There have been some massive artificial intelligence (AI) infrastructure deals announced in recent weeks with chip design powerhouses Nvidia, Broadcom, and AMD. Each offers viable computing chips suitable for AI hyperscalers, but these companies all have one thing in common: They don't fabricate their own chips.

Instead, much of their manufacturing is done by Taiwan Semiconductor (TSM +2.06%), the world's leading chip foundry. This means that it doesn't matter which one is winning the AI computing race -- TSMC will benefit regardless. I think this is going to translate into spectacular growth for Taiwan Semiconductor, and this could cause the stock to soar on Oct. 16 after it reports third-quarter results.

Image source: Taiwan Semiconductor Manufacturing Company.

Taiwan Semiconductor's new technology could be a game changer

Taiwan Semiconductor has a lot going for it. It offers the leading fabrication technology with best-in-class yields for advanced chip nodes. While Intel's foundry division has historically been a competitor, today it's having difficulty attracting customers for its advanced chip node foundries because it hasn't been relevant in some time. Another third-party fabrication option is Samsung, but there have been reports suggesting that its 3-nanometer (nm) chip production lines have usable yields of around 50%, well behind TSMC, which has in recent years improved its 3nm chip yield to around 90%.

No matter how you slice it, Taiwan Semiconductor is the biggest and best foundry name in town, and I think it's one that investors should have in their portfolios. An investment in Taiwan Semiconductor is a bet that the world is going to keep needing an ever-growing quantity of more advanced chips. Considering the massive AI infrastructure spending that's already occurring, that feels like a safe bet.

NYSE: TSM

Key Data Points

Taiwan Semiconductor is also working on addressing a massive problem in the AI infrastructure space: energy consumption. This is a huge concern, as the amount of energy demanded by hyperscale data centers looks likely to outstrip the available electricity supply in the future. Cloud companies, utilities, and alternative energy companies are already working on various ways to generate the additional power that new AI infrastructure will need, but in cases where demand exceeds supply, that bottleneck could put a pause on some massive computing projects.

However, TSMC expects to launch its 2nm chip node this year. Chips made using that process node will consume 25% to 30% less power than its current top-of-the-line 3nm chips when configured for the same speeds. This could help solve the energy crunch being created by data center construction, and will enhance demand for these cutting-edge chips. TSMC's management will likely give an update on the status of its 2nm chip lines in Q3; they could provide it with a revenue bump heading into the end of the year, and will for sure in 2026.

TSMC had a strong Q2, with 44% year-over-year revenue growth in U.S. dollars. For Q3, it expects between $31.8 billion and $33 billion in sales, which at the midpoint would equate to a gain of 37.9% from last year. Considering the massive levels of demand for AI chips, I wouldn't be surprised if TSMC's growth rate exceeds that. If it does, don't be surprised if the stock rockets higher.

Taiwan Semiconductor doesn't trade at the same premium as its peers

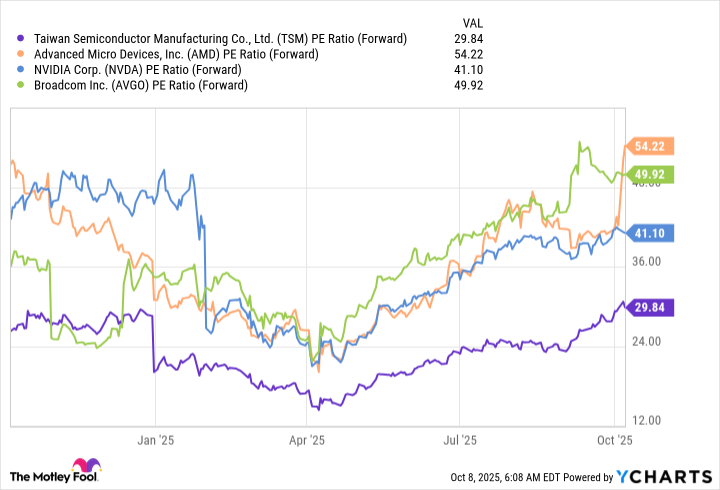

Despite the fact that TSMC operates in an adjacent part of the chip industry to Nvidia, Broadcom, and AMD, and experiences similar demand trends, it's valued at a significant discount to the chip designers.

TSM PE Ratio (Forward) data by YCharts.

While 30 times forward earnings isn't a cheap valuation by any stretch of the imagination, it's still less than some of its peers that are posting slower growth than it is.

I think that TSMC's Q3 results could send the stock soaring in part because the expectations already baked into its stock price aren't quite as high as those for some of the other AI hardware plays. It also has the advantage of being a neutral player in the segment, and one that benefits from nearly all AI infrastructure spending.

Because of all this, TSMC has the chance to be a long-term winner for investors. Investors should consider adding it to their portfolio before Oct. 16.