When Nvidia (NVDA 1.68%), was getting started in the 1990s, Intel (INTC -0.32%) was dominating the semiconductor chip industry. Now, the fortunes of these companies have flipped. Today, it's Nvidia that's dominating, thanks to its advanced chips for artificial intelligence.

Meanwhile, Intel has fallen on hard times. This stark reality led to Nvidia's $5 billion investment in Intel shares in September. But it also heralds a new era for both companies, one where they play a larger role in the AI ecosystem.

Nvidia CEO Jensen Huang described the decision to invest in Intel by stating, "This historic collaboration tightly couples Nvidia's AI and accelerated computing stack with Intel's CPUs and the vast x86 ecosystem -- a fusion of two world-class platforms."

This could mean now is the time to buy shares in one or both companies. A deeper dive into Nvidia and Intel can provide insights into which to invest in.

Image source: Nvidia.

Nvidia capitalizes on Intel's woes

Nvidia's decision to join forces with ailing Intel is a bet on the latter's ability to bounce back from its current struggles. Intel's fall from grace started in the early 2000s when it decided against developing chips for mobile devices. Then, it was caught flat-footed when artificial intelligence emerged, forcing the company to catch up.

These missteps resulted in a share-price decline that brought Intel stock's price-to-book (P/B) ratio to a multiyear low last year. But things are looking up for Intel in 2025.

Data by YCharts.

In March, the company brought in a new CEO, Lip-Bu Tan, to right the ship. Then in August, the Trump administration took the unusual approach of investing $8.9 billion in Intel stock in support of President Donald Trump's vision to build up U.S. manufacturing.

In September, Nvidia added to the government's investment with its own $5 billion stock buy. But its share price purchase wasn't just to benefit from a low valuation.

Intel owns foundries to manufacture semiconductor components. As a fabless chip company, Nvidia lacks this capability. Together, they plan to produce data center and PC products with the computing power necessary for the AI era.

Intel's role in Nvidia's AI vision

That's just the tip of the iceberg. Nvidia's Huang sees a future where the entire cloud computing industry must transform to support the rigorous computational needs of AI systems.

He described this transformation: "Companies and countries are partnering with Nvidia to shift the trillion-dollar traditional data centers to accelerated computing and build a new type of data center -- AI factories."

These AI factories will be responsible for producing the various artificial intelligence products used by organizations and individuals. The shift Huang articulated isn't just a marketing boast or some future state that will occur years down the road. It's happening now.

One example is the British government's efforts to increase AI computing capacity by 20 times over the next five years. Another is the Stargate project, which aims to invest $500 billion in U.S. AI infrastructure by 2029.

Nvidia's Intel partnership not only aspires to get ahead of this transition, it seeks to enable the transformation as broadly and quickly as possible. As a result, Intel now finds itself armed with Nvidia's cutting-edge technology, and the opportunity to deliver it to businesses and governments hungry for AI.

Investing in Intel, Nvidia or both stocks

The deal between Nvidia and Intel holds exciting implications for each's future. So does this mean it's time to buy one or both stocks?

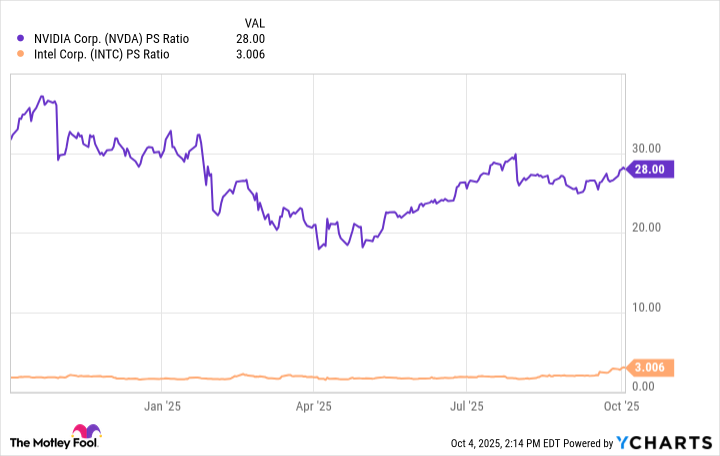

Although Nvidia and Intel shares took off since the deal's announcement, the latter's stock remains reasonably valued. Because Intel isn't profitable, this can be assessed using the price-to-sales (P/S) ratio, which measures how much investors are willing to pay for every dollar of revenue produced over the trailing 12 months.

Data by YCharts.

Intel's P/S multiple is just a fraction of Nvidia's. This suggests Intel stock is a great value, while Nvidia shares are at a premium.

In fact, Nvidia stock hit a record high of $191.05 on Oct. 2. This doesn't necessarily mean you should avoid buying shares. Nvidia's ambition to transform the data center industry with Intel's help is a potential game changer. But Nvidia's lofty share price indicates it's best to watch for the stock to pull back before deciding to buy.

As for Intel, given the prospects in front of it and its reasonable share-price valuation, the veteran semiconductor giant looks like a worthwhile investment as well. Lip-Bu Tan will have to ensure Intel executes, but with the new opportunities presented by Nvidia, Intel is poised for a comeback.