It might feel like yesterday, but it's been over half a decade since the COVID-19 pandemic shut down the world, grounding Carnival Corporation's (CCL 1.62%) ships and forcing it to take on billions in long-term debt to stay afloat. Now business is booming.

But is the company rebounding fast enough to overcome its overleveraged balance sheet? Let's dig deeper into the pros and cons of buying the stock.

Image source: Getty Images.

Business is booming

Carnival's stock has soared by over 200% from its lows in mid-2020. And this rally has a lot to do with the company's profitable operations. This trend continued in the third quarter when revenue grew by 3.3% year over year to a record $8.15 billion, and net income jumped 6.7% to a record of $1.85 billion. The cruise company is transporting more guests at higher prices while trying its best to keep operational costs in check.

NYSE: CCL

Key Data Points

According to CEO Josh Weinstein, Carnival has now notched 10 consecutive quarters of record revenue. And even though cruising is luxury spending that tends to go down in a weak economy, there is reason for investors to be optimistic about the future as consumer deposits remain high ($7.1 billion for the third quarter). Macroeconomic tailwinds like lower interest rates could help spur consumer spending.

Interestingly enough, Carnival's robust demand isn't necessarily seen in the entire U.S. tourism industry. For example, according to The New York Times, Las Vegas is currently facing a historic slump amid a sharp decline in visitors due to higher prices, consumer uncertainty, and fewer international arrivals. It is unclear how Carnival has managed to avoid these headwinds and how much longer its good luck will last.

Is the debt problem under control?

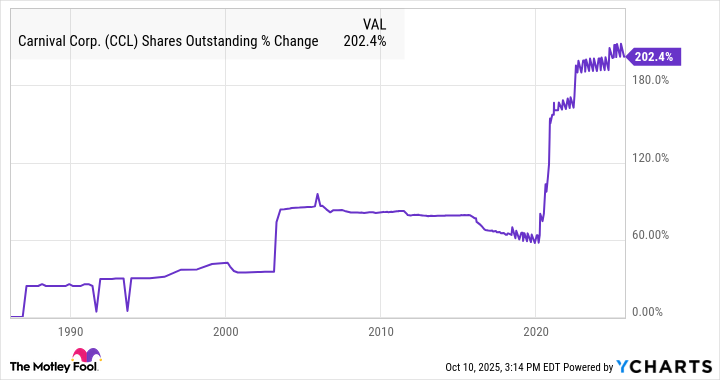

As mentioned earlier, Carnival has been forced to raise vast amounts of debt (and also issue additional shares) to survive the COVID-19 pandemic, when it couldn't operate its ships due to lockdowns and travel restrictions. This level of equity dilution and cash outflow will undermine investor returns for years, if not decades, into the future. Carnival's shares outstanding went parabolic in 2020.

CCL Shares Outstanding data by YCharts

But while the equity dilution is alarming, the long-term debt is probably the most pressing issue because it generates interest expense ( $317 million in the third quarter alone) and must be paid back. Currently, the total long-term debt stands at a whopping $25 billion.

The good news is that Carnival has made impressive progress in deleveraging its balance sheet. In the third quarter, the company retired roughly $700 million of debt through prepayment and refinanced $4.5 billion. Furthermore, falling interest rates will make it easier for management to replace older, higher-interest notes with new, cheaper ones.

Carnival stock is not as cheap as it looks

Carnival Corporation is a stable, growing business that is enjoying healthy demand for its services despite weakness in other parts of the tourism economy. Furthermore, it is making impressive progress in managing its debt levels. So what's the catch? The short answer is valuation.

On the surface, Carnival stock looks cheap with a forward price-to-earnings (P/E) of just 12, which corresponds to a market capitalization of $38 billion. But when you consider the company's enterprise value (which is a more realistic assesment of what it would cost to buy a company because it factors in debt levels), the equity's valuation jumps by 68% to $64 billion, making it look quite pricey considering the uncertainty about how much longer tourism demand will hold up.

While Carnival is far from a bad stock, investors should consider looking for safer and cheaper options in the market today.