Palantir (PLTR +6.75%) has been one of the most impressive stocks in the market this year, with its shares about doubling in price. That has brought Palantir up to an impressive $370 billion market cap at the time of this writing. However, there's a company that has a $292 billion market cap that I believe will be worth more than Palantir by 2030. It's one of the most critical companies in the artificial intelligence (AI) arms race, and few have actually heard of it.

This under the radar company? ASML (ASML 3.26%). ASML is one of the most important companies in the AI arms race, and still has a bright future. I also think it can be worth more than Palantir in 2030, although it will achieve this feat in an odd way.

Image source: Getty Images.

ASML is a critical supplier for the AI arms race

ASML makes extreme ultraviolet lithography machines, which doesn't seem like an AI-centric product at all. These machines are used to lay the microscopic electrical traces on chips, and it's the only company in the world with this technology. ASML's technological monopoly in this space makes it incredibly important to the AI arms race, as without its machines, advanced chip-making wouldn't be possible. Without cutting-edge chips, AI training and inference are much different.

NASDAQ: ASML

Key Data Points

Because of the massive demand for AI hardware, ASML's business is well-positioned to grow over the next few years. They expect their revenue to increase to a range of 44 billion to 60 billion euros (ASML is based in the Netherlands) by 2030. Over the past 12 months, ASML has generated 32.2 billion euros. At the midpoint, that indicates ASML's revenue will rise 62% over the next few years or a compounded annual growth rate (CAGR) of 9.1%.

That's not incredibly fast growth, but it's important to know that ASML's management team is rather conservative when laying out guidance. Additionally, it's far slower than the blazing fast 48% growth Palantir delivered during Q2.

So, how will ASML be worth more than Palantir by 2030 if it's growing slower and valued at a lower starting point?

Palantir's stock has more than five years' worth of growth baked into the stock price

The issue with Palantir's stock is that it has uncoupled from the business. While Palantir is doing well, the stock's price tag indicates that the company is doing far better. This shows up in Palantir's valuation, which has reached unprecedented levels.

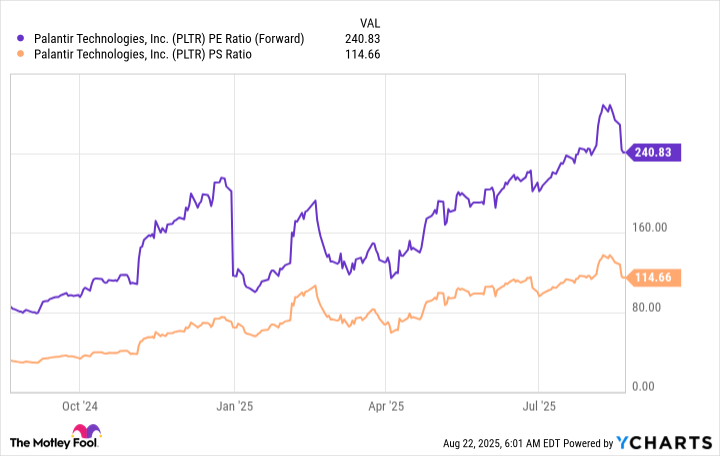

PLTR PE Ratio (Forward) data by YCharts

At 241 times forward earnings and 115 times sales, Palantir is easily one of the most, if not the most, expensive stocks on the market. At reasonable long-term expectations, Palantir already has years' worth of growth baked into the stock price, even past 2030.

Over the next five years, if Palantir can grow at a 40% CAGR (Wall Street expects 35% growth next year, and it will likely slow after that, so this is a bullish projection) and achieve a strong long-term profit margin of 35%, it will generate $21.9 billion in revenue and $7.66 billion in profits.

If we assign Palantir's stock a far more reasonable 40 times forward earnings multiple, that would give the stock a market cap of $306 billion. If you recall, Palantir's stock is worth $370 billion today, so even with bullish growth and profit projections, Palantir's stock has more than five years' worth of growth already priced into the stock.

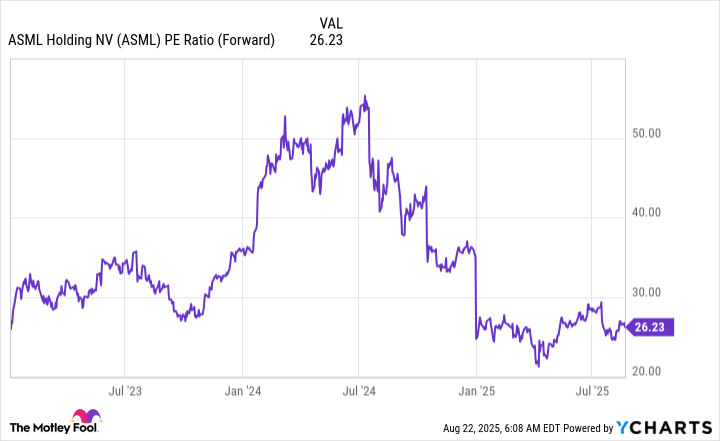

ASML is worth $292 billion and trades at a multi-year low valuation. This indicates that ASML should be able to grow at about the same pace as its revenue, which will easily allow ASML to be a larger business than Palantir will be by 2030.

ASML PE Ratio (Forward) data by YCharts

The expectations baked into Palantir's stock price are far too high, and AI investors are much better off scooping up shares of a company like ASML that has solid long-term prospects.