SoundHound AI (SOUN +4.25%) has been one of the most popular pure-play artificial intelligence (AI) stocks on the market. It has also displayed phenomenal growth and recently reported a blowout quarter. However, the AI investment opportunity isn't measured in months or quarters; it's measured in years.

As a result, SoundHound AI investors need to keep their eyes focused on the horizon and consider where the company is heading over the next five years. This will guide them on what to consider doing now for the best returns possible.

Image source: Getty Images.

SoundHound AI saw explosive growth in Q2

SoundHound AI combines AI technology with audio recognition, which isn't a new concept. Voice assistants like Siri and Alexa have been around for some time, but their performance has left a lot to be desired. SoundHound is the next iteration of these and has produced results that outperform human counterparts.

The company's platform has been widely deployed in restaurant and automotive applications and is expanding to healthcare and financial services. The company is gaining a lot of traction in that last sector and has seven of the top 10 global financial institutions as clients.

NASDAQ: SOUN

Key Data Points

SoundHound AI revenue rose 217% year over year in the second quarter. It also raised its full-year outlook from about $167 million to $169 million.

The company is doing quite well in revenue growth, but its profitability leaves a lot to be desired. In the second quarter, its operating loss totaled $78 million -- or nearly double the $43 million in revenue it generated. This is a key factor for AI investors to understand, since it's unlikely to generate profits for some time with its sole focus on capturing market share.

Over the next five years the company may be able to turn the corner and generate profits, but that would likely be toward the end of that period. With profits being hard to predict, the only metric we have to go on is revenue.

You'll have to pay a huge premium to own the stock

It's unlikely for the company's pace of revenue expansion to last forever. Wall Street analysts project 29% growth for 2026. Furthermore, SoundHound has made lots of acquisitions in the past few years, so understanding what is purchased growth and what is organic growth is even more difficult. At the stock's current price tag, the market has already priced in significant growth.

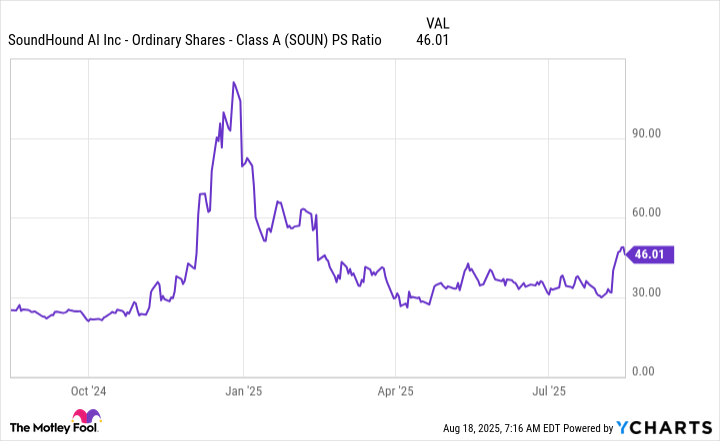

SOUN PS Ratio data by YCharts; PS = price to sales.

At 46 times sales, SoundHound AI is far from cheap, and a lot of its future growth is already baked into the stock price. Normally, software stocks trade between 10 and 20 times sales, but most aren't tripling revenue year over year, either.

So, the business ends up being a difficult-to-analyze combination of high growth, high valuation, and no profits. In five years, the company could be a sprawling AI leader with huge profits and a platform used by businesses everywhere. In this scenario, SoundHound AI is a no-brainer stock pick and worth every penny today. On the flip side, a competitor could come out with a superior product that causes SoundHound to struggle to grow.

It's impossible to know looking five years out. With the success it is having today, combined with the relationships it's creating, I have a hard time envisioning the second scenario happening. Still, the high stock price today is prohibitive of future robust returns unless the company can continue doubling its revenue through next year.

SoundHound AI is an incredibly risky stock that could have high returns or high losses. If you're a believer in the company and its products, there's no problem in taking a position here, as long as it's no larger than 1% of your portfolio. That way, it can make a huge difference if it continues to rise, but it won't sink your portfolio if it fails.