One side effect from the explosion in artificial intelligence (AI) in the last couple of years is the growth of some interesting tech stocks that have been able to take advantage of the trend.

One example is CoreWeave (CRWV +3.96%), a New Jersey cloud-computing company that has been investing heavily in graphics processing units (GPUs) over the last three years.

Now, the company is getting a new boost after it announced a multibillion-dollar deal with Meta Platforms (META +1.08%), which has been investing heavily in AI to build out its own infrastructure.

CoreWeave stock jumped 13% on the news and is up more than 240% so far in 2025. And for long-term investors, its recent deals make the stock all the more appealing, since they indicate that the company's growth is accelerating quickly.

About CoreWeave

CoreWeave is a New Jersey-based company that got its start in 2017 as a crypto miner. But by 2019 it had changed its name from Atlantic Crypto and leaned into the business of building and offering GPU computing power.

Its been a close partner with Nvidia over the years, even getting a $100 million investment from the semiconductor giant. Nvidia currently holds about 24.3 million shares of the company.

And CoreWeave has benefited in that partnership. It was the first cloud provider to make Nvidia H100 and H200 GPUs available, giving it a leg up in attracting businesses that were eager to build and power AI applications.

Nvidia hasn't been the only partner, though. CoreWeave also got a key deal in 2023 with Microsoft, which reportedly agreed to spend potentially billions on AI cloud infrastructure from the company over a period of years.

And CoreWeave recently announced an expansion of its deal with OpenAI, broadening its tie-in with the creator of ChatGPT by $6.5 billion to bring the total agreement to $22.4 billion.

NASDAQ: CRWV

Key Data Points

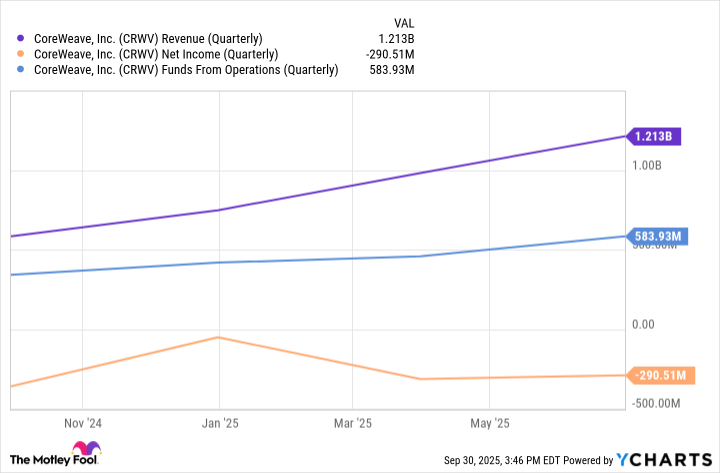

Such deals are helping CoreWeave grow rapidly. Revenue in the second quarter was $1.21 billion, up from $395 million a year ago. The company also narrowed its net loss from $323 million and $1.62 per share to $290.5 million and $0.60 per share.

"We are scaling rapidly as we look to meet the unprecedented demand for AI," CEO Michael Intrator said.

The company's revenue is growing quickly, and even though its posting a loss each quarter, I think the financial picture is better than one may think.

CRWV Revenue (Quarterly) data by YCharts.

That's because the company's funds from operations (FFO) have been solidly consistent in the last year. CoreWeave is posting losses, yes, but once you take out noncash charges like depreciation and amortization, the core business is generating more than $500 million per quarter.

The Meta Platforms deal

CoreWeave's deal with Meta Platforms, the parent company of social media platforms Facebook, Instagram, Messenger, and others, was disclosed in a filing Tuesday with the U.S. Securities and Exchange Commission. In the filing, CoreWeave said that the $14 billion deal runs through Dec. 14, 2031, and that Meta has the option to expand its commitment for added capacity through 2032.

NASDAQ: META

Key Data Points

Meta has committed to spending billions on data centers to build out its AI infrastructure in order to power AI-assisted advertising and content recommendations, as well as its Meta AI chatbot and creative tools. Management has said it plans to spend $114 billion to $118 billion on AI this year, and would spend even more in 2026.

The bottom line

CoreWeave is going through what all tech companies are going through: scaling up the business and spending a lot of money now to make it in the future. And the company is growing fast, going from just three data centers in 2022 to a network of 33 of them today.

It previously issued guidance for third-quarter revenue to be $1.26 billion to $1.30 billion, and full-year revenue between $5.15 billion and $5.35 billion, and analysts at Yahoo! Finance are forecasting 2026 revenue at more than $12 billion.

Those are strong growth numbers, but I would not be surprised at all if CoreWeave exceeded them. The global appetite for AI and GPU computing power is enormous -- and it is one of the few companies that is able to feed the beast.