Billionaires running hedge funds on Wall Street are some of the smartest investors in the world. They have decades of professional trading experience, and many have generated superior returns that have made them a household name on Wall Street. So when the 13F filings come out showing what stocks they purchased in the prior quarter, it can be a powerful signal to Wall Street that they have strong conviction on a particular stock name.

Investors should never follow billionaires blindly. Instead, they should make sure to do their own due diligence because by the time 13F forms are released to the public, the reported trades can be a few months old. Furthermore, hedge funds tend to invest on shorter time horizons than retail investors, making their true intentions harder to fully understand. The 13F forms are still helpful for new investment ideas, but investors should be aware of the issues mentioned above.

In the second quarter, billionaires piled into an exchange-traded fund (ETF) that at least one Wall Street expert thinks could soar as much as 124% by 2030.

Image source: Getty Images.

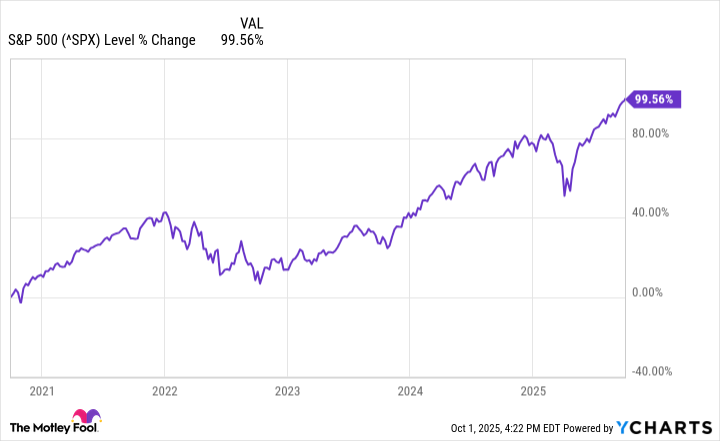

The broader market has upside

Despite experiencing a tremendously bullish five years, many Wall Street analysts still think the broader benchmark S&P 500 index has significant room to run over the next few years, driven by powerful market tailwinds from lower interest rates to a continuation of the artificial intelligence (AI) revolution. One ETF that tracks the S&P 500 is the SPDR S&P 500 ETF Trust (SPY 0.33%). In Q2, several notable investors piled into the index, which contains roughly 500 large-cap U.S. stocks across several sectors:

- Millennium Management, the large multimanager "pod shop" run by billionaire Israel Englander, increased its position in SPY by 1,913% and owned over 1.21 million shares at the end of Q2.

- Tudor Investment Corp, run by Paul Tudor Jones, increased its position in SPY by 1,867% and held over 1.98 million shares.

- Farallon Capital Management, run by billionaire Tom Steyer, initiated a new position in the quarter, purchasing 5.5 million shares.

Whether it's built-up savings and stimulus money from the pandemic, a decade of quantitative easing, or the AI revolution, the S&P 500 has been on a stellar run over the past five years.

Data by YCharts.

As a result, there is a strong camp of investors who believe the market is due for a correction or significant pullback. But not all investors share this view. In fact, some think the stock market is still in the early-to-mid innings of a bull market that can continue to push higher. One of those analysts is Tom Lee of Fundstrat Global Advisers. Lee has been a permabull over the years, but he absolutely nailed his bullish calls on the market in 2023 and 2024, a time when many analysts were bearish.

As recently as August, Lee gave an S&P 500 price target of 6,600, which the market has already surpassed at over 6,700, as of this writing. However, Lee also said he could see the market hitting 7,000 this year if two things happen:

The Fed will finally cut rates, after being on 'pause' for entire 2025 [and] the ISM (Purchasing Managers' Index) will finally recover >50, after spending 28-months plus below 50 ... To us, this makes sense. We just don't know how stocks might initially react to a Fed cut. But once interest rates are reflecting a dovish Fed, this is good for the economy and stocks.

The Fed has officially cut interest rates, which clearly worked out for the market based on its current level. The latest ISM reading came in at 49.1 in September, up from August and slightly above expectations. A reading over 50 indicates economic expansion.

Lee previously said in 2024 that the S&P 500 could reach 15,000 by 2030, implying 124% over the next five years. Lee's bullish sentiment has to do with the fact that the large cohort of millennials is about to enter their prime buying years (ages 30 to 50). In addition, AI and related spending will power this boom with more money flowing into tech stocks and higher valuations for the S&P 500.

Is the S&P 500 poised to run?

Historically, those who hold the broader market for five and 10 years tend to do well. Many trends Lee discussed are materializing from more concentration in the large tech stocks that are pursuing AI, as well as those benefitting from the enormous AI infrastructure spending now underway. While I don't think AI is a fad, I'm also not quite sure it will move linearly. Instead, I think its movement will be similar to how the internet boom suffered setbacks, which is why investors can't rule out a pullback.

Based on everything that has happened, one would also think that the economy has to find a recession at some point, although admittedly, it's very hard to see a severe recession in the near term based on recent economic data. My biggest concern is a stagflation scenario where unemployment rises and inflation remains elevated, making it difficult for the Federal Reserve to achieve its dual mandate.

Ultimately, investors with a long-term investing horizon can keep buying and owning the market. However, because the market is at all-time highs, I continue to recommend a dollar-cost averaging approach to smooth out your cost basis over time and better prepare for volatility.