The market is full of fantastic investment opportunities, and if you've got $1,000 waiting to deploy, I think there are several compelling stocks available right now. While this stock should already be a part of a well-diversified portfolio, buying $1,000 worth of Taiwan Semiconductor Manufacturing (TSM 3.03%) shares today looks like a genius move.

TSMC, as it is better known, stands to benefit greatly from a massive, marketwide trend, as it is a top operator in its industry. It's growing rapidly and shows no signs of slowing down, and it is priced at a reasonable level. I think it's one of the top stocks to buy in the market today, and should make investors a healthy profit if they can keep a long-term mindset.

Image source: Getty Images.

TSMC is a key part of the AI supply chain

TSMC is a semiconductor chip manufacturer that contracts to produce chips for companies with chip design operations that lack large-scale in-house production capabilities. That's nearly all of big tech today, and companies like Nvidia, Advanced Micro Devices, and Apple all use TSMC as their primary chip producer.

This is a key investment point for TSMC: It doesn't compete against its clients -- it just provides valuable fabrication services for them (chip production at scale is a notoriously complex process that requires expertise to do well). This is a key selling point in its business too, as clients don't have to worry about TSMC stealing their designs and launching competing chips.

Another reason why TSMC is a top choice in this space is its high yields. TSMC's most advanced chip available is its 3nm (nanometer) chips. Reportedly, TSMC has achieved greater than a 90% yield for this node, while competitor Samsung hasn't cracked 50% (yield represents the percentage of chips produced that are fully functional). This is a big deal, as it drives prices up when the yield is low.

NYSE: TSM

Key Data Points

Even though TSMC has one of the top processes in the 3nm chip node, it isn't stopping there. TSMC has plans to launch a 2nm chip later this year, and plans are in place for further innovation after that. The 2nm chip is already seeing massive demand, thanks to its improved efficiency. 2nm chips can be configured to run at the same speed as their 3nm counterparts, but consume 25% to 30% less power. With energy consumption in high-powered computing applications being a large concern for many, this is a welcome improvement and will drive massive demand for this product.

Because TSMC's chips are used by nearly every company in the AI race, the future looks incredibly bright for the company. At the start of 2025, management projected that AI-related revenue would increase at a 45% compound annual growth rate (CAGR) over the next five years, with overall revenue rising at around a 20% CAGR. So far, 2025's results have been ahead of management's expectations, so it's possible that TSMC could surpass these bold projections, which would lead to even more long-term outperformance.

TSMC is firing on all cylinders right now, making it an excellent stock to buy. But even if a stock is doing well, if it's bought at the wrong price, it could turn into a losing investment. Fortunately for investors, TSMC's stock looks reasonably priced.

TSMC's stock is priced alongside the broader market

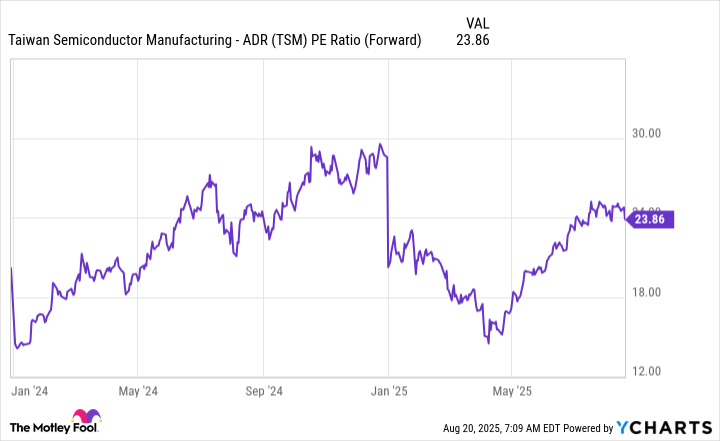

TSMC's stock trades at a reasonable 24 times forward earnings.

Data by YCharts.

It's slightly cheaper than the broader market, as measured by the S&P 500, which is valued at around 24.1 times forward earnings. While both of these valuations are historically high, the growth that's ahead of TSMC and the broader market (due to leadership from big tech) is also unprecedented.

We're still in the early stages of rolling out AI technologies, and are still building out the computing capacity needed to deliver an AI-first experience. That bodes well for Taiwan Semiconductor Manufacturing over the long term, making it an excellent stock to buy and hold right now.