It's only been a few weeks since China froze Nvidia (NVDA 3.18%) from selling its high-powered chips in the Chinese market. China has been an important market for Nvidia, accounting for 13% of its sales in the company's 2025 fiscal year, so the loss was troubling for Nvidia shareholders.

However, the stock got a boost on Thursday when Bloomberg reported that the U.S. has now granted an export license for Nvidia to ship tens of billions of dollars worth of its top artificial intelligence (AI) graphics processing units (GPUs) to the United Arab Emirates.

NASDAQ: NVDA

Key Data Points

The authorization stems from a May trade agreement that permits the UAE to buy up to 500,000 advanced Nvidia processors each year in exchange for committing to $1.4 trillion of investment in the U.S. over the next decade. Bloomberg reports that the AI accelerators being shipped to the UAE will be earmarked for American companies that have data centers in the UAE, rather than being used by G42, an Abu Dhabi-based AI company.

Nvidia stock was up more than 2% in morning trading.

Image source: Getty Images.

What the deal means for Nvidia

These are chips that Nvidia already planned to sell -- the company and investors had anticipated the U.S. would issue the license. But clearing government red tape is always an important accomplishment, especially since some of the company's foreign sales were blocked in the past.

However, the impact of the sales is indisputable. Blackwell chips reportedly cost roughly $30,000 each, so selling 500,000 annually would mean $15 billion in annual revenue for Nvidia. That's significant, even for this company, which is expecting between $180 billion and $200 billion in revenue for the current fiscal year.

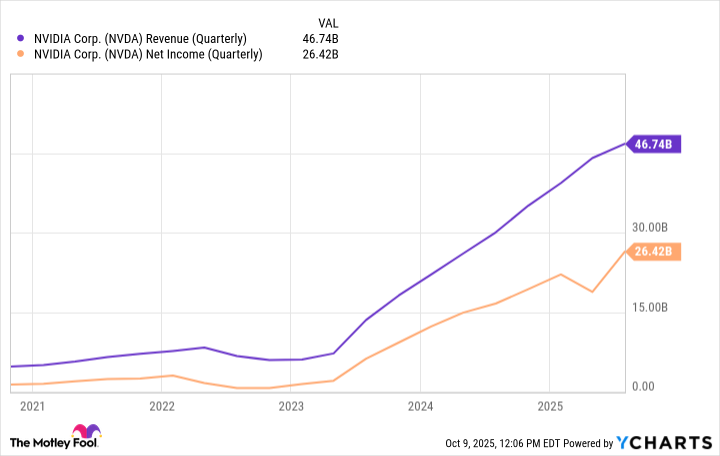

Nvidia will need such deals to keep its revenue and profits growing at levels that investors expect.

NVDA Revenue (Quarterly) data by YCharts.

What the deal means for U.S. chipmakers

There's a bigger picture here, as well. As Bloomberg reports, the UAE deal allows the U.S. to have a foothold in the lucrative Middle East, where AI is expanding rapidly in the UAE, Saudi Arabia, and Qatar.

China's manufacturing is increasingly becoming a competitor with U.S. companies. Huawei topped Apple's position as the leading smartphone supplier, and Beijing's willingness to freeze Nvidia from China indicates the government is increasingly confident in its ability to develop its own technology infrastructure, including high-powered chips to run AI applications.

Washington's deal with the UAE is meant to give American companies an opportunity to compete in the Middle East, rather than ceding the region to China. The newly awarded export license, if successful, could serve to be a model for future deals.