Once upon a time, satellite radio looked like a get-rich-quick scheme. The two predecessors of Sirius XM Holdings (SIRI +1.63%) made some people very rich in the second half of the 1990s, as new cars started shipping with satellite-enabled radios.

But Sirius XM's stock peaked at the turn of the millennium, and longtime shareholders have seen share prices drop 97% from that ancient peak. A million dollars invested in Sirius XM on Feb. 17, 2000, would be worth roughly $32,000 on Oct. 10, 2025. With dividends reinvested along the way, you'd have a total return of $40,850 -- still a disastrous result in 25 years and change.

With a plethora of media-streaming options and nearly ubiquitous access to high-speed internet connections, Sirius XM looks like an unlikely winner these days. I would much rather invest in a proven performer that made more millionaires than Sirius XM ever did -- and kept building their wealth for decades. In particular, I'm thinking about Warren Buffett's Berkshire Hathaway (BRK.A 0.30%) (BRK.B +0.00%).

Image source: Getty Images.

Sirius XM Holdings is losing its signal

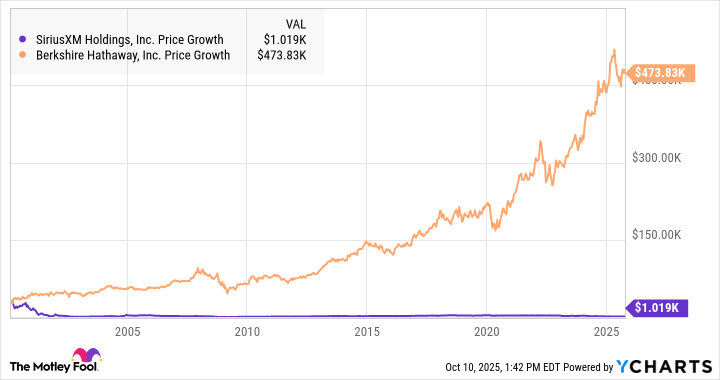

Just for fun, let's imagine investing $32,000 in Sirius Satellite Radio and another $32,000 in Berkshire Hathaway's Class B shares at the satellite radio veteran's peak in February 2000. As expected, the Sirius XM bet would have dropped to approximately $1,000 by now. Berkshire investors, on the other hand, would have nearly half a million dollars in their portfolio:

Yeah, I'm hand-picking the worst possible time to buy Sirius XM stock, but the picture doesn't change much in other long-term spans. Berkshire's robust insurance operations and brilliant equity investments have generated market-beating annual returns over the last few decades, no matter how you slice them.

Switching channels to Berkshire Hathaway's proven success

Berkshire is like a mini-index or exchange-traded fund, all in one company. Its operations range from insurance (GEICO) and railroads (BNSF) to clothing (Fruit of the Loom) and batteries (Duracell). I'm sure you're familiar with these household-name brands.

And that's just the wholly owned businesses fully under Berkshire Hathaway's control. Buffett's company also owns large stock investments in many public companies, putting Berkshire representatives in their boardroom. The largest holdings include Apple (AAPL +0.13%) and American Express (AXP 1.92%), which add up to 39.5% of Berkshire's stock portfolio right now.

If you insist on some Sirius XM exposure, Berkshire will serve that purpose too. It holds a dominant stake in the satellite radio business, at 37.1% of Sirius XM's shares. Mind you, that's still a small commitment for Berkshire at 0.9% of its diversified stock portfolio.

NYSE: BRK.B

Key Data Points

Berkshire Hathaway's stellar stability

If you thought the S&P 500 (^GSPC +0.65%) was a calm, safe, and stable investment option, Berkshire Hathaway beats the market index in some ways.

-

The stock has a beta value of 0.7, which means that it tends to be significantly less volatile than the broader market.

-

For example, the S&P 500 fell 2.7% last Friday, along with identical price drops in index funds like the Vanguard S&P 500 ETF (VOO +0.67%) and the SPDR S&P 500 ETF Trust (SPY +0.66%). Buffett's empire only fell 1.5% on the same tariff-escalation news.

-

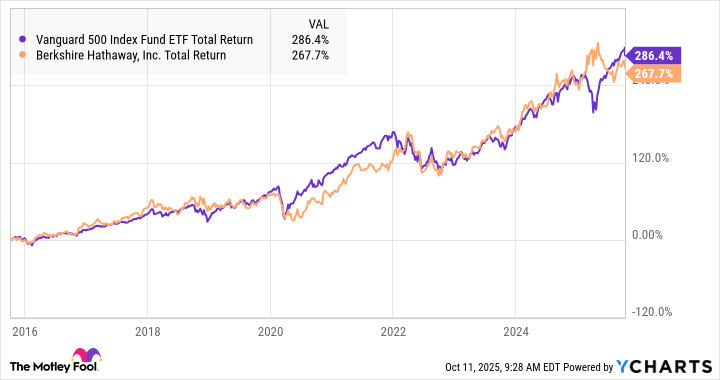

Berkshire Hathaway's stock tends to outperform the market in the long run, though it should be said that the index funds can make up the difference with dividend payouts. The total returns are very similar in multi-year periods:

VOO Total Return Level data by YCharts

Berkshire Hathaway's bench is as strong as its balance sheet

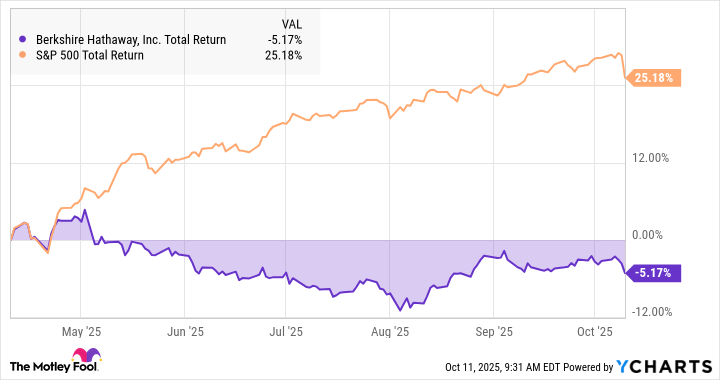

If there ever was a great time to start a Berkshire Hathaway investment, this might be it. Check out the total returns of the last 6 months:

BRK.B Total Return Level data by YCharts

The tiny peak in early May was Berkshire Hathaway's all-time high. It was also the last market day before Warren Buffett announced his retirement. The S&P 500 has soared since then while Berkshire investors missed the rally -- the pending exit of a legendary leader weighs heavily on the stock.

But I have full confidence in incoming Berkshire Hathaway CEO Greg Abel and his fully intact team of executives, analysts, and portfolio managers. I can't imagine a better investing mentor than Warren Buffett, and Abel has served by his side for decades. Abel and others have executed many of Berkshire's investments in recent years, so it's really just an upgraded title. Not much should change in terms of business operations.

And you can pick up Berkshire Hathaway shares at a discount while the market worries about this humble speed bump.

Berkshire has made lots of millionaires over the decades while Sirius XM's wealth-building era was long ago and temporary. As with any rock-solid investment vehicle, adding money over time to a Berkshire Hathaway position could build a million-dollar portfolio for you, too.