Over the past few years, Nvidia has become synonymous with the artificial intelligence (AI) revolution. Its GPUs power everything from ChatGPT to self-driving cars, and its market capitalization surged past $4 trillion, firmly establishing the chipmaker as the largest company in the world.

Yet as the AI race matures, the next decade may not belong to Nvidia alone. Two companies -- Taiwan Semiconductor Manufacturing (TSM -2.15%) and Alphabet (GOOGL -1.50%) (GOOG -1.55%) -- are quietly positioning themselves to challenge its dominance from distinct but equally powerful angles.

Nvidia's rise has largely been fueled by its high-performance chips, but the broader AI ecosystem relies on companies that supply crucial infrastructure and integrated platforms enabling this revolution. By 2030, investors may look back and realize that the true winners of the AI boom were those laying the foundation of the intelligent economy.

1. Taiwan Semiconductor Manufacturing: The ultimate pick-and-shovel AI stock

While Nvidia specializes in designing GPUs, its Taiwan Semiconductor (TSMC for short) that brings this hardware to life. As the world's largest chip manufacturer by revenue, it produces cutting-edge 3-nanometer and 5-nanometer chips that power not only Nvidia's products, but also those of Advanced Micro Devices and Apple's M series processors. In many ways, TSMC is the pillar supporting the broader semiconductor industry.

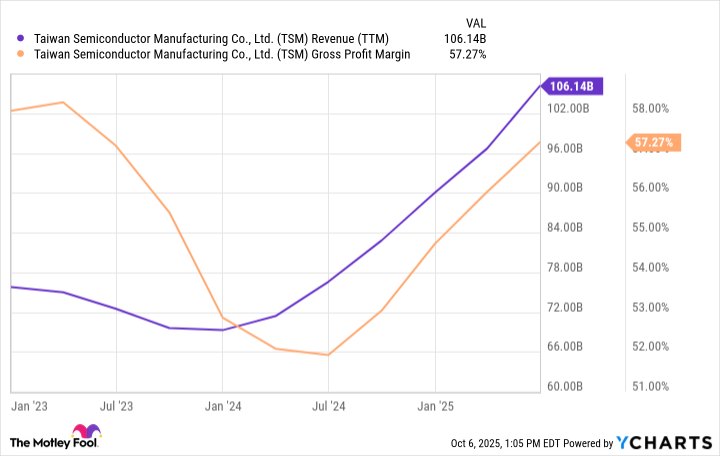

As global demand for AI computing accelerates, the company's value proposition grows increasingly compelling. Its dominance in advanced node manufacturing should drive sustained revenue growth and expanding profit margins, backed by industry-leading pricing power.

TSM Revenue (TTM) data by YCharts; TTM = trailing 12 months.

Moreover, TSMC's strategic investments to diversify its geographic footprint beyond Taiwan -- including new production facilities in the U.S. -- are helping mitigate geopolitical vulnerabilities while deepening relationships with key customers. For investors looking for an infrastructure-first way to participate in the AI revolution, it represents the ultimate pick-and-shovel opportunity.

Image source: Getty Images.

2. Alphabet: Building a complete AI ecosystem

Over the past several years, Alphabet has methodically constructed a vertically integrated AI ecosystem.

At the infrastructure layer, Google Cloud's tensor processing units (TPUs) provide a powerful alternative to Nvidia's GPUs for both training and inference workloads. Layered on top of this hardware foundation are Alphabet's growing ambitions in quantum computing, anchored by its custom Willow chip.

On the software side, the company has introduced Cirq, an open-source quantum programming framework that complements the company's hardware advances. Meanwhile, DeepMind, the company's in-house AI research lab, is helping push the frontiers of next-generation machine intelligence. Taken together, these assets position it at the intersection of classical computing and quantum AI.

Crowning this ecosystem is Gemini, Alphabet's large language model (LLM), which competes directly with OpenAI's ChatGPT (via Microsoft Azure) and Anthropic's Claude (via Amazon Web Services). By combining infrastructure, research, and software under one roof, Alphabet has quietly built one of the most diversified and formidable AI suites in the world.

The next AI winners might already be hiding in plain sight

While Nvidia will likely remain a cornerstone of the AI narrative, investors seeking durable, long-term growth may find greater opportunity in companies that enable and scale up AI rather than those centering on a single product line.

TSMC stands to benefit from continuous chip upgrade cycles regardless of which company's designs are in demand, while Alphabet is embedding AI into every layer of its business: search, advertising, streaming, Android, cybersecurity, cloud computing, and autonomous systems.

In many ways, Taiwan Semi and Alphabet represent two sides of the same coin: One company powers the physical infrastructure of the AI era, while the other drives its digital intelligence.

By the end of this decade, both TSMC and Alphabet could quietly -- yet decisively -- outperform Nvidia, reminding investors that the true winners of technological revolutions are rarely those that perfect a single product category, but rather the ecosystems and enablers that make these products and services a crucial feature of everyday life.