Quantum computing stocks have soared over the past year, and one of these is D-Wave Quantum (QBTS 4.00%). The company's shares surged nearly 1,300% over the last 12 months through Aug. 21.

Excitement around quantum computing's potential to transform sectors of the economy have fueled investor interest in the industry. After all, D-Wave says that its quantum system is "capable of solving computationally complex problems beyond the reach of classical computers."

But the question is whether D-Wave's current business can translate into long-term success. Getting to an answer requires peeling back the layers of this pure-play quantum computing company.

Image source: Getty Images.

D-Wave's auspicious year

D-Wave stock's jaw-dropping performance is not entirely unwarranted. Through the first half of 2025, the company's sales skyrocketed 289% year over year to $18.1 million. The result is particularly impressive considering it generated revenue of $8.8 million in all of 2024.

This year's dramatic sales growth shows the company's technology is gaining customer traction. For example, bookings in the Asia-Pacific region have grown 83% over the past 12 months. (Bookings represent customer orders that should generate revenue once the orders are fulfilled.)

In addition, D-Wave released its latest quantum computer, the Advantage2, in May. In describing the new system, CEO Dr. Alan Baratz stated, "It's an engineering marvel, with substantial technical advancements that highlight D-Wave's progress in scaling quantum technology."

A scalable quantum computer is something the industry lacks. Quantum machines are prone to calculation errors because they use atomic particles that are disrupted by the slightest disturbance, referred to as noise. The Advantage2 boasts a 75% reduction in noise compared to its predecessor.

NYSE: QBTS

Key Data Points

The risks of investing in D-Wave

Although D-Wave has enjoyed success this year, it's not a profitable business. After two quarters, the quantum computing trailblazer's 2025 loss from operations stood at $37.8 million, more than double its $18.1 million in sales.

The result was due to operating expenses rising to $53.6 million through the first half of 2025, up from $39.4 million in 2024. With such substantial costs, D-Wave's business is unsustainable in the long run if the situation doesn't change.

That's why the company executed an equity offering in June. As a result, D-Wave's second quarter balance sheet boasted $819.3 million in cash and equivalents, a record high for the company. The funds will sustain the business in the short term as revenue ramps up and D-Wave explores possible acquisitions.

Nonetheless, a hurdle to sales is the Advantage2's appeal to customers. The system uses annealing quantum computing, a technique to find the optimal solution among many possibilities. Annealing is effective in some situations, but not all, which can deter customers.

To address this, D-Wave is also building gate-model quantum computers to tackle use cases that annealing can't handle. The company claims to be the only provider of both annealing and gate-model quantum machines.

However, D-Wave admitted gate-model devices involve higher investment costs and are years away from commercial applications. This suggests D-Wave won't be making income from the tech any time soon.

On the bright side, the company seems to be gaining customers for its annealing approach. In Q2, it closed deals with businesses such as electronics giant Sharp and NTT Docomo, Japan's largest mobile phone operator.

To buy or not to buy

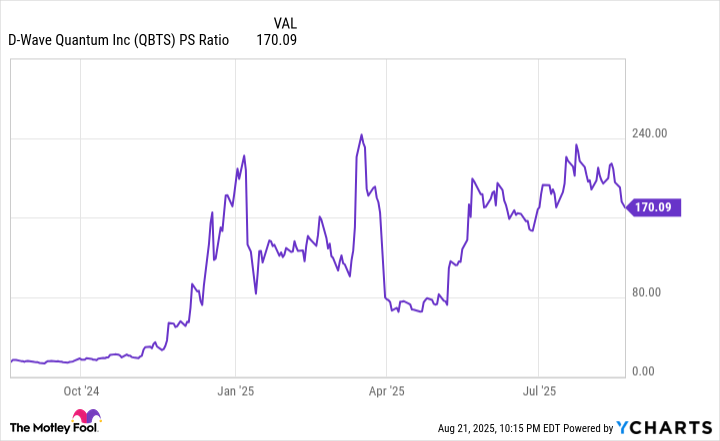

D-Wave's budding business isn't the only consideration in determining if now is the time to pick up shares. A key factor is its stock's valuation. This can be evaluated through the price-to-sales (P/S) ratio, which measures how much investors are willing to pay for every dollar of revenue generated over the trailing 12 months, and is commonly used for unprofitable businesses.

Data by YCharts.

D-Wave's P/S multiple is significantly higher than it was a year ago, or even in April, when the broader stock market plunged due to President Trump's contentious tariff policies. This suggests D-Wave shares are pricey, so now isn't the ideal time to pick up shares.

Instead, wait for the stock price to drop before deciding to buy. In fact, you may want to wait until D-Wave's Q3 earnings report, which can provide insight into customer adoption of the company's Advantage2 system and the revenue brought in by new deals.

That said, D-Wave is a risky investment. The challenges inherent in quantum computing technology mean it could be years before widespread adoption takes place. Given the company's modest revenue compared to its staggering costs, D-Wave may not last long enough for that moment to arrive. Consequently, this stock should be considered only by investors comfortable with high risk.