Artificial intelligence (AI) stocks with paradigm-shifting potential are the go-to choice for investors looking for explosive growth opportunities in today's market. But some investors may be concerned by AI stock valuations. Alternatively, they may already have significant exposure to these stocks and are seeking new investment opportunities.

Turnaround stocks are the opposite of high-flying growth shares. These companies are so out of favor due to declining business fundamentals that management teams have little choice but to overhaul operations and realign strategies. Think of it like a corporate U-turn. If the plan works, it can restore investor confidence and lead to epic gains.

For example, Netflix's growth was slowing and expenses were mounting. Netflix cracked down on password sharing, successfully implemented an ad-supported tier, and perfected its balance between content quality and quantity. The strategy worked, and Netflix is up nearly fourfold since the start of 2023.

Unlike Netflix, which successfully implemented a turnaround in just a few years, Target (TGT 0.66%) is approaching its third year of turnaround. But unlike Netflix, Target pays a sizable dividend with a 5.1% yield and has 54 consecutive years of dividend raises, making it a Dividend King.

Here's why Target stock deserved to fall, but why the company could be a great long-term buy for patient investors.

Image source: Target.

Target is playing to its strengths

Target's struggles are extensive. It overestimated consumer demand after an initial surge in discretionary goods spending during the COVID-19 pandemic. This led to a bloated inventory, which Target had to subsequently reduce through steep price cuts, resulting in lower operating margins.

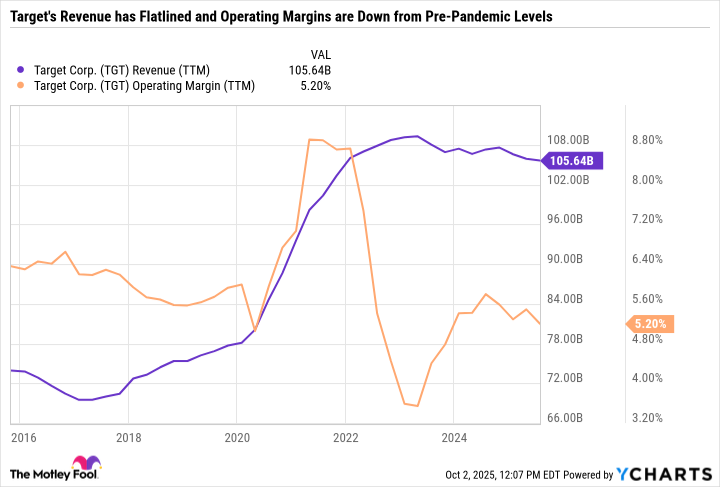

TGT Revenue (TTM) data by YCharts

As you can see in the chart, Target isn't growing sales and its margins haven't fully recovered to pre-pandemic levels. What makes Target's situation especially concerning is that there are few signs of improvement. Foot traffic is down as investors gravitate toward value-focused options and less toward experiences -- which is why Walmart and Costco Wholesale are winning business while so many discretionary-focused retailers are struggling.

Target can't compete with Walmart and Costco on price alone. It is leaning into the activity side of shopping by improving the in-store experience, offering an exciting and enjoyable product selection, and, most importantly, developing exclusive partnerships. These collaboration, like its Taylor Swift exclusives, helped drive sales during last year's Black Friday.

Despite all of its blunders, exclusive partnerships are something that Target does very well, and it's a reason to be hopeful that the company's turnaround will be successful. But there's only so much impact these offerings have on Target's bottom line.

Earlier this year, Target launched a strategic plan to unlock $15 billion in sales growth by 2030 by improving its supply chain, leaning into its rewards program, and coordinating its online presence with its in-store experience. But given the stock is hovering around six-year lows while the S&P 500 is near an all-time high, it's clear that investors aren't giving Target the benefit of the doubt.

Investing in Target demands patience, even at these levels

Today's market is particularly brutal for companies like Target. The S&P 500 is reaching new all-time highs seemingly every day, with AI stocks delivering jaw-dropping results and promising even more impressive numbers in the future. There is always an opportunity cost associated with investing. And folks who have stuck with Target over the last few years have seen the value of their investment shrink while the market has gained, which is never a good feeling.

For Target to unlock explosive growth over the next five years and potentially outperform the market, it needs to regain investor confidence by demonstrating its ability to succeed in today's value-driven economy. It's an uphill climb for Target, but there's reason to believe the worst could be over.

Given Target's reliable dividend, it's reasonable for investors to expect that the payout will continue to increase over the next five years. If we pencil in a 2% annual increase in Target's payout, that would mean $23.73 in dividends per share over the next five years -- which would be a return of 26.5% based on Target's stock price at the time of this writing of $89.65. That a decent haul for passive income-focused investors. And if Target returns to steady growth, the stock price could be significantly higher.

In a market where many stocks are expensive, Target stands out as a dirt-cheap deep value play with a high yield that is backed by free cash flow. Despite the potential, some investors may prefer to take a wait-and-see approach to Target before smashing the buy button right now.

The most important metric for determining the turnaround's progress is same-store sales growth. If it grows, it would indicate that Target is attracting buyers back into its stores and spending money, rather than just window shopping. Investors interested in the stock will want to pay close attention to this metric in Target's upcoming earnings reports.