It's no secret that the stock market is expensive, with the broader benchmark S&P 500 Index hitting new all-time highs all year and repeatedly rebounding from sell-offs. As many are aware, the market now trades at its most expensive valuation in over two decades and essentially dating back to the dot-com bubble. While that would seem like an obvious sell signal, investors have been shaking these signs off for months and continue to drive the market higher.

In a recent appearance on CNBC, billionaire investor David Tepper, who runs Appaloosa Management, acknowledged that he doesn't like the multiples he's seeing but that it's hard to stay out of the stock market for one key reason.

Image source: Getty Images.

The punchbowl is still there

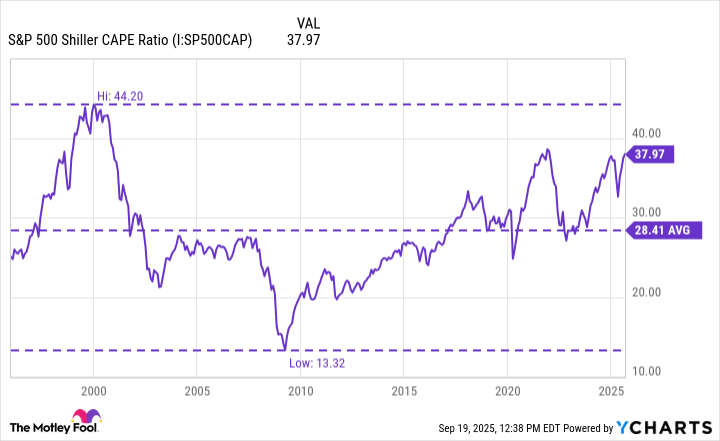

There are many ways to value the S&P 500, but one metric investors often look at is the Shiller Cape Ratio, which looks at the market cap of the S&P 500 compared to its 10-year average inflation-adjusted earnings, which helps to smooth out big fluctuations in earnings due to changes in the economic cycle.

S&P 500 Shiller CAPE Ratio data by YCharts

The Shiller Cape Ratio trades around 38, right around where it did before market crashes in 2021 and during the dot-com bubble leading up to 2000. The S&P 500 also trades at a historically high 23 times forward earnings, largely due to the high-flying Magnificent Seven stocks, which all exceed trillion-dollar market caps. Tepper acknowledged that it's a tough market for his firm because of where valuations are at right now.

"We're having a really good year and I am so miserable for having a really good year because I still own the market and I can't stand that I own the market," he said. "I don't love the multiples ... but I am not ever fighting this Fed ... because the punch bowl is still there." By punch bowl, Tepper is referring to the Fed resuming its accommodative easing cycle and lowering interest rates, which tends to be supportive of stocks.

While things are certain to change, the Fed has indicated it expects to cut rates two more times this year and one more time in 2026. Fed Chair Jerome Powell described the Fed's move in September as a "risk management cut."

"My view has been that one easing or two easings or even three easings don't matter because we're still in a little restrictive territory with a little bit too high inflation, even without the tariff-induced inflation. So they should be a little bit restrictive," said Tepper. "Beyond that, you're really risking a lot of things, a weaker dollar, more inflation and those sort of things."

Don't trade the cycle

I agree with a lot of what Tepper is saying. The market is undoubtedly expensive, but it's hard not to stay involved with the Fed lowering rates. Future economic data has the ability to change the Fed's trajectory for better or worse.

While all investors would love to be able to time the market, it's really not practical for retail investors. Tepper has decades of experience and has generated some of the best returns around, so he may be able to do it but I wouldn't try it. Instead, retail investors should stick to long-term investing and use dollar-cost averaging to smooth out their cost basis over time.

The market is going to move up and down but history shows that the longer one keeps their money invested, the less likely they are to lose money. Investors who understand how the market works and what moves it higher and lower will be calmer in more tense periods of trading and be able to make more rational decisions.