The artificial intelligence (AI) sector is ushering in a transformative era for industries, much like the internet did at the turn of the century. And like that time, new start-ups are popping up, with Groq being one notable example.

Groq is competing with AI semiconductor chip leaders Nvidia (NVDA 2.83%) and Advanced Micro Devices (AMD 0.72%). But rather than the start-up posing a threat to the market share of its larger competitors, it's looking like a catalyst to drive demand higher.

Here's how Nvidia and AMD stand to win as Groq, Cerebras Systems, and other AI start-ups join the race to capitalize on artificial intelligence.

Image source: AMD.

Groq's challenge to Nvidia and AMD

Nvidia and AMD emerged as AI leaders by supplying graphics processing units (GPUs) to customers such as OpenAI. GPUs are crucial for powering the computational capabilities of AI systems, making them essential hardware for artificial intelligence.

Groq challenges Nvidia's and AMD's market dominance with its language processing unit (LPU). GPUs are effective for general AI computing and training. Groq's LPUs were designed specifically for AI inference, the process of analyzing data and drawing conclusions after an AI has been trained.

Because Groq's LPU focuses only on AI inference, the product delivers impressive speed and efficiency to the task. These capabilities have attracted customers.

Today, companies focused on artificial intelligence, such as OpenAI, are aggressively pursuing better AI inference. Groq is benefiting from the trend, resulting in a $750 million fundraising round in September, which boosted its valuation to nearly $7 billion.

How Groq helps Nvidia and AMD

In what ways do Nvidia and AMD gain from Groq's success? As the old saying goes, a rising tide lifts all boats. The increase in chip demand specific to AI inference means Nvidia and AMD can sell more products.

For example, AMD adopted a multipronged approach by offering GPUs and neural processing units (NPUs) to AI customers. NPUs are processors engineered to emulate the human brain's processing capabilities.

By providing various kinds of AI chips specialized for different tasks, Nvidia and AMD can drive up revenue. Their sales are poised to grow as the AI industry increasingly shifts from training AI models to inference.

That's already proving to be the case. In October, AMD signed a multiyear deal with OpenAI to deliver AI computing hardware. Describing the partnership and how it advances artificial intelligence, OpenAI's CEO, Sam Altman, stated, "This partnership is a major step in building the compute capacity needed to realize AI's full potential."

Meanwhile, Nvidia made its own deal with OpenAI in September, and as part of that, will deliver millions of AI chips to the ChatGPT creator.

Additionally, Groq's success shows customer demand exists for alternatives to the market leader, Nvidia, which is estimated to control a dominating 94% market share. Groq's rise can loosen Nvidia's grip on AI chips as enterprises become more open to adopting non-Nvidia hardware.

This creates an opportunity for AMD to strengthen its market position. But Nvidia benefits as well by reducing the chances of a federal antitrust investigation.

That said, neither Nvidia nor AMD are at risk of losing serious market share to Groq at this time. Both have deep pockets to continue investing in cutting-edge AI tech, enabling them to ward off Groq's challenge.

Does investing in Nvidia and AMD stock make sense?

Groq's success signals the opportunity to invest in Nvidia and AMD is far from over. However, the growth the industry veterans can expect in the coming years has already pushed share prices skyward.

Nvidia's stock hit a record high on Oct. 9, exceeding $195, while AMD did the same with its share price surpassing $240 that day.

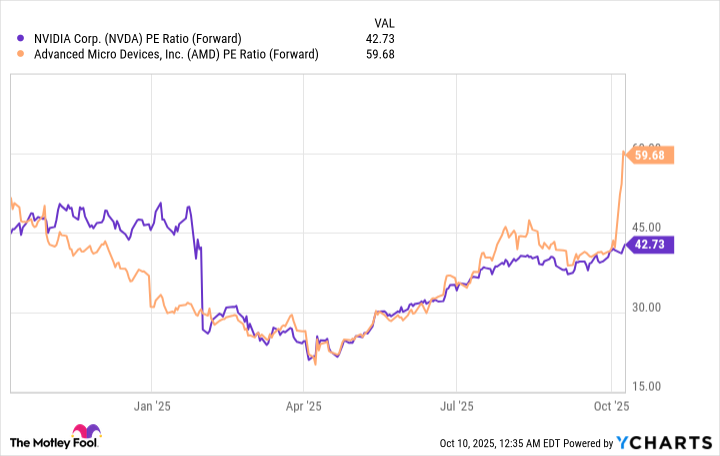

Consequently, both stocks sport elevated share price valuations based on the forward price-to-earnings (P/E) ratio, which tells you how much investors are willing to pay for a dollar's worth of earnings based on estimates for the next 12 months.

Data by YCharts.

As the chart shows, AMD's announcement of a partnership with OpenAI caused the former's P/E multiple to soar, and it's now far above Nvidia's. As a result, Nvidia shares are the better value.

Its superior valuation makes Nvidia the stock to consider purchasing despite both it and AMD being poised to enjoy years of business growth from AI. That said, Nvidia shares aren't cheap either, so the prudent approach is to wait for the stock price to dip before deciding to buy.