The Invesco QQQ Trust (QQQ 0.08%) is an exchange-traded fund (ETF) that aims to mirror the performance of the Nasdaq-100 index. Since its inception in 1999, QQQ has rewarded patient investors with massive long-term gains, and it's one of the most popular and heavily traded ETFs in the market today.

QQQ has soared 486% over the past 10 years, turning $1,000 into nearly $6,000. That factors in reinvestment of QQQ's modest dividend, which currently has a 0.50% yield.

Should you expect QQQ to deliver similar returns in the future? To answer that question, let's look at why QQQ has been such a juggernaut.

Image source: Getty Images.

One tech ETF to rule them all

The Nasdaq-100 is a basket of 100 of the largest nonfinancial companies listed on the Nasdaq Stock Market. But these aren't just any companies.

The top 10 holdings in QQQ are:

|

Rank |

Company |

Allocation |

|---|---|---|

|

1. |

Nvidia |

10.09% |

|

2. |

Microsoft |

8.59% |

|

3. |

Apple |

7.84% |

|

4. |

Amazon |

5.54% |

|

5. |

Broadcom |

5.31% |

|

6. |

Meta Platforms |

3.69% |

|

7. |

Netflix |

2.92% |

|

8. |

Tesla |

2.9% |

|

9. |

Alphabet (Class A) |

2.75% |

|

10. |

Alphabet (Class C) |

2.59% |

|

Total |

52.2% |

Source: Invesco (as of Aug. 26)

With nine of the world's most disruptive tech companies comprising half of QQQ's holdings, it's not surprising that this ETF has been such a beast. Overall, 61% of QQQ is weighted toward technology companies, which is why QQQ is a popular choice for investors seeking exposure to the best of the best in the tech sector.

In case you were wondering, Palantir Technologies is a prominent component of QQQ, sitting just outside the top 10 holdings with a 2% allocation.

By the way, QQQ is more diversified than you might think. Consumer discretionary stocks represent 19% of QQQ's holdings by weight. QQQ also includes healthcare companies, industrials, utilities, consumer staples, energy firms, and even a few railroads.

High growth, low costs

QQQ is considered a passively managed ETF. That's because the goal of QQQ is to closely match the returns of the Nasdaq-100 by mirroring the index's holdings. By contrast, an actively managed ETF aims to outperform a particular index through active stock selection and/or market timing.

An ETF's expense ratio tells you how much of your investment will be deducted annually as management fees. Because QQQ is a passively managed ETF, its expense ratio is lower than you'd find in an actively managed ETF or mutual fund. A passively managed fund doesn't require the constant oversight involved in an active management strategy -- hence the lower fees.

QQQ's expense ratio is 0.20%, which means you'll pay $2 annually for every $1,000 invested. That's a competitive fee -- even for passively managed funds -- considering that the category average is nearly five times higher at 0.92%. At the end of the day, that means less of your investment is going into the pockets of the fund managers.

NASDAQ: QQQ

Key Data Points

The power of passive indexing

Investing in passively managed index funds and ETFs -- also known as passive indexing -- is a time-tested wealth-building strategy. Over time, passive index funds often match or even outperform actively managed funds, with lower fees. They also provide instant diversification, helping you avoid single-stock risk.

QQQ is a great way to get exposure to the most disruptive megatrends in tech, including artificial intelligence, electrification, cloud computing, e-commerce, mobile, streaming, and big data. Like the tech innovators that dominate its portfolio, the ETF has a history of massive returns. Since its inception in 1999, QQQ has delivered total returns of 1,200%.

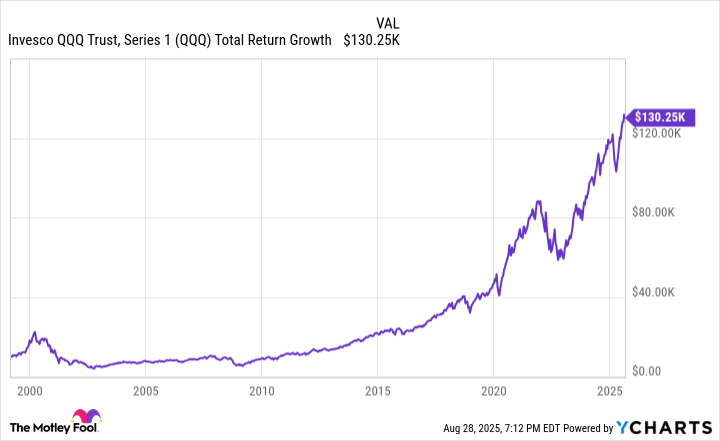

QQQ Total Return Level data by YCharts

If you'd invested $10,000 in QQQ in 1999, you'd be sitting on a cool $130,000 today. Keep in mind that tech stocks can be more volatile than other types of stocks, so the ride would've been a bit bumpy at times. But a long-term, buy-and-hold approach tends to smooth out short-term peaks and valleys. That's a lesson QQQ has been teaching patient investors for over two decades.