Nvidia (NVDA 2.71%) has been one of the most successful investment stories of all time. It has been an excellent pick since the AI race began in 2023 (it's up 1,220% since then), and if you stretch that time frame out, it's even more impressive: $10,000 invested in Nvidia's stock a decade ago is now worth nearly $3 million. If you bought it 20 years ago, that $10,000 investment is worth $6.9 million.

We can't go back in time to capture those excellent returns, but we can look toward the future and see if Nvidia is a worthy stock pick. I still think it is, and I have three reasons it's worth buying shares now.

Nvidia headquarters. Image source: Getty Images.

1. Demand for AI computing power isn't slowing down

It seems like every day you hear about a new artificial intelligence (AI) data center being announced. This shows that we haven't even scratched the surface of the computing power needed to fully integrate AI into both business and our daily lives.

Furthermore, because these data centers don't pop up overnight, there could still be a few years between when the investment is announced and when Nvidia recognizes the revenue coming from outfitting these data centers with computing equipment.

The AI hyperscalers have forecast that their 2026 capital expenditures (capex) on data centers will greatly exceed 2025's already high values, and Nvidia will benefit significantly from all of this spending. These clients are likely in touch with the company years in advance of when they actually need the graphics processing units (GPUs), so when it makes bold projections on the future of AI computing demand, investors should listen.

During the second-quarter conference call, management projected that global data center capex will reach $3 trillion to $4 trillion by 2030, up from around $600 billion today. That's nearly unbelievable growth, but when you realize that Europe has hardly started building out its AI capacity, the U.S. is still heavily spending on it, and China is also building out its footprint, these numbers start to make sense.

If management is correct on the size of the expenditures by 2030, it will make it a must-own stock. Even if the actual spending falls short of the projection, the general trend is for increased data center capex, which bodes well for Nvidia.

2. GPUs don't last forever

Nvidia's GPUs are run incredibly hard in a data center. One Alphabet specialist estimated that GPUs have a life span between one and three years. That means the GPUs purchased since the AI race began in 2023 are likely starting to burn out and need replacement. This will create a new demand wave for Nvidia GPUs, already adding to what's coming from the need for increased capacity in general.

And once the world has built out the computing capacity necessary to run AI effectively, the chipmaker will still have a recurring revenue stream that comes from replacing these GPUs. So the stock won't fall flat on its face even after the AI build-out is complete.

3. The stock isn't all that expensive given its growth

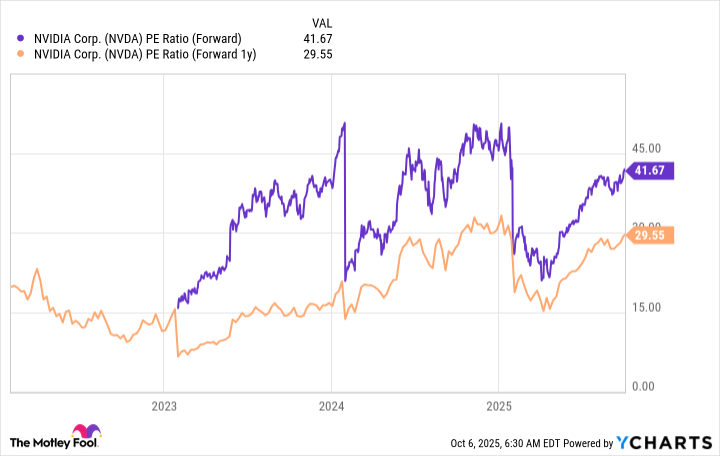

Although Nvidia has been a success story, its stock isn't nearly as expensive as some think it is. It trades for 42 times forward earnings and about 30 times next year's earnings.

NVDA PE Ratio (Forward) data by YCharts; PE = price to earnings.

While that's not cheap by any means, it shows that Nvidia isn't in a bubble that's about to burst. There are real profits being made here, and if the market is underestimating the business' growth like it has done over the past few years, the stock could actually be cheaper than it appears.

Many investors have been proven wrong about Nvidia's growth year after year, and those who have believed in the business have made a ton of money. I think management bought itself some credibility with its recent market projections, and if investors trust that AI hyperscalers will be spending increased sums of money in data centers over the next five years, I think they should believe it.

As a result, Nvidia is still an excellent buy. Although it won't deliver the 1,000% or greater returns it did over the past three years, I still think it can beat the market.