Shares of quantum computing company IonQ (IONQ 5.63%) are up more than 600% over the past 12 months through Sept. 16. The stock rose recently after it received regulatory approval to acquire Oxford Ionics, and a Sept. 12 analyst day event sparked share-price upgrades from Wall Street.

With this swirl of activity, could now be the time to invest in IonQ stock? The short answer is to wait. Let's dig into why that's the case.

Image source: Getty Images.

Patience is best for IonQ shares

The jump in IonQ stock makes sense, given its latest acquisition. Oxford Ionics owns the current world record for fidelity, according to IonQ.

Fidelity measures the accuracy of a quantum computer's calculations. An impediment to adoption of quantum devices is that they're error-prone, so Oxford Ionics can help IonQ overcome this challenge.

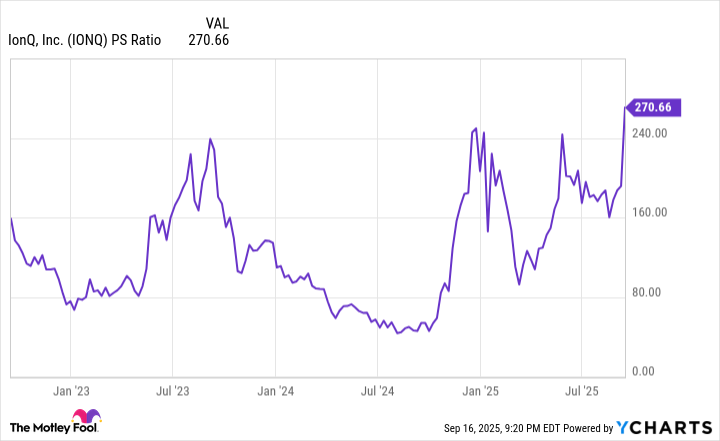

But its share-price rise means IonQ stock looks pricey. This can be seen in its price-to-sales (P/S) ratio, which measures how much investors are willing to pay for every dollar of revenue generated over the trailing 12 months.

Data by YCharts.

As the chart shows, the stock's P/S multiple is currently higher than it's been over the last couple of years. This indicates IonQ's share-price valuation is elevated, meaning now is not a good time to buy.

The ideal approach is to bide your time until the stock price drops -- and you may not have to wait long for that. IonQ shares are prone to high volatility.

This is demonstrated by the stock's beta of more than 2.5 as of Sept. 16. So hold off for the next swing in IonQ's share price before deciding whether to pick up the stock.