Palantir (PLTR +2.28%) has been one of the most electric stocks in the market since 2023, rising from just over $6 to more than $150. Any investor who has been along for that ride has enjoyed incredible gains, but it's impossible to recapture them now.

Investors must look to the future to determine where Palantir's stock price will be over the next five years. I think that many investors will be surprised at what Palantir's stock price will be in 2030, and it has massive implications for what investors should do with any Palantir shares they hold right now.

Image source: Getty Images.

Palantir's growth rate is accelerating

Palantir has been a significant beneficiary of the AI arms race, as its software has become one of the top options for deploying AI technology in both government and commercial businesses. Originally, Palantir started as a product designed for government use, but it eventually expanded into the commercial sector, where it has achieved equally strong success.

The basic idea behind Palantir's product is to take in multiple data streams, process that information with AI, and deliver insights to those with decision-making authority. This enables well-informed decisions to be made at a moment's notice, a critical tool for nearly any role. Palantir also offers products that enable AI agents to be deployed throughout a business, automating tasks traditionally performed by humans.

NASDAQ: PLTR

Key Data Points

It's easy to see how this product can pay for itself in short order, as it increases business execution while decreasing operating expenses. This combination has driven Palantir's impressive growth rates over the past few years, with Q2's growth coming in the fastest of all.

In Q2, commercial revenue rose 47% year over year to $451 million. There is a mismatch between how U.S. companies are adopting AI and how international businesses are deploying it, which caused the U.S.'s growth rate to be substantially higher. U.S. commercial growth increased by a jaw-dropping 93% year over year, indicating that there could be a massive upside if international commercial businesses deployed Palantir's technology at a similar rate. Government revenue was strong both domestically and internationally, increasing at a 49% pace to $553 million.

Palantir is clearly succeeding as a business and has a ton more growth in store, but what ramifications does this have for its stock price?

Too much growth is priced into Palantir's stock

There are two parts to any investment thesis: The projected growth and the current stock price. A stock can be a bad purchase, even if it is projected to double its revenue every year for the next decade, if it's bought at the wrong price. I think Palantir falls under this designation, as its stock is unbelievably expensive.

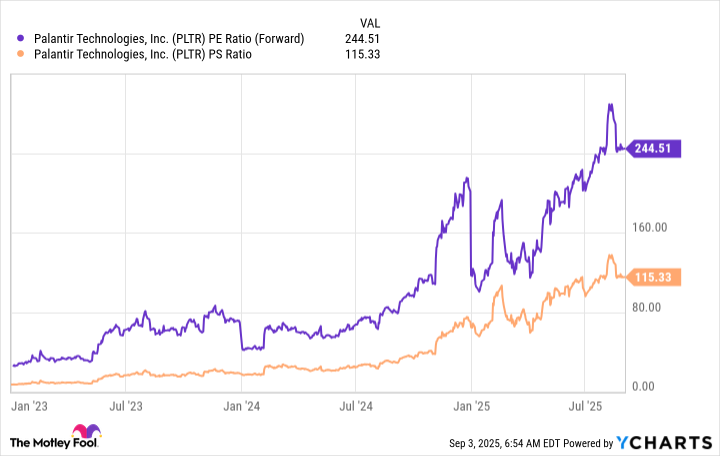

Palantir's stock trades for an astonishing 115 times sales and 244 times forward earnings.

PLTR PE Ratio (Forward) data by YCharts

Few companies have ever achieved this extreme level of valuation. There is just too much growth priced into Palantir's stock, and it's easy to illustrate how.

Let's make a few assumptions about Palantir over the next five years:

- Palantir's revenue grows at a 50% compounded annual growth rate (CAGR)

- Palatnir's profit margin reaches 35%

- Palatnir's share count remains the same

These are incredibly bullish assumptions, as sustaining a 50% growth rate for five years is a feat few companies accomplish. Furthermore, Wall Street analysts project Palantir's revenue to grow at a 35% pace next year, which is far slower than the rate established above. Palantir has also experienced significant shareholder dilution, with its share count increasing by 4.6% over the past year.

But even if we ignore the fact that those are incredibly bullish projections, Palantir's stock still has no chance of making investors money.

If Palantir achieves everything outlined above, it will produce $26.1 billion in revenue, a massive increase from its current $3.3 billion total. With a 35% profit margin, Palantir would generate $9.1 billion in profits. If you divide its current market cap by this profit projection, you'd get its five-year forward price-to-earnings ratio. This comes out to 41 times forward earnings, which is a level that Palantir's stock probably should be trading at now.

As a result, I think Palantir's stock price will remain the same or decrease over the next five years. The only way Palantir's current valuation makes sense is to assume unrealistic expectations, as outlined above. Even then, Palantir would be an incredibly expensive stock, limiting future upside. Palantir has generated substantial returns for many investors, but I believe it's time to explore a new AI stock to invest in, as Palantir's stock appears significantly overvalued.