Buying artificial intelligence (AI) stocks after the run they've had over the past few years may seem silly. However, the reality is that many of these companies are still experiencing rapid growth and anticipate even greater gains on the horizon.

By investing now, you can get in on the second wave of AI investing success before it hits. While it won't be nearly as lucrative as the first round that occurred from 2023 to 2024, it should still provide market-beating results, making these stocks great buys now.

Image source: Getty Images.

AI Hardware: Taiwan Semiconductor and Nvidia

The demand for AI computing power appears to be insatiable. All of the AI hyperscalers are spending record amounts on building data centers in 2025, but they're also projecting to top that number in 2026. This bodes well for companies supplying products to fill those data centers with the computing power needed for processing AI workloads.

Two of my favorites in this space are Nvidia (NVDA -1.77%) and Taiwan Semiconductor Manufacturing (TSM -1.06%). Nvidia makes graphics processing units (GPUs), which have been the primary computing muscle for AI workloads so far. Thousands of GPUs are connected in clusters due to their ability to process multiple calculations in parallel, creating a powerful computing machine designed for training and processing AI workloads.

Inside these GPUs are chips produced by Taiwan Semiconductor, the world's leading contract chip manufacturer. TSMC also supplies chips to Nvidia's competitors, such as Advanced Micro Devices, so it's playing both sides of the arms race. This is a great position to be in, and it has led to impressive growth for TSMC.

Both Taiwan Semiconductor and Nvidia are capitalizing on massive data center demand, and have the growth to back it up. In Q2 FY 2026 (ending July 27), Nvidia's revenue increased by 56% year over year. Taiwan Semiconductor's revenue rose by 44% in its corresponding Q2, showcasing the strength of both of these businesses.

With data center demand only expected to increase, both of these companies make for smart buys now.

AI Hyperscalers: Amazon, Alphabet, and Meta Platforms

The AI hyperscalers are companies that spend a significant amount of money on AI computing capacity for internal use and to provide tools for consumers. Three major players in this space are Amazon (AMZN -1.55%), Alphabet (GOOG -0.63%) (GOOGL -0.65%), and Meta Platforms (META -0.45%).

Amazon makes this list due to the boost its cloud computing division, Amazon Web Services (AWS), is experiencing. Cloud computing is benefiting from the AI arms race because it allows clients to rent computing power from companies that have more resources than they do. AWS is the market leader in this space, and it is a huge part of Amazon's business. Despite making up only 18% of Q2 revenue, it generated 53% of Amazon's operating profits. AWS is a significant beneficiary of AI and is helping drive the stock higher.

Alphabet (GOOG -0.63%) (GOOGL -0.65%) also has a cloud computing wing with Google Cloud, but it's also developing one of the highest-performing generative AI models: Gemini. Alphabet has integrated Gemini into nearly all of its products, including its most important, Google Search.

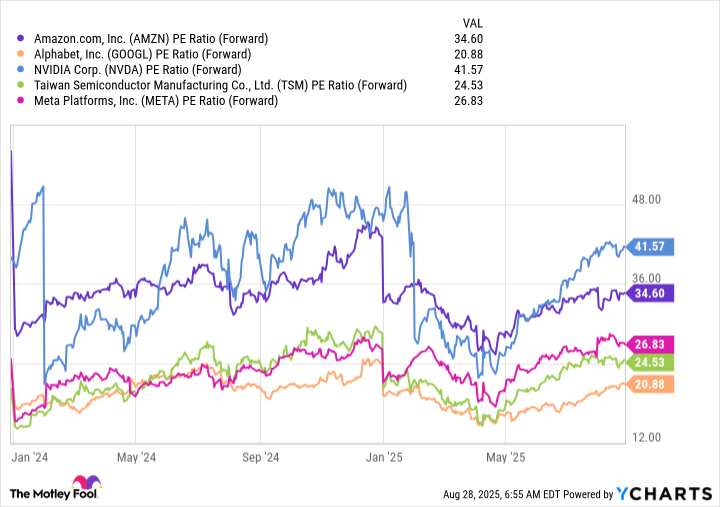

With the integration of generative AI into the traditional Google Search, Alphabet has bridged a gap that many investors feared would be the end for Google. This hasn't been the case, and Alphabet's impressive 12% growth in Google Search revenue in Q2 supports that. Despite its strong growth, Alphabet is by far the cheapest stock on this list, trading for less than 21 times forward earnings.

AMZN PE Ratio (Forward) data by YCharts

With Alphabet's strength and strong position, combined with a cheap stock valuation, it's an excellent one to buy now.

To round out this list, Meta Platforms (META -0.45%) is another smart pick. It's the parent company of social media platforms Facebook and Instagram, and gets a huge amount of money from ads. As a result, it's investing significant resources into improving how AI designs and targets ads, and it's already seeing some effects. AI has already increased the amount of time users spend on Facebook and Instagram, and is also driving more ad conversions.

We're just scratching the surface of what AI can do for Meta's business, and with Meta spending a significant amount of money on top AI talent, it should be able to convert that into some substantial business wins.

AI is a significant boost for the world's largest companies, and I wouldn't be surprised to see them outperform the broader market in the coming year as a result.