Long-time investors in Amazon have gained generational wealth. A company that may be following in its footsteps is Coupang (CPNG +0.32%). The South Korean technology giant has built an Amazon-like e-commerce service that is rapidly gaining share in its home market due to its fast delivery and wide selection for shoppers.

Now, it is taking inspiration from Amazon in another business line. How? By expanding its cloud computing division to focus on artificial intelligence (AI) and selling to third parties. Here's the skinny on Coupang's grand ambitions, and why the technology stock may be a perfect fit in your portfolio today.

NYSE: CPNG

Key Data Points

Betting on the AI cloud

Pioneering the cloud computing sector with its Amazon Web Services (AWS) has enabled Amazon to become a "Magnificent Seven" stock. It was able to succeed by taking its internal data center technology and selling the computing power to third parties.

Coupang is now doing the same with its rebranded Coupang Intelligent Cloud. The company formally announced the business line in July, making bold claims about the cutting-edge infrastructure it has built, although it is likely just a sliver of the business' $32 billion in trailing consolidated revenue today.

You couldn't script better timing for Coupang to launch an AI cloud division. Spending on AI data centers is going through the roof, while the South Korean government has proposed spending $1 billion to spur homegrown data center infrastructure in the country. Coupang is one of the few companies vying for this contract, which could lead to huge growth in its nascent cloud division.

Image source: Getty Images.

Automation in e-commerce delivery

Cloud computing is not the only way Coupang should benefit from AI. It's building what is perhaps the most advanced and automated e-commerce fulfillment network. Shoppers on Coupang can get free delivery by 7 a.m. the next morning when they order by 12 a.m. the night before. This is only possible because of the efficient system of drivers, robots, and automation in its warehouses. Management even mentioned investing in humanoid robots on the latest quarterly conference call.

Focusing on building the most automated and efficient e-commerce network brings long-term cost savings to Coupang and simultaneously improves its customer value proposition. This is why the company's revenue grew 19% year over year last quarter on a foreign currency neutral basis with improving gross profit margins. Since going public in 2021, Coupang's trailing 12-month revenue has grown by a cumulative 170%.

With irons in the fire exploring opportunities in food delivery, a fashion marketplace with its acquisition of Farfetch, video streaming, advertising, and a geographical expansion to Taiwan, Coupang's potential for growth is sky-high.

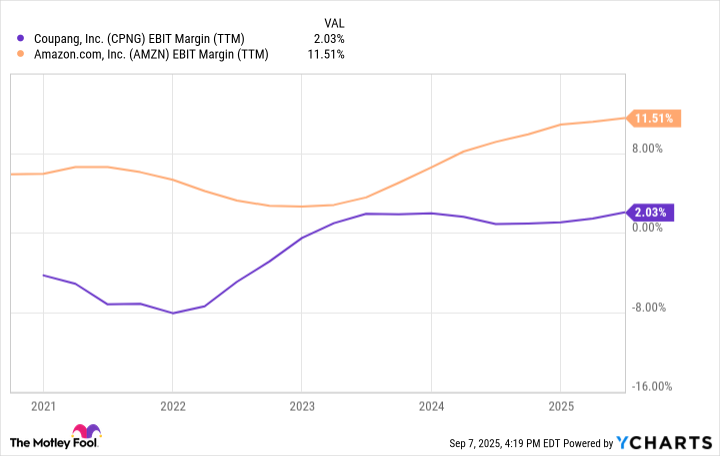

CPNG EBIT Margin (TTM) data by YCharts. EBIT = earnings before interest and taxes.

Why Coupang stock is a buy today

At today's stock price, Coupang only has a market capitalization of $53 billion, compared to $32 billion in trailing revenue. In a few years, Coupang can reach $50 billion in revenue, with $100 billion well within reach over the long term.

Management believes that its e-commerce business can achieve at least 10% profit margins, while potential growth in advertising and cloud computing could drive margins even higher than 10% because of how lucrative these business lines are. For reference, Amazon's operating margin has expanded to 11.5% due to growth of higher-margin segments as a percentage of its overall revenue. If Coupang eventually reaches $100 billion in revenue, a 10% profit margin equates to $10 billion in annual earnings power, or a price-to-earnings ratio (P/E) of just five.

This makes Coupang stock incredibly cheap for those with their eyes on the long term. Don't trade this stock: Buy it and hold it for a decade, and watch the gains roll in.