Over the past few years, investors have witnessed a historic run in the stock market, fueled by unprecedented enthusiasm around artificial intelligence (AI). With the S&P 500 and Nasdaq Composite hovering near record highs, many stocks now trade at frothy valuation levels and appear expensive at first glance.

Against this backdrop, defense technology specialist BigBear.ai (BBAI 7.05%) -- which trades for just $5 per share -- might look like a bargain compared to rivals such as Palantir Technologies. But looks can be deceiving.

Let's take a closer look at whether BigBear.ai is truly an undervalued gem in today's pricey AI market.

Stock price does NOT equal valuation

A common mistake beginner investors make is evaluating a company's worth solely by looking at its share price. While price per share is a visible metric, it lacks critical details around the broader valuation story. A better way to gauge value is by benchmarking a company against its peers.

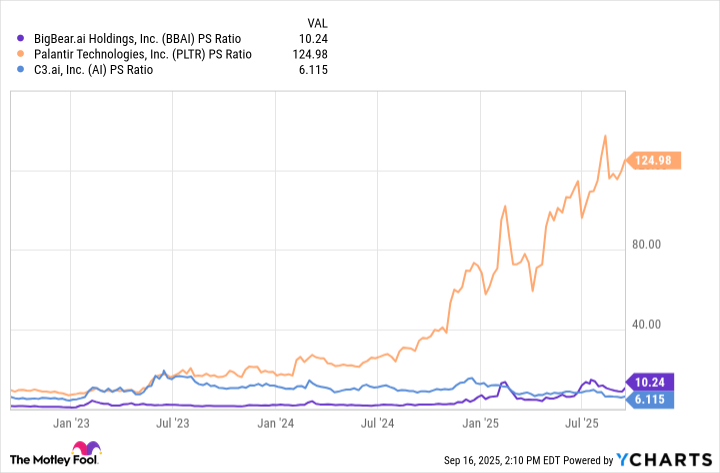

In the chart below, I've compared the price-to-sales (P/S) ratio of BigBear.ai with two of its closest competitors in defense tech: Palantir and C3.ai.

BBAI PS Ratio data by YCharts

The clear takeaway is that Palantir has seen pronounced valuation expansion throughout the AI revolution -- far outpacing its peers. By contrast, BigBear.ai's P/S multiple of 10.2 may look far more reasonable on the surface.

However, valuation multiples do not move in isolation. They reflect deeper narratives about growth, profit durability, and competition positioning. Before labeling BigBear.ai a bargain opportunity, it's worth examining the unique dynamics shaping each of these companies.

Image source: Getty Images.

The "next Palantir" narrative is getting weak

Once a hot theme or business emerges, investors naturally look for the "next big thing." When it comes to the intersection of defense and AI, Palantir has cemented itself as the de facto leader. This dynamic has fueled a speculative narrative that BigBear.ai might one day follow in Palantir's footsteps. Yet when we look at the financial trends, that narrative grows weaker with each passing quarter.

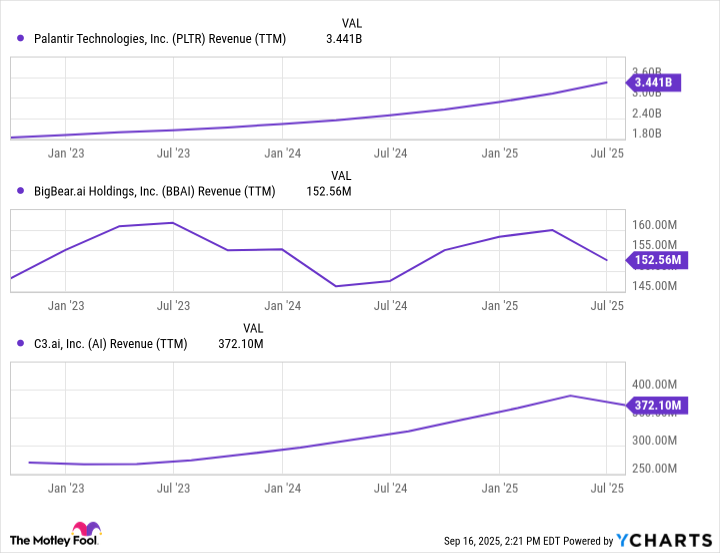

PLTR Revenue (TTM) data by YCharts

Palantir is consistently winning multiyear, multibillion-dollar contracts with the U.S. Army, collaborating with NATO allies, and securing mission-critical work with agencies like Immigration and Customs Enforcement (ICE). These awards have been transformative for Palantir, underscored by the company's accelerating revenue trajectory.

By contrast, BigBear.ai and C3.ai are relegated to modest, niche opportunities. This has translated into slowing momentum and even declining growth while Palantir broadens its reach within the Department of Defense (DOD).

Taking this a step further, Palantir's deepening role in the defense landscape could suggest that it is building a durable structural moat -- one that BigBear.ai is unlikely to penetrate, given its diminishing market position. With these factors in mind, BigBear.ai's discounted valuation relative to Palantir isn't a sign of hidden value. Instead, it's a reflection of the company's weak competitive realities.

Don't chase downward pressure

At first glance, BigBear.ai stock might look like a rare bargain in today's overheated AI market. The company does hold contracts, operates in a sector with high and growing demand, and trades at a fraction of its largest rival's valuation.

Yet, a closer look suggests its compressed multiple is less a sign of mispriced value and more a reflection of persistent operational headwinds in the shadow of Palantir's dominance.

For investors, the key is distinguishing between a low stock price and a fundamentally sound opportunity. In BigBear.ai's case, the depressed valuation appears justified. While the company is not necessarily a falling knife, framing it as a prudent buy-and-hold investment at current levels involves outsized risk.

In my view, BigBear.ai is best seen as a speculative trade rather than a long-term core holding.