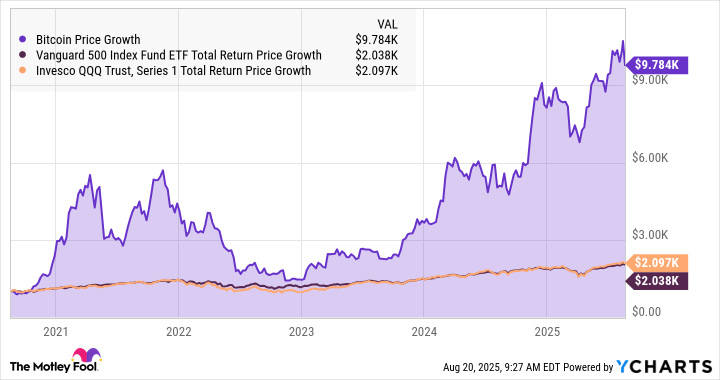

Let's say you had $1,000 of spare cash to invest on Aug. 20, 2020. If you had invested that money in the popular Vanguard 500 Index Fund (VOO +0.19%) and enabled dividend reinvestments, that investment would be worth $2,038 today.

A double in five years? That's a compound annual growth rate (CAGR) of 15.3%. Not too shabby!

Image source: Getty Images.

The tech-heavy Invesco QQQ Trust (QQQ 0.19%) would have served you slightly better. The index fund, which tracks the performance of the Nasdaq-100 market index, showed a total return of $2,097 over the same period.

However, both wealth-building stock market trackers look sleepy next to the skyrocketing cryptocurrency Bitcoin (BTC +1.12%). A $1,000 Bitcoin investment in the summer of coronavirus lockdowns would be worth $9,784 today:

Bitcoin Price data by YCharts

How Bitcoin earned its returns

Bitcoin's path to these market-crushing returns wasn't smooth. The digital currency soared in 2020 and 2021, fell back a hair-raising 75% by the end of 2022, and found a second wind after that trough.

These days, Bitcoin is exploring fresh all-time highs on a weekly basis, but in a nerve-wrackingly volatile way. Last year's halving event almost disappears in the ruckus of market-moving Bitcoin news. The introduction of spot Bitcoin exchange-traded funds (ETFs) had a calming effect on the underlying cryptocurrency, and recent support from the U.S. government also helped.

All told, Bitcoin ETFs sport a beta value of 2.8. That makes Bitcoin about three times as volatile as the S&P 500 (^GSPC +0.19%) stock market index, which underpins Vanguard's VOO fund.

CRYPTO: BTC

Key Data Points

Can Bitcoin keep beating Wall Street?

My time machine is in for repairs, so I can only speculate about the next five years.

However, Bitcoin's anti-inflationary design should combine with rising cryptocurrency usage, adding bullish weight to the supply and-demand balance. So the next half-decade probably won't see another ninefold price gain, but Bitcoin's squiggly chart should generally trend higher again.