YieldMax MSTR Option Income Strategy ETF (MSTY 2.50%) is kind of a weird beast. Let's walk down the ladder of strangeness, starting with a really basic stock market tracker and ending up with the YieldMax fund. The route goes straight through the cryptocurrency corner of Wall Street:

- A simple index fund like the Vanguard S&P 500 ETF (VOO 0.60%) reflects the general health of the stock market. Buying this exchange-traded fund (ETF) lets you mirror the gains (or losses) of the S&P 500 (^GSPC 0.59%) market index with a single stock-like ticker symbol. You can pocket the Vanguard fund's 1.2% dividend yield as a cash profit, or enable a dividend reinvestment plan (DRIP) to buy more ETF shares with each payout. Diversification never looked easier.

- But what if you want to explore the higher-octane realms of cryptocurrency? You could buy some Bitcoin (BTC -0.14%), giving your portfolio exposure to the oldest, largest crypto coin, with all the volatility and future promise that comes with it. It's quite a bit more risky than the broad market tracker listed above, so your Bitcoin investment should be relatively small.

- But maybe you don't want to mess with direct cryptocurrency trades. You might need a new brokerage account, learn the ins and outs of placing crypto orders, and be comfortable having a digital wallet (on your phone, or your laptop, or managed by an online brokerage firm such as Coinbase Global or Robinhood). There are ETFs for this situation, too. Led by the iShares Bitcoin Trust ETF (IBIT -0.26%), a handful of spot Bitcoin ETFs reflect the market moves of Bitcoin in a more familiar asset format. Some would call this a simpler investment than a direct Bitcoin buy, but you're really adding one more layer of abstraction.

- Beyond the spot-price Bitcoin ETFs, you can buy stock in companies that own a lot of Bitcoin. The leading name here is Strategy (MSTR 2.77%), the enterprise software company formerly known as MicroStrategy. Co-founder and executive chairman Michael Saylor has converted most of Strategy's cash reserves into Bitcoin holdings, adding more by taking on fresh debt and selling stock on the open market. With 636,500 Bitcoins on the balance sheet, the $70 billion Bitcoin investment represents more than half of Strategy's market cap. It's just a simple stock, but one with heavy ties to the Bitcoin world. Owning Strategy stock is a lot like investing in a bank, whose only financial service consists of owning Bitcoin.

- And here's the final step into Bitcoin complexity: The YieldMax MSTR ETF doesn't own Strategy stock exactly. Instead, the fund manager takes advantage of Strategy's extreme volatility, generating a dividend-like income stream with the help of stock options and other derivatives. The options-based strategy consumes some of the fund's assets over time, driving the ETF's price lower more often than not.

But the resulting income stream can be impressive when the market conditions are right. As of Sept. 2, the YieldMax Strategy ETF's monthly yield is 7.1%. That's an annual yield of 128%, if you assume that the payouts stay stable from month to month.

Image source: Getty Images.

Why the payouts jump around

As you might imagine, the ETF's payouts aren't stable at all. After 18 monthly cash distributions in this ETF's short history, the monthly payout has varied from $1.09 to $4.42 per share. The peak payouts have come in periods of extreme Strategy volatility, usually based on corresponding Bitcoin moves.

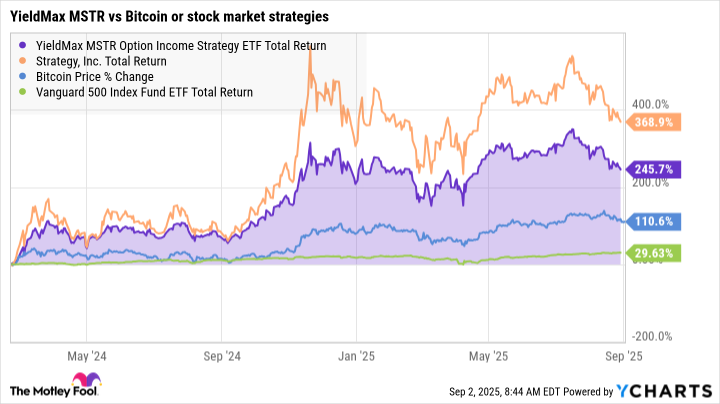

To be clear, the total return (with DRIP enabled) on the YieldMax ETF usually sticks fairly close to Strategy's stock chart. The fund price is firmer and generally higher when the volatility-based payouts are lower.

So you win some and lose some, but even the weakest monthly payout so far can be extrapolated to an annual distribution yield of 128%. Yes, the latest payout is the smallest one on the fund's distribution ledger. The ETF's price is down 26.9% since its inception in February 2024, but the total return more than tripled anyhow.

MSTY Total Return Level data by YCharts

How the fund compares with Strategy stock

As seen in the chart, the YieldMax MSTR ETF's total return has delivered market-beating returns so far. It has not kept up with Strategy's massive gains, though.

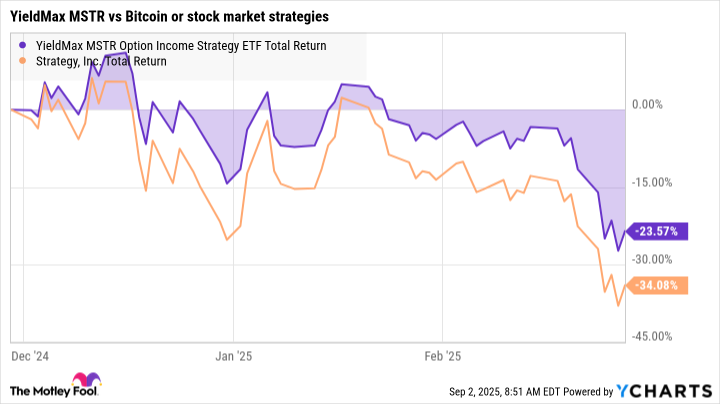

However, there's an upside to the fund's occasional divergence from the underlying stock's performance. Zooming in on negative periods like the three-month span from December 2024 to February 2025, you'll see milder downtrends in YieldMax fund's total return than in Strategy's chart:

MSTY Total Return Level data by YCharts

So this fund acts as a modest buffer against Strategy's rambunctious volatility, usually staying closer to the break-even line than the actual stock. I always assume you're running an active DRIP plan, of course. The pure price chart will always favor Strategy's stock over the options-based ETF.

A one-year playbook for adventurous investors

Where will the YieldMax MSTR Option Income Strategy ETF go in the next year, then? Well, that depends on what you expect from Strategy, which largely depends on Bitcoin's progress. Some expect a significant Bitcoin jump in the second half of 2025, targeting million-dollar coin prices as early as 2030. Other investors see a cryptocurrency downturn around the bend, as the Bitcoin halving cycle prepares for the next refresh in 2028. Macroeconomic turmoil can undermine or support either thesis at this point.

It's time to pick a rung on that ladder of crypto-related exposure and risk. Bitcoin bulls can go for direct investments or spot Bitcoin ETFs. Crypto bears should prefer broad index funds instead. Only the most adventurous investors should consider Strategy's stock, or the weirder but somewhat lower-risk YieldMax MSTR ETF.