2025 is three-fourths over. While that may be odd to say, the reality is that a new investing year is almost upon us. However, there are still plenty of stocks that are worth buying now, especially to capture an end-of-year rally that may occur as institutional investors reposition their portfolios to capture gains where they think the market will be heading in 2026.

Three stocks that I think are must-owns heading into 2026 are Alphabet (GOOG 0.24%) (GOOGL 0.18%), Meta Platforms (META 0.64%), and Amazon (AMZN +0.06%). All of these could see significant investor interest over the next year as the artificial intelligence (AI) arms race intensifies, making them excellent stocks to own now.

Image source: The Motley Fool.

1. Alphabet

Alphabet is the parent company of Google, among many other brands. While it was initially a laggard in the AI arms race, it has caught up and established itself as a top option in the space. Its Gemini generative AI model consistently ranks as one of the best, and it is likely the most quickly used due to its integration with the Google Search engine via AI overviews.

Alphabet was negatively viewed throughout most of 2025 as investors were worried that generative AI could replace the Google Search engine. Additionally, there were antitrust concerns surrounding Google's search engine business, although those fears were relieved when a Judge only required Alphabet to change a few things and didn't require a breakup.

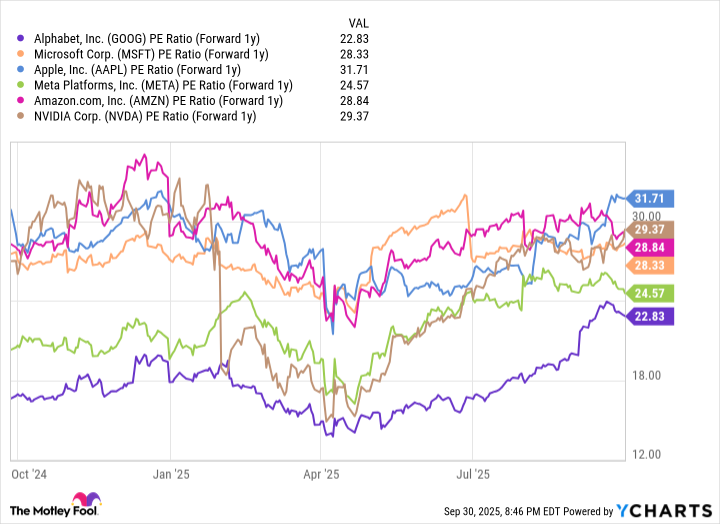

Now that both of those fears are essentially gone, investors can appreciate Alphabet for the impressive business that it is. I predict this will cause the stock price to increase substantially over the next few years, as it still trades at a discount to most of its big tech peers (when measured by its forward price-to-earnings ratio, as seen in the chart below).

GOOG PE Ratio (Forward 1y) data by YCharts

Alphabet is a top stock to own heading into 2026, and buying shares even after its sizable run is a smart move.

2. Meta Platforms

Meta Platforms is the parent company of Facebook and Instagram, along with a handful of other social media sites. This makes Meta primarily an advertising business, but it's using AI to increase the effectiveness of its platforms.

Meta continues to improve its AI-powered ad tools, but it has already seen higher conversion rates combined with more time spent on its platforms. This increases Meta's revenue, but the effect is far from complete. We'll see more tools released and other technologies implemented that continue to increase effectiveness over the next few years, and this should lead to continued strong growth from Meta, which grew its revenue by an impressive 22% in Q2.

NASDAQ: META

Key Data Points

Additionally, Meta released the second generation of its AI glasses. Time will tell if these are a hit among the general population, but if it can produce a piece of hardware that's a must-own, then Meta will have created a brand-new revenue stream out of nothing. Even if it flops, Meta's AI investments in its ad business will pay off, making Meta a great stock for 2026.

3. Amazon

Nearly every person in the U.S. is familiar with Amazon, but few recognize what really drives Amazon's profits: AWS. Amazon Web Services (AWS) is Amazon's cloud computing wing, and it is essentially Amazon building out excess computing capacity and renting it out to those who need it. This allows clients to move workloads from expensive on-site hardware that must be maintained by skilled labor to Amazon's servers, where this isn't needed.

This has become a popular option for traditional workloads alongside emerging artificial intelligence workloads. As a result, the cloud computing industry is booming.

NASDAQ: AMZN

Key Data Points

AWS is the market leader in this industry, but it has grown more slowly than its two primary competitors (Google Cloud and Microsoft's Azure). However, it may be able to turn it around in 2026 and deliver strong growth that boosts Amazon.

Although AWS only accounted for 18% of total revenue in Q2, 53% of operating profits came from AWS. This makes AWS' continued growth key for Amazon investors. If AWS can increase its growth rate from its current 17% pace to a much faster 30% to 40% range (how quickly Google Cloud and Azure are growing), Amazon shareholders could be handsomely rewarded in 2026.