The artificial intelligence (AI) sector is booming, leading to a surge of businesses touting AI expertise. Two such companies are SoundHound AI (SOUN 0.29%) and C3.ai (AI 3.84%).

SoundHound specializes in consumer-oriented AI voice solutions, such as the ability to take customer orders at restaurant drive-thrus. In contrast, C3.ai concentrates on enterprise AI applications for organizations, including the U.S. government.

Could one of these businesses represent a compelling investment opportunity in the hot AI sector? The answer isn't straightforward, so let's take a closer look at SoundHound and C3.ai.

Image source: Getty Images.

Unpacking SoundHound's success

SoundHound is experiencing robust revenue growth with second-quarter sales rising 217% year over year to $42.7 million. Its AI voice platform has been adopted by customers in sectors such as automotive, financial services, and restaurants.

Its strong sales performance prompted management to boost 2025's revenue outlook to between $160 million to $178 million. That's about double 2024's $84.7 million.

The company's sales are up thanks to strategic acquisitions made last year. However, the acquired businesses added to costs, resulting in a Q2 operating loss of $78.1 million.

Although the loss is substantial, SoundHound has $230 million in cash and equivalents with no debt on its Q2 balance sheet. This can sustain operations in the short term while it works to reduce expenses.

In fact, the company expects to reach adjusted EBITDA profitability by the end of the year. Its Q2 adjusted EBITDA was negative $14.3 million.

Dissecting C3.ai's current business

C3.ai's business model relies on partners such as Microsoft to help sell its AI solutions to businesses and governments. The approach worked well for its 2025 fiscal year, ended April 30, where it delivered record fourth-quarter revenue of $108.7 million, representing 26% year-over-year growth.

However, fiscal 2026 kicked off with a period of transition for C3.ai. CEO Tom Siebel had to relinquish his role for health reasons, and the company announced a new CEO, Stephen Ehikian, on Sept. 3.

In addition, C3.ai restructured its sales and services organization, disrupting the team's ability to deliver revenue. Adding to this, Siebel stated his health issues "prevented me from participating in the sales process as actively as I have in the past."

According to management, these factors led to revenue of $70.3 million in its fiscal first quarter, ended July 31, a decline from the prior year's $87.2 million. On top of that, Q1 operating expenses increased to $151.3 million from $124.8 million a year ago.

The combination of falling sales and rising costs is a concerning sign, and led to a Q1 operating loss of $124.8 million, up from the prior year's loss of $72.6 million. The situation looks like it will extend into fiscal Q2 as well.

That's because the company estimates fiscal Q2 sales to come in between $72 million to $80 million. While this is an uptick from Q1 revenue of $70.3 million, it's a notable drop from the previous year's $94.3 million.

Making a choice between SoundHound and C3.ai stocks

C3.ai's year-over-year revenue decline and current organizational upheaval point to SoundHound as the better AI stock to buy. Not so fast. Another factor to consider is share price valuation.

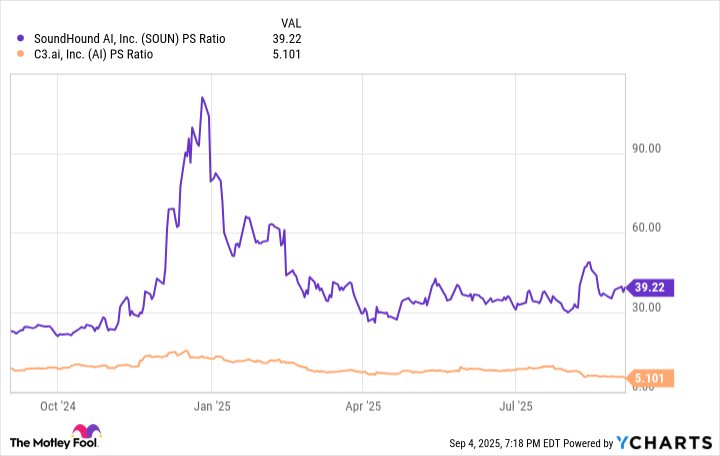

This can be evaluated using the price-to-sales (P/S) ratio, which measures how much investors are willing to pay for every dollar of revenue produced over the trailing 12 months.

Data by YCharts.

SoundHound's P/S multiple is sky-high compared to C3.ai's, which suggests SoundHound shares are pricey, although not as expensive as they were around the start of 2025.

Meanwhile, C3.ai's sales multiple indicates its stock price is at a reasonable level. With a new CEO and organizational changes designed to strengthen its sales channel, the company looks capable of bouncing back from its current revenue slowdown.

C3.ai also sports a strong balance sheet. Assets totaled $1 billion compared to total liabilities of $187.6 million. This includes cash, cash equivalents, and short-term investments of $742.7 million.

Yet C3.ai's attractive valuation comes with risk. Can new CEO Stephen Ehikian deliver the double-digit, year-over-year sales growth the company enjoyed under Tom Siebel?

Given this open question, SoundHound has the edge as the better AI investment right now, especially if it can maintain its strong sales growth while continuing down the path to profitability. But because of SoundHound stock's elevated valuation, it's best to wait for the share price to drop before deciding to buy.