It's easy to be a pessimist about any sort of investing trend. Skepticism always sounds smart in the moment, but optimism tends to make investors more money over the long haul. One of the biggest stocks that investors have been skeptical of is Nvidia (NVDA -4.84%), as they are worried that this stock could end up just like some of the dot-com stocks that crashed after the boom was over.

However, Nvidia is a much stronger business than those, and is making real profits and growing at monstrous rates. I think the stock has plenty of room to run, and there are a few data points that back that up.

Nvidia's management has bold predictions about future growth rates

Nvidia makes graphics processing units (GPUs), which are computing devices that excel at arduous workloads. They can process multiple calculations in parallel, allowing them to outperform other computing units. This has made GPUs a popular option for decades, being used for tasks like gaming graphics, engineering simulations, drug discovery, and cryptocurrency mining. However, their largest use case by far has been artificial intelligence training and inference.

Demand for these computing units has been insatiable, and it only looks like it will continue growing. Many of the largest AI hyperscalers have already clued investors in on their capital expenditure plans for 2026, and all of them told investors to expect record-setting spend on data centers. This is on top of 2025's record-setting figures, indicating that there's plenty of fuel left in this buildout trend.

However, Nvidia may not recognize the revenue from these capital expenditures for some time. Data centers take time to construct. Companies must acquire land and build the facilities before they're ready to install computing hardware from Nvidia. This can take years to accomplish, so some of these data centers being announced won't need Nvidia chips until a few years down the road.

This ensures that Nvidia's growth case won't be wrapped up any time soon, and management believes that there's still massive expansion on tap through 2030.

Nvidia's management expects about $600 billion in data center capital expenditures during 2025. By 2030, it expects that figure to rise to $3 trillion to $4 trillion. That's a huge expansion, and some investors are skeptical of that figure.

However, I think there's a bit of investor ego getting in the way here. Because of how long it takes to build a data center, clients are likely to be in contact with Nvidia about future chip demand years in advance. Otherwise, there may not be enough GPUs available to meet that demand by the time it's built. This gives Nvidia a better picture of what the future holds than any of us has access to, so investors must consider what the investing consequences are if Nvidia is right.

Investors don't need to blindly trust the exact dollar figure that Nvidia announced, but I think the general direction of AI spending that Nvidia projects is reasonable. This could lead to further upside in Nvidia's stock, making it a great buy now.

Nvidia's stock may be even cheaper than it appears

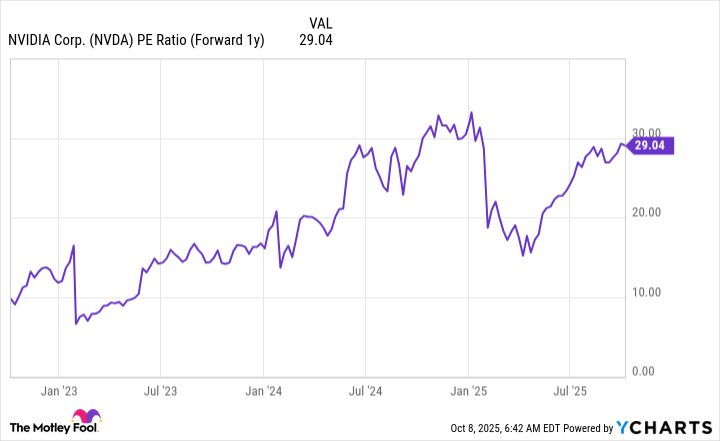

Even after Nvidia's dominant run, the stock still isn't all that expensive. Nvidia trades at 29 times next year's earnings, which isn't cheap, but it's also not overly expensive considering its growth and market position.

NVDA PE Ratio (Forward 1y) data by YCharts

Furthermore, that figure is based on analyst projections, and analysts only expect 33% revenue growth next year. If the data center capital expenditure market ends up at the midpoint of management's projection ($3.5 trillion), then data center capital expenditures must rise at a compounded annual growth rate of 42% over the next five years. It's not unreasonable to assume that Nvidia's revenue will grow at a similar rate, so if this projection comes true, then analysts are greatly underestimating Nvidia's growth for next year.

Time will tell how next year pans out for Nvidia, but if it's right on the growth trajectory of the AI computing market, the stock could be even cheaper than it appears now. This gives Nvidia plenty of room to run, making it a great long-term investment.