Palantir (PLTR -5.39%) has been one of the biggest success stories over the past few years. Investors have made a ton of money from this stock, as it's up around 130% in 2025 alone (at the time of this writing). If you increase the holding period, it's up 2,600% since the artificial intelligence (AI) arms race began in 2023.

Investors don't have access to a time machine to go back and capture those returns, so we must consider what the stock could do moving forward. I think there's a split investment case on Palantir's stock right now, with one solid reason to buy and another to sell. But which one holds more weight?

Buy side: Palantir is growing rapidly with no signs of slowing down

Palantir's artificial intelligence-powered data analytics software has two primary customer bases. Originally, this software was intended for government use, and Palantir found huge demand from the U.S. government and others around the globe. Eventually, Palantir decided to expand its footprint and offer commercial software, where it has also found strong demand.

The one-two punch of government and commercial clients gives Palantir a really balanced growth story, with both client bases rapidly expanding their usage of Palantir's products. In the second quarter, Palantir's government revenue rose 49% year over year to $553 million, and commercial revenue increased 47% to $451 million. Both of those are incredible growth rates and showcase the massive demand for AI software.

However, there's still rising demand.

The U.S. has been an early adopter of AI trends, and this has shown up in Palantir's results. U.S. commercial and government revenue increased at a 93% and 53% pace, respectively, during Q2. Although the U.S. is driving the lion's share of growth, regions like Europe have yet to adopt AI at a wide scale. Time will tell if Europe follows in the U.S.'s footsteps, but this would provide an additional growth lever if it does. Even if Europe lags behind, Palantir still has plenty of business to capture in the U.S., as it only has 485 commercial clients. Palantir's U.S. growth isn't likely to slow down in the near future with the focus on AI spending, and the U.S. alone can still deliver strong growth for Palantir moving forward.

Palantir has an incredible product, and its usage is growing. These types of growth stories are rare and make the stock an intriguing buy if that's the only factor investors look at.

Unfortunately, the market has gotten enamored with Palantir's growth rate, and I think it gives the sell side more credence.

Sell side: Palantir's growth rate isn't fast enough to justify its price tag

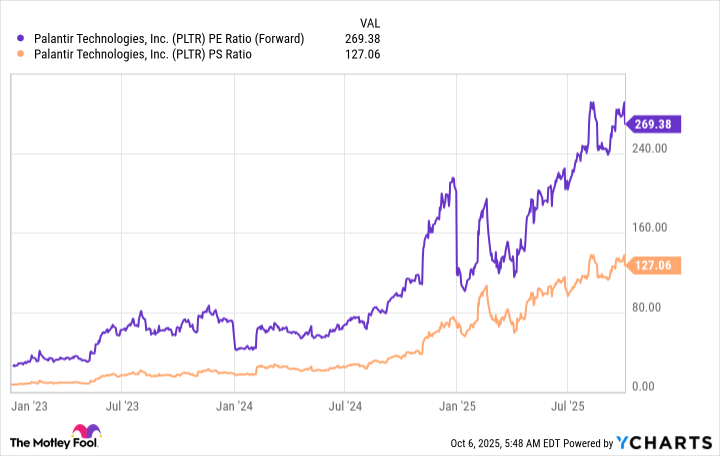

Because of its massive run-up due to excitement in the AI investing realm, Palantir has achieved a valuation that few stocks ever reach. It trades for nearly 130 times sales and 269 times forward earnings.

PLTR PE Ratio (Forward) data by YCharts

Those are extreme valuations, as most software stocks trade for 10 to 20 times sales, with the best performers trading at 30 times sales. The expectations that are already baked into the stock price cannot be understated, and there is at least five years' worth of growth already priced in.

If Palantir grows its revenue at a compound annual growth rate (CAGR) of 50% over the next five years, achieves a profit margin of 35%, and does not increase its share count, it will generate $15.4 billion in revenue and $5.4 billion in profits. That's a huge increase from today's $3.44 billion in revenue, but it would still value the stock at 27 times sales and 76 times 2030 earnings.

Many stocks are cheaper than that right now, so you're essentially paying for at least five years' worth of growth by investing in Palantir's stock today.

That's far too hefty a price tag for me, and I think investors would be better suited looking for a different AI play. Palantir is a phenomenal company with a great product, but with too much growth priced in, I don't think it will be a successful investment moving forward.