Warren Buffett famously said that most investors would be better off if they only had a punch card with 20 slots, adding up to the total number of investments they could make in their lives. While this may be an extreme example to illustrate a point, the philosophy still stands. Investors generally get into trouble by trading too much and would benefit from patient, buy-and-hold stock picking approaches in the punch card manner.

One investor took this lesson to heart: Norbert Lou. The investor started a fund called Punch Card Management that only makes a select few investments. Surprisingly, last quarter Punch Card Management had two new stocks added to the portfolio in Crocs (CROX 0.58%) and PayPal (PYPL 1.05%). Does that mean you should follow Lou and buy these stocks for your personal portfolio?

NASDAQ: PYPL

Key Data Points

PayPal's comprehensive fintech strategy

A mainstay of the financial technology space since the beginning of the internet, PayPal is now under new management and has a comprehensive strategy to provide financial services to both merchants and individuals. Included in its brand portfolio are personal finance app Venmo, the namesake PayPal service, and merchant payment processor Braintree. Previous management acquired many businesses, but new CEO Alex Chriss has begun a retrenching strategy after joining PayPal two years ago to simplify its operations.

First, it has refocused PayPal to be a commerce and shopping application for its core users. Through cash back programs, credit cards, and new services such as buy now, pay later (BNPL) loans, PayPal is pushing for users to utilize the application when shopping online and in person, while also partnering with merchants to promote the services. Active accounts have now stabilized. Last quarter, PayPal users (which includes its other brands) grew 2% year over year to a record 438 million, a great sign for a business that had a decline in customers while coming out of the COVID-19 pandemic.

More promising may be the growing subsidiaries of Venmo and Braintree. Venmo's personal finance and money transfer application is growing its monetization tactics. Revenue grew 20% year over year for the application last quarter, as monthly debit card accounts grew 40% year over year. Turning the application into more of a banking service will help Venmo improve its revenue-generating potential and keep its users coming back to the service.

Braintree is an unbranded payment processing service for merchants. It has grown aggressively in recent years. However, new management decided that it was chasing unprofitable deals to win on price and recently got out of these contracts, which severely hurt payment volume growth for the division. This quarter, payment volume for Braintree began to grow again, a good sign for the business.

Image source: Getty Images.

Sneaky growth in footwear

Crocs operates in the hypercompetitive footwear category, selling its unique-looking plastic sandals that can be styled up with pins and different branding. Crocs' stock is in a 50% drawdown because of a bad acquisition and slowing growth in North America.

Last quarter, revenue from the namesake Crocs brand decreased 6.5% in North America to $457 million, a trend that has continued for many quarters now. The HeyDude brand that Crocs acquired saw revenue decrease 3.9% last quarter, another notch in the belt for a terrible acquisition for the company. HeyDude was a $2.5 billion purchase for Crocs, but has been written down on its balance sheet as the brand sees declining sales.

On a positive note, Crocs' revenue internationally is doing well, with sales up 18% last quarter to $502 million, and is now larger than Crocs' North America revenue. While the company is struggling in its home country, Crocs is doing well in new markets like China, where it is getting introduced to the region with well over 1 billion people.

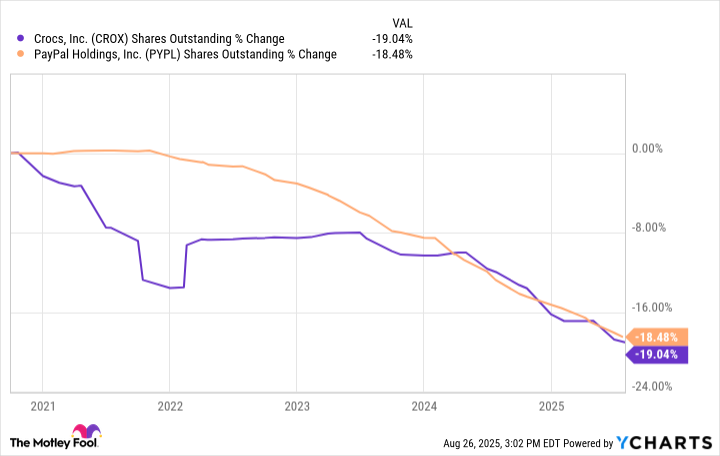

CROX Shares Outstanding data by YCharts

Two patterns in these beaten-down stocks

These two stocks -- PayPal and Crocs -- are not world-class businesses with fast-growing revenue. But there are two characteristics that likely have led Punch Card Management to take a stake in these businesses.

First is the discounted valuation. PayPal has a forward price-to-earnings ratio (P/E) of 13, while Crocs has a dirt-cheap forward P/E of 7.5. These are well below the market average. What this means is that PayPal and Crocs are heavily discounted by Wall Street, reducing forward expectations for earnings growth. This means the businesses do not have to knock it out of the park in order for the stocks to perform well for shareholders.

Second, both PayPal and Crocs have begun aggressively repurchasing stock. Both of these companies' shares outstanding have fallen by around 20% in the last five years. A reduction in shares outstanding will help increase earnings per share (EPS), the key driver of stock price gains over the long term. If you believe these businesses will remain stable, it might be a good time to follow Punch Card Management and take a position in these cheaply trading stocks.