Billionaire investor Bill Ackman has become one of the hedge fund managers to watch in the modern era. Ackman runs the fund Pershing Square Capital Management, which is the investment manager of Pershing Square Holdings. At the end of August, Pershing had generated a five-year return of roughly 121%, net of fees.

Pershing Square Capital Management owned 10 stocks at the end of the second quarter of the year because Ackman and his team focus on doing an extremely thorough bottom-up analysis of individual stocks. One, which Pershing has been involved in for more than a decade, earns almost $60 million in passive income for the fund each year.

Image source: Getty Images.

An attractive franchise model

Pershing has owned Restaurant Brands International (QSR 1.50%) since it went public in 2012. QSR is the owner of the popular fast-food chains Burger King, Tim Horton's, and Popeye's.

Over the past five years, QSR has not performed well, with the stock up only about 13%. The company has dealt with intense competition, supply chain problems, and inflationary pressures. QSR also has high debt of about $13.4 billion and a high debt-to-equity ratio of more than 4 at the end of the second quarter.

In a recent letter to shareholders, Ackman and his team said they like QSR because of its "high-quality, capital-light" franchise model that generates royalties from some of the leading fast-food brands. In its most recent quarter, Burger King International generated same-store sales growth of more than 4% year over year, which, according to Pershing, beat that of McDonald's.

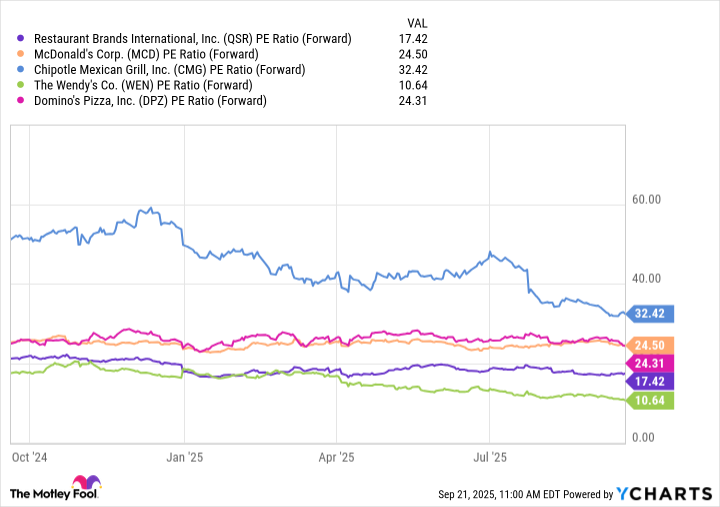

Ackman and his team are also optimistic about Burger King's U.S. business, which is currently going through a revamp. In 2024, QSR acquired Carrols Restaurant Group, the largest Burger King franchisee in the U.S. with more than 600 restaurants. QSR plans to infuse another $500 million into these restaurants to update them for the modern fast-food experience before refranchising the restaurants out. Ackman and his team also point out that QSR trades at a discount to peers on a forward price-to-earnings basis.

QSR PE Ratio (Forward) data by YCharts

Investors are paid to wait

As Pershing waits for QSR's long-term strategy to unfold, it is able to generate strong passive income due to the company's high dividend. Over the past 12 months, QSR had a dividend yield of roughly 3.90%. QSR launched a modest dividend in 2015 but then more than doubled its dividend in 2018 and has grown it steadily every year since.

In the first six months of the year, QSR paid $544 million in dividends, giving it an annual dividend run rate of roughly $1.09 billion. Over the past 12 months, QSR has generated free cash flow of $1.35 billion, which provides a solid buffer for dividend payments. Net income of $484 million through the first six months of the year is currently below dividends paid, but the company has been dealing with high restaurant expenses, which include food, beverage and packaging costs, wages, and occupancy expenses.

Beef prices, in particular, have been extremely high, but management said on the company's most recent earnings call that food prices move in cycles, so it doesn't think this will last forever. That doesn't necessarily mean prices will come down soon, but food and energy are two of the more volatile price categories when looking at inflation.

At the end of the second quarter, Pershing's stake in QSR amounted to $1.52 billion. Assuming the 3.90% dividend yield, that equals roughly $59.5 million in dividends every year.