Goldman Sachs reports that data centers, powering the innovative artificial intelligence (AI) algorithms, could cause power demand from data centers to increase by 165% by 2030. While renewable energy sources are on the rise, they'll likely fall short of meeting this escalating demand on their own.

Enter nuclear energy. With its reliability and established infrastructure, nuclear energy is gaining momentum worldwide.

Two standout stocks that have surged over the past year in this industry are Cameco (CCJ +1.70%) and Oklo (OKLO +7.90%). Despite both operating within the nuclear space, they couldn't be more different. Here's what investors need to know and which is a better buy today.

Image source: Getty Images.

Similarities between Cameco and Oklo

Cameco and Oklo, while differing in scale, stage, and business models, share some broad thematic similarities. Both companies operate or aim to operate within the nuclear or related sectors and are exposed to similar regulatory, policy, and technological influences.

Both stand to benefit from the global shift toward low-carbon baseload power and the renewed interest in nuclear energy, contributing to the narrative of a "nuclear revival." That said, nuclear projects, including mining, fuel cycling, and reactor development, typically require substantial upfront capital, long lead times, and extensive regulatory oversight.

Exploring the differences between the two nuclear stocks

Cameco

Cameco is considered one of the world's largest providers of uranium and controls significant portions of the world's high-grade mineral reserves. Cameco divides its supply sources into two segments: uranium and fuel services.

The uranium segment includes exploration, mining, milling, and the purchase and sale of uranium concentrate. Here, Cameco has majority ownership stakes in the McArthur River and Key Lake, which are considered the world's largest high-grade uranium mine and mill. It also holds a majority stake in Cigar Lake, a high-grade uranium mine, as well as a 40% stake in JV Inkai, a joint venture located in the uranium-rich region of Kazakhstan.

NYSE: CCJ

Key Data Points

Cameco also offers processing services. It operates the world's largest commercial uranium refinery in Blind River, Ontario, which refines uranium concentrates into uranium trioxide. It also operates the Port Hope Conversion Facility in Ontario, the only uranium conversion facility in Canada.

Finally, Cameco holds a 49% interest in Westinghouse, partnering with Brookfield Renewable Partners. Cameco accounts for this investment using the equity method. Westinghouse is a nuclear reactor technology original equipment manufacturer (OEM) and a leading global provider of aftermarket products and services to commercial utilities.

Oklo

Founded in 2013, Oklo is an early stage company with no commercial projects currently operational. Its mission is to develop advanced fission power plants utilizing metal-fueled fast-reactor technology.

To accomplish this, its core product line is the Aurora powerhouse, designed to be a modern, small-scale, scalable reactor. The Aurora powerhouses are designed to produce electricity in compact sizes, initially targeting 15 MWe and 75 MWe, with potential expansion to 100 MWe and higher.

The core technology is based on proven liquid-metal-cooled sodium fast-reactor technology. The Aurora design specifically builds on the foundation of the Experimental Breeder Reactor-II, which operated successfully for over 30 years and demonstrated spent nuclear fuel recycling.

NYSE: OKLO

Key Data Points

As a pre-revenue company, Oklo continues to incur significant operating losses. In the first half of this year, the company reported a loss from operations of $45.9 million. The total net cash used in operating activities for the full year 2025 is expected to be in the guided range of $65 million to $80 million.

Oklo hasn't yet built any operational Aurora powerhouses or secured binding agreements to supply electricity or heat to customers. The company aims to have its first Aurora powerhouse operational by late 2027 or early 2028. Achieving this milestone will be pivotal, as it will enable Oklo to transition from development to commercialization and begin generating revenue for the first time.

Which is a better buy today?

Cameco stands to benefit from rising uranium prices over time. Years of underinvestment in new uranium supply and mine depletion globally could lead to tighter markets, which favor established producers like Cameco. Through its stake in Westinghouse, Cameco is positioned to capture a greater share of the downstream margins beyond raw uranium.

If Oklo can successfully deploy its Aurora at scale, it can capture margins in the whole value chain. Because its reactors are compact, they may serve places where grid extension is uneconomical or provide resilient on-site power.

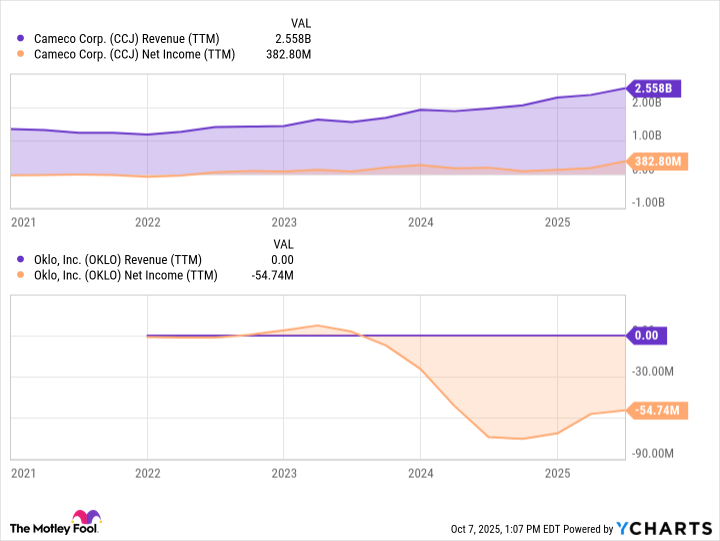

CCJ Revenue (TTM) data by YCharts.

Both have some risks. Cameco has increased by 68% over the past year and is currently priced at 77 times this year's projected earnings per share (EPS) and 58 times next year's projected EPS. Meanwhile, Oklo has risen by 1,119% over the past year, but analysts don't project it to earn meaningful revenue until 2028.

Both stocks have experienced a surge and are currently trading at lofty valuations. That said, Oklo stock has experienced an incredible rise. However, it will be years before the company operates commercially and starts generating revenue, and even longer before achieving positive cash flow. For that reason, Cameco is a better buy today.