With shares up by a jaw-dropping 3,600% over the last 12 months, D-Wave Quantum (QBTS 4.74%) has probably already minted plenty of millionaires. Investors are pouring into quantum-related stocks because of their disruptive long-term potential. But is the recent rally based on hype or fundamentals?

Let's dig deeper to see if D-Wave Quantum is still a millionaire maker or if it's better to wait on the sidelines.

What is driving this explosive rally?

While D-Wave Quantum hit the market through a merger with a special purpose acquisition company in 2022, shares didn't start gaining traction until late 2024. That was when the tech giant Alphabet debuted its cutting-edge quantum chip Willow, which was taken as a sign that the industry might be getting closer to large-scale commercial viability.

NYSE: QBTS

Key Data Points

Over the following months, the industry notched a few more wins as customers put in orders for quantum-related machinery from D-Wave and other players. The company's second-quarter revenue grew 42% year over year to $3.1 million as it inked consumer deals with both research institutions and enterprise clients interested in its quantum hardware.

But while D-Wave's recent equipment sales are encouraging, they don't necessarily mean the company is on track to scale up a viable business anytime soon. In fact, D-Wave sold its first quantum computing system to Lockheed Martin all the way back in 2011. That's a whopping 14 years ago. There is no guarantee that the company's more recent sales will be any different from the one-off experimental purchases in the past. In the meantime, the company's bottom line leaves much to be desired.

D-Wave Quantum is burning through cash

While D-Wave's $3.1 million in revenue sounds great, it's much less impressive when you consider the $28.5 million it spent on operating expenses, with a lot of that going to vital things like research and development. D-Wave has turned to equity raises (issuing and selling more units of its own stock) to raise the money it needs to sustain its cash burn, with $400 million in capital raised this way in July alone.

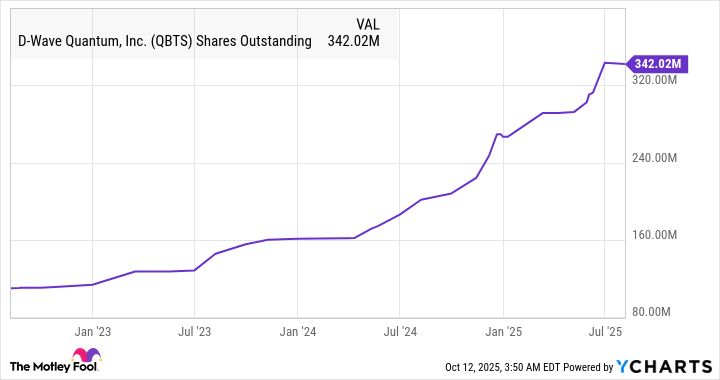

D-Wave's share count has increased dramatically since its public listing in 2022, and investors should expect this trend to continue.

QBTS Shares Outstanding data by YCharts

While equity raises can benefit shareholders by keeping a company afloat and providing money it can use to finance research that will create value in the future, it also dilutes current investors' ownership and their claim on future earnings, which can cause shares to underperform. With quantum technology years, if not decades, away from widespread commercial viability, this will be a long-term headwind for D-Wave's early investors.

D-Wave's valuation is also uncomfortably high. With a price-to-sales ratio of 336, shares trade at an immense valuation over the S&P 500 average of just 3.31. And while some investors may see this as a reasonable premium considering the potential of quantum technology, it means a lot of future growth is already priced in.

Is D-Wave Quantum a millionaire-maker stock?

Image source: Getty Images.

After soaring 3,600% in 12 months, D-Wave Quantum clearly has millionaire-maker potential in the right conditions. The stock market is always itching for the next best thing and is often willing to ignore fundamentals in favor of hype. That said, over the long term, fundamentals usually win. And while D-Wave Quantum could eventually have a bright future, its operations will need to scale up substantially before it can be considered a reasonable long-term bet.