pipeline with additional customers, more prime contract targets, larger opportunities, and expansion into new markets, including international."

To that end, BigBear.ai announced a new collaboration with organizations in the United Arab Emirates (UAE) as part of a partnership between the U.S. and UAE governments to share technologies such as artificial intelligence.

BigBear.ai has the funds to maintain operations as the new sales pipeline ramps up. Its balance sheet at the end of Q2 sported total assets of $599.4 million versus total liabilities of $332.8 million.

This included a record-high cash balance of $391 million compared to total debt of $143 million, putting the company in a net positive cash position for the first time. BigBear.ai's cash hoard should sustain operations while it rebuilds revenue.

Other considerations in weighing a BigBear.ai investment

A factor in BigBear.ai's favor is the historic level of funding the U.S. Department of Homeland Security (DHS) received after President Trump signed the “big, beautiful bill” into law earlier this year. BigBear.ai provides tech to DHS, such as its biometrics software, so it is well positioned to receive some of the department's funds.

Could this mean BigBear.ai stock is worth picking up, especially considering its hefty cash reserve, improvements to its sales process, and a drop in share price after Q2 earnings were released on Aug. 11?

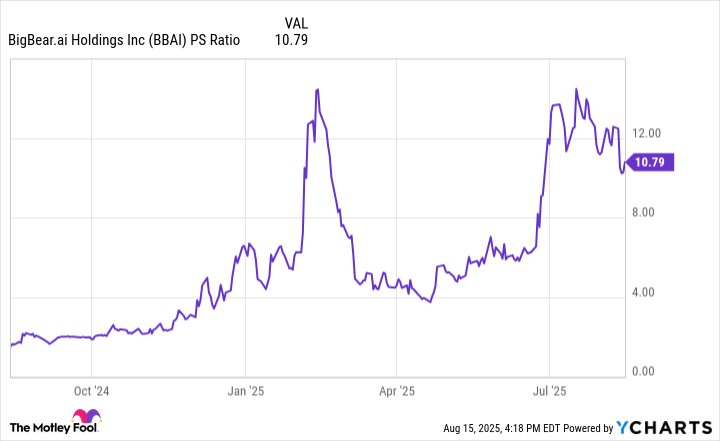

To evaluate this, here's a look at the company's share price valuation, which can be assessed using the price-to-sales (P/S) ratio. This metric measures how much investors are willing to pay for every dollar of revenue produced over the trailing 12 months.

Data by YCharts.

The chart shows BigBear.ai's P/S multiple is elevated, both compared to where it was around April and a year ago. This suggests its stock is not a bargain despite the share price drop.

BigBear.ai could bounce back from the misfortune of government budget cuts, but how soon that could happen is unknown, and it could suffer another tough quarter of declining revenue in Q3. For now, it's best to wait and see how its business performs in the ensuing months before deciding to invest.